- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

"Needless change by the IRS that we all need to suffer through."

It's always been this way ( as per Instructions cited).

If in the past TurboTax was letting negatives go through, now it doesn't.

Last I tried, TurboTax still doesn't let you enter "Expired" in column (d) or (e).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

Do I have to say it again ?

Please be aware that you can aggregate covered transactions without adjustments on Schedule D Line 1a.

or Line 8a.

Form 8949 is not required and no mailing is necessary.

There is no reason to key in or import those transactions.

Options written after 2013 that expire are covered transactions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

Is this the same issue here?

"Can I enter a negative amount for proceeds (Box 1d) on my 1099-B?"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

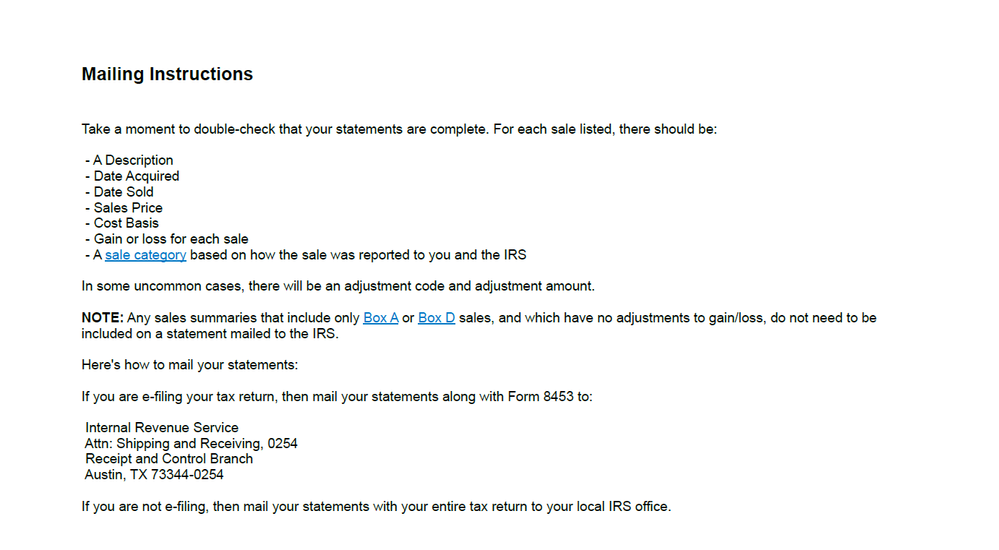

Well, instead of importing the positions from TD Ameritrade, I tried entering it as a summary instead, wherein it asks for proceeds/cost basis/adjustment/etc. Because I have adjusted "wash sales", I am triggered to fill out a Form 8453 and to mail 100+ pages of my 1099 document to the IRS office in Austin, TX (screenshot below). Is there not a simple fix for this? By the way, 21 billion options contracts were traded last year in 2020 -- many of which came from ETrade/TD Ameritrade/Fidelity/Schwab/etc. Is TurboTax not willing to fix this issue for its customers?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

How do you do that? Sum the negatives and enter the total as one positive amount on Schedule D, Line 1a for covered calls and short puts? And if so, will that mess up the totals on Schedule D, since my import agrees currently with what I show as the total capital gain and loss for the year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

you don't have to mail 100+ pages.

you have to mail the details for adjusted transactions i.e. wash sales.

maybe you can pull just those pages out of your consolidated 1099-B.

How many wash sales do you have ??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

I just spoke to someone at Intuit who stated that they are very familiar with this issue (ie TT not allowing negative values in "Proceeds" and that they will be issuing a patch "in a few days". I believe they had this same issue last year and also applied a patch. I checked my TT return last year and confirmed that negative values were allowed in this field.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

Ladies and gentlemen:

my broker told me this morning that TT has fixed the problem. I went to TT and confirmed that it is indeed fixed.

good day everyone. Let’s go Trump!

🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

TT is now allowing negative values proceeds. However we got a new and bigger problem. I filed the return yesterday and got a rejection notice. The error message from IRS through TT is “several amounts on Schedule D are negative which is not allowed....”. What should we do now? Brokers insist that negative values are allowed. TT made a patch to fix it. Now IRS rejects it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

The issue has been submitted and is currently under investigation. Please click on the following link and sign up for an email notification when it's fixed.

A Form 1099-B is issued to report the proceeds from your stocks and bonds transactions. The transactions will generate either a long term or short term capital gain or loss depends on how long the stocks are being held. The amount will be reported on line 7 of your Form 1040 along with a Schedule D and Form 8949.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

I am thinking about just going back to the orginal solution of changing the numbers by showing the cost as a positive number and the proceeds as zero. This does not change the tax calculation as it will be seen as a loss of the same amount although the total proceeds will no longer match what the broker submitted. I don't want to print and mail the return (have heard the IRS was accepting the negative proceeds if mailed--may not be accurate information) as we have had all types of probems with the mail service in recent months.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

Is this still relevant for 2021 taxes? I didn't receive an error, but I did get prompted for a review. I didn't change anything this year and turbo tax allowed me to continue. I just want to make sure my return won't get rejected if I have a negative number in the proceeds or cost basis this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

Yes, this is still relevant for the 2021 tax year. The IRS has not changed the instructions for reporting options, so you are likely to be blocked from e-filing your tax return if you enter a negative number for proceeds.

The IRS Schedule D instructions describe how to report options sales.

As @ColleenD3 paraphrased, "The take away is that gains from expired options are reported with the gain amount in the proceeds column and no amount in the cost basis column, while losses from expired options are reported with the loss amount in the cost basis column and no amount in the proceeds column."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

You would think it's not rational, but TD Ameritrade does report negative numbers for proceeds of some trades.

I found this out this year.

The tax software I use (not TurboTax) accepts the imported numbers and does not flag any issues.

For my own simplicity of reporting and cross-checking, I'm going with what they show.

I haven't e-Filed yet, but I have no doubt the filing will be ACCEPTED.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

Having the same issue. Can you give a hint what software you are using?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rkhattak

New Member

ltandblondie

New Member

cindyxsun

New Member

iamthekat

New Member

iamthekat

New Member