- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

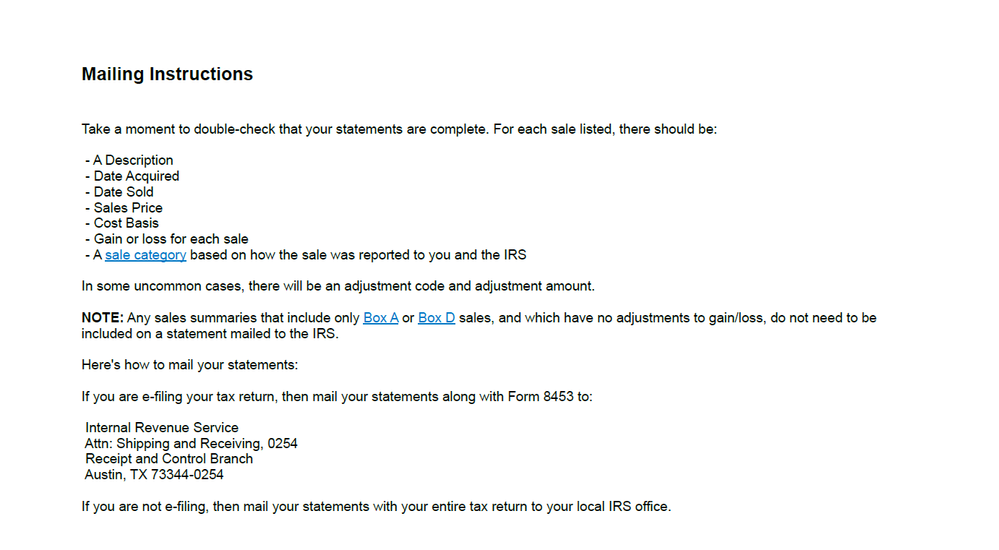

Well, instead of importing the positions from TD Ameritrade, I tried entering it as a summary instead, wherein it asks for proceeds/cost basis/adjustment/etc. Because I have adjusted "wash sales", I am triggered to fill out a Form 8453 and to mail 100+ pages of my 1099 document to the IRS office in Austin, TX (screenshot below). Is there not a simple fix for this? By the way, 21 billion options contracts were traded last year in 2020 -- many of which came from ETrade/TD Ameritrade/Fidelity/Schwab/etc. Is TurboTax not willing to fix this issue for its customers?

February 14, 2021

11:43 PM

3,153 Views