- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Why hasnt turbo tax generated a form 4562 for depreciation?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why hasnt turbo tax generated a form 4562 for depreciation?

Where do you think you don't have to form 4562 for any other year??

Turbotax Says

Filing Form 4562

File Form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a Section 179 election. When you claim depreciation, it’s incredibly important that you retain copies of all 4562's so you can track your prior deductions and claim the appropriate amount in future years.

When you use TurboTax to do your taxes, we’ll ask questions about your business and help you determine which assets you can depreciate, and how much you can deduct for each. We’ll also fill in all the right forms for you. Better still, when you use TurboTax every year, we’ll keep track of all the assets you’ve already been depreciating, so you can accurately track and report multi-year depreciation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why hasnt turbo tax generated a form 4562 for depreciation?

And why does Turbotax NOT generate the 4562, when it states it is required??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why hasnt turbo tax generated a form 4562 for depreciation?

Except as otherwise noted, complete and file Form 4562 if you are claiming any of the following.

-

Depreciation for property placed in service during the 2021 tax year.

-

A section 179 expense deduction (which may include a carryover from a previous year).

-

Depreciation on any vehicle or other listed property (regardless of when it was placed in service).

-

A deduction for any vehicle reported on a form other than Schedule C (Form 1040), Profit or Loss From Business.

-

Any depreciation on a corporate income tax return (other than Form 1120-S).

-

Amortization of costs that begins during the 2021 tax year.

See https://www.irs.gov/instructions/i4562#en_US_2021_publink1000309253

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why hasnt turbo tax generated a form 4562 for depreciation?

Farm tractor purchased Dec. 30th, 2021 and March 02, 2022 is the first year put into service. Back Hoe purchased June 23rd, 2022 put into service June 24th, 2022.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why hasnt turbo tax generated a form 4562 for depreciation?

Did you enter as an asset?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why hasnt turbo tax generated a form 4562 for depreciation?

Tried to find the form 4562, in TurboTax Premier, for instructions but could not. Attempting to fill out as a fillable PDF from IRS, but not sure how to import to TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why hasnt turbo tax generated a form 4562 for depreciation?

Could not find section to enter as asset.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why hasnt turbo tax generated a form 4562 for depreciation?

To generate Form 4562, you'll need to enter the cost of your farm assets under the Assets/Depreciation topic in TurboTax.

The easiest way to find this area of TurboTax Desktop is to use the Search box at the top right side of the TurboTax header. Enter "farm income" and click on the first result. This will take you directly to the start of this section.

If you have already entered some information for your farm, click edit on that line. Or begin entering your farm information.

Work through the screens until you see either "Farm Asset Summary" or Assets/Depreciation. Add an asset by answering the questions. TurboTax will calculate depreciation for you.

Continue back to the start of the Farming section.

If you have Schedule C (self-employment) assets and not a farm, search for "schedule c" and follow the same basic steps.

To view Form 4562 or your Depreciation Report, click the Forms icon in the TurboTax header. Find the form or report in the left column and click on the form name to open it in the large window.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why hasnt turbo tax generated a form 4562 for depreciation?

I want to depreciate rental properties and want to confirm the information Turbotax is automatically including in the filled in boxes from last year is correct. Is the number it uses for prior depreciation meant to show just last years depreciation or all total prior depreciation?

Additionally, I looked at my 2022 tax return on Turbotax where I also depreciated rental properties. It shows depreciation in line 18 of Schedule E so I believe it correctly included the information last year. But I cannot find any form 4562 in the copy of the return provided by Turbotax to see my total prior depreciation. Is there a reason it was not included? Or a way to access it on the website?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why hasnt turbo tax generated a form 4562 for depreciation?

Is the number it uses for prior depreciation meant to show just last years depreciation or all total prior depreciation?

It shows the total of "all" prior depreciation taken.

, I looked at my 2022 tax return on Turbotax where I also depreciated rental properties. It shows depreciation in line 18 of Schedule E so I believe it correctly included the information last year.

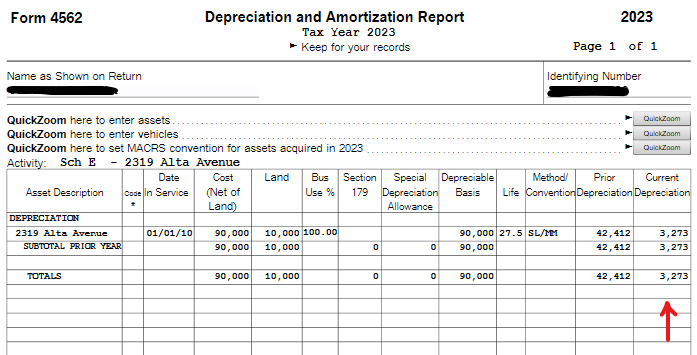

Yes. Line 18 of the SCH E shows the total depreciation taken on all assets for tax year 2022. To see the total depreciation taken since the asset was placed in service, you have to look at the 4562 "that prints in landscape format" that is titled "Depreciation and Amortization Report". To get that specific form, you have to save everything in PDF format. Then you'll find it in the PDF file. The 4562 is only included with your "filed" taxed return in the tax years there is an addition, change, or removal of an asset from service.

If you want to check the math the program used (I encourage it) then see IRS Publication 946 at https://www.irs.gov/pub/irs-pdf/p946.pdf and use the MACRS worksheet that starts on page 36. For line 6 of that worksheet use table A-6 on page 71.

If your figures are off by a few bucks, don't sweat it. That's caused by "rounding" which the IRS allows.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why hasnt turbo tax generated a form 4562 for depreciation?

@XL13 wrote:

Is the number it uses for prior depreciation meant to show just last years depreciation or all total prior depreciation?

All total prior depreciation based upon the date the property was placed in service.

@XL13 wrote:

I cannot find any form 4562 in the copy of the return provided by Turbotax......

Form 4562 is used for listed property and property placed in service in the current tax year.

TurboTax uses a Depreciation and Amortization Report on which you will see all prior (accumulated) depreciation as well as current year depreciation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why hasnt turbo tax generated a form 4562 for depreciation?

New 2nd year user here, with rental property first listed last year (2022 tax year). I'm am still confused about the lack of presence of my second year of depreciation that I thought should have shown up, as you and others have said, ONLY in the pdf printed version of my current (in progress) 2023 return. I was expecting it to show up on line 18 of Schedule E worksheet. All of my other expenses for the property are there as I entered them. However, unlike last year's worksheet in TurboTax, that depreciation amount is NOT there.

I should mention that I still have a few items to enter for the remainder of my return, but they are just personal deductions such as charitable giving and home property taxes. So I haven't actually pressed the "process return" button, because I'm not there yet. But I have followed previous directions given in this particular post about "saving to pdf" and looking for the worksheets and forms that are there, but will not be submitted in the actual return. Regardless, still no dollar figure on line 18. By my calculations using Table A-6 from the IRS, it should be close to $10,000, if I'm understanding how the 27-year thing works.

Am I misunderstanding something, or does TurboTax have another software glitch?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why hasnt turbo tax generated a form 4562 for depreciation?

In TurboTax Desktop, I am able to report 2023 depreciation for residential rental property on IRS Schedule E line 18.

I am also able report 2023 depreciation on the Form 4562 Depreciation and Amortization Report.

Is your depreciable asset in the final year of reporting depreciation? Are you using the Desktop product or Online? Please clarify.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why hasnt turbo tax generated a form 4562 for depreciation?

I am using the Desktop version, and have uploaded any updates that I'm made aware of.

This is my second year of claiming the same single property I am renting. Last year's 4562 and Schedule E worked great. But this year's line 18 is blank, nor do I see any historical data showing last year's figures.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why hasnt turbo tax generated a form 4562 for depreciation?

@EB2C As said on the second post back on page 1 in this thread....Unless it is the first year an asset is placed in service, you don't always get Form 4562.

But you should have the current year depreciation listed. When you started 2023 did you transfer from 2022? Did you use the Desktop program last year too?

Form 4562 is just a Summary of the Depreciation for the current year and doesn't list the items.

Using the Desktop program you can get an Asset Life History worksheet but you have to do it in Forms Mode, click Forms in the upper right (upper left for Mac) You can't get detailed worksheet showing all the assets but you can get the Asset Life History on each one. It doesn't print out with your return or save in the pdf. So you have to print each Asset Life History individually.

Scroll down the list of forms in your return to a Asset Entry or Asset Worksheet and open it. Then down on line 14 is a QuickZoom button to Asset Life History, Click on that.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SB2013

Level 2

Binoy1279

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

jack

New Member

RyanK

Level 2

ttla97-gmai-com

New Member