- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- What form/sheet/cells from previous years tax return inform Passive Loss Carryovers on TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

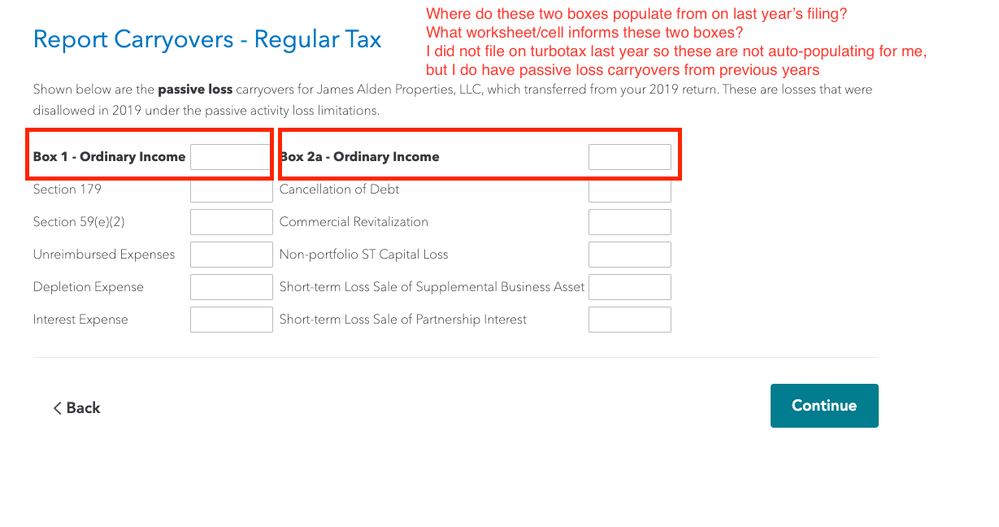

What form/sheet/cells from previous years tax return inform Passive Loss Carryovers on TurboTax?

Hi,

See attached screen shot. I did not file my taxes on Turbo Tax last year (2019), but have passive loss carryovers reported on my 2019 return from a K1 - I need to carry these over to my 2020 return. I'm trying to figure out which forms and cells on the previous years tax return populate "Box 1 Ordinary Income" and "Box 2a Ordinary Income" on the passive loss carryovers page of Turbo Tax. Any help would be greatly appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What form/sheet/cells from previous years tax return inform Passive Loss Carryovers on TurboTax?

IRS Form 8582. If you don't have that in your 2019 taxes, then you didn't have any suspended losses to carry over.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What form/sheet/cells from previous years tax return inform Passive Loss Carryovers on TurboTax?

I have form 8582 with carryovers, what specific cells should I bring over to populate "Box 1ordinary income" and "Box 2a - ordinary income"? @Carl

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What form/sheet/cells from previous years tax return inform Passive Loss Carryovers on TurboTax?

Line 7

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What form/sheet/cells from previous years tax return inform Passive Loss Carryovers on TurboTax?

@Carl Line 7 is modified gross income, there is nothing listed there.

It must be somewhere in section 3 that highlights passive losses - this is driven by worksheets 1-6

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gerald_hwang

New Member

HNKDZ

Returning Member

ahkhan99

New Member

jjon12346

New Member

user17550208594

New Member