- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Why does Turbotax not ask me about recovery rebate? This has been noted on Reddit complaining as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax not ask me about recovery rebate? This has been noted on Reddit complaining as well.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax not ask me about recovery rebate? This has been noted on Reddit complaining as well.

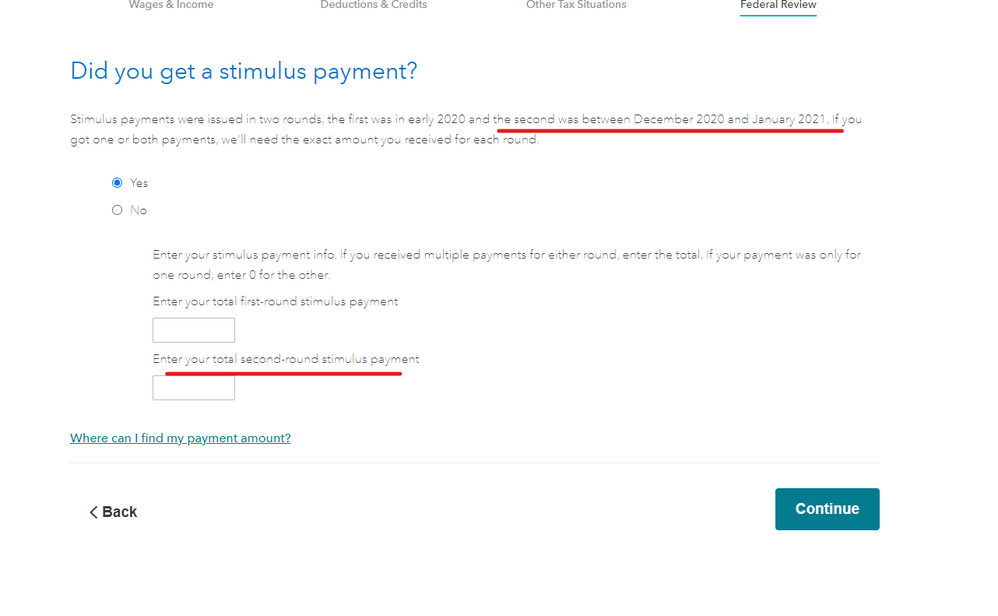

The stimulus check is an advance on a credit you can receive on your 2020 tax return. If something went wrong or you did not get the stimulus check in 2020, you can get it when you file your 2020 return in early 2021

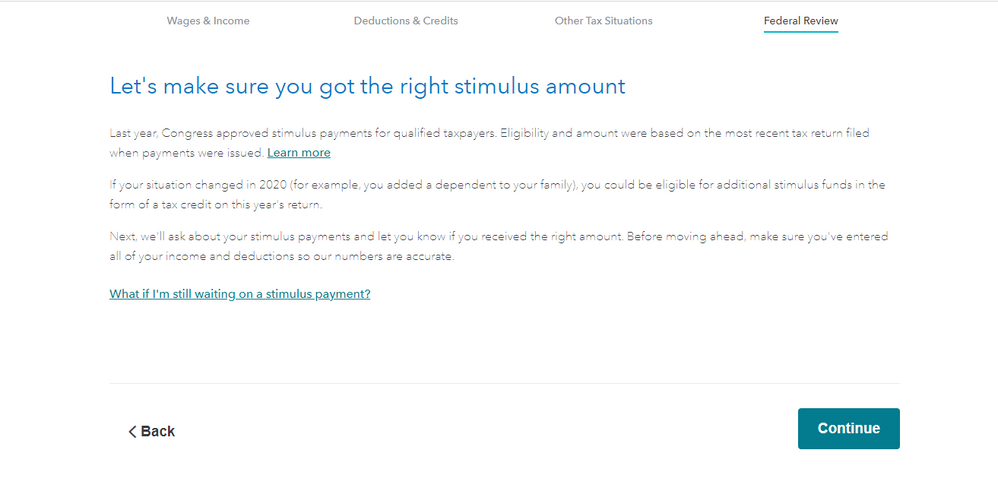

The Recovery Rebate Credit will be found in the FEDERAL REVIEW section. ( you should see "Let's make sure you got the right stimulus amount”) If you are eligible it will end up on line 30 of your 2020 Form 1040.

Make sure that you enter ALL of the stimulus money received for the 1st ad 2nd stimulus for yourself, your spouse and your children.

https://ttlc.intuit.com/questions/1901539-how-do-i-preview-my-turbotax-online-return-before-filing

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax not ask me about recovery rebate? This has been noted on Reddit complaining as well.

If you follow the interview then everyone who is not being claimed as a dependent will be asked about the advance stimulus payments ... this is right after the Other Tax Situations tab as you enter the Federal Review tab ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax not ask me about recovery rebate? This has been noted on Reddit complaining as well.

make sure you are not clicking that you may be claimed as a dependent on someone else's return. It will by pass those questions. If you are then you will not be able to claim recovery on TT online.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax not ask me about recovery rebate? This has been noted on Reddit complaining as well.

Also if your income is above the phase out range for any of the recovery credit that screen will not be presented.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

luigicaloi

New Member

sebastiengrrr

New Member

proper1420

Returning Member

Ckelly62

Returning Member

lkmcmillen

New Member