- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- Re: I am being asked "Which state is $XX.XX of exempt-interest dividends from?" Where can I find ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am being asked "Which state is $XX.XX of exempt-interest dividends from?" Where can I find this information on the tax form?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am being asked "Which state is $XX.XX of exempt-interest dividends from?" Where can I find this information on the tax form?

That information would be reported on supplemental statements attached to your form 1099 that reported the income. If not, then you would have to ask the issuer of the form. It is asked to see if the interest is from state obligations of the state that you live in, as it may get special tax treatment there. There may be a response available that says "various" that you could use as a default answer.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am being asked "Which state is $XX.XX of exempt-interest dividends from?" Where can I find this information on the tax form?

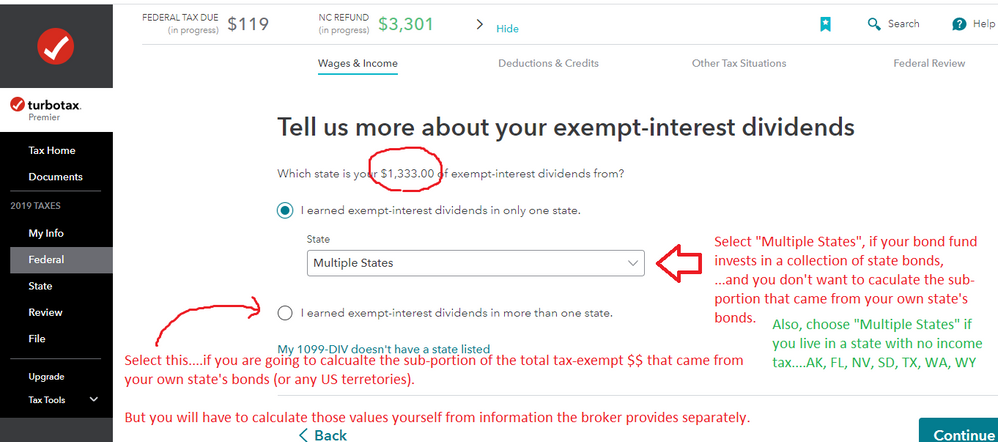

Unless you are willing to go thru the calculation to break out JUST the amount from your own state's bonds, you would select "Multiple States" for all of it

____________________________________

_____________________________________

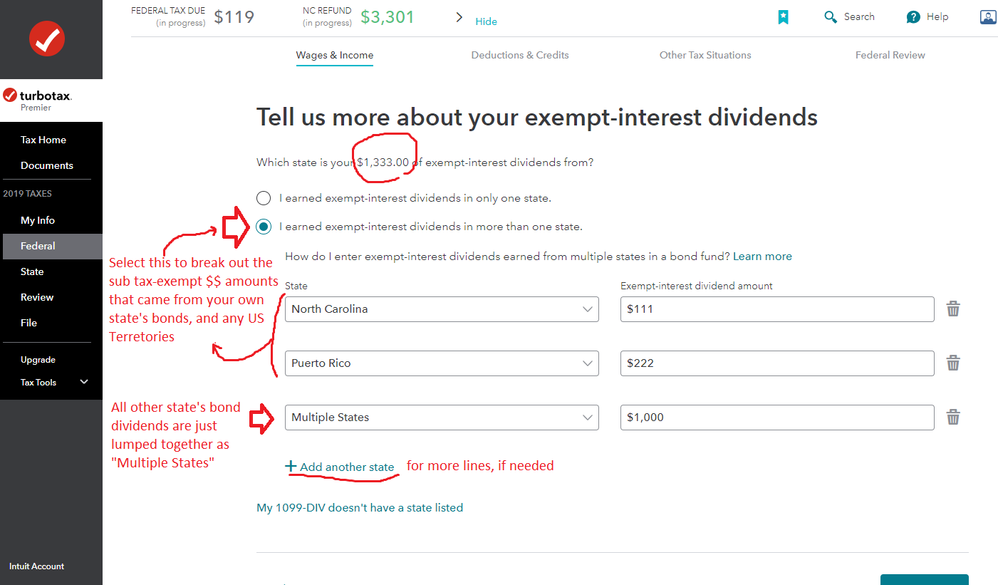

IF you are going to break out your own state's $$ then you check the selection that displays the extra boxes

(note, for a 1099-DIV, box 11, this is not allowed by Illinois, and CA & MN have severe restrictions on when it is allowed). The amount actually from your own state's bonds would have to be more than ~$50 or $100 before it had much of an effect.

____________________

Example is for a NC resident:

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

brelaz99

New Member

fredtex1

Level 2

jvmorrow

New Member

HollyP

Employee Tax Expert

delinah100

Level 2