- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Turbotax 2019 does not allow negative number in Indiana K-1 form line 19

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2019 does not allow negative number in Indiana K-1 form line 19

Hello,

I'm a resident of CA but need to file an Indiana non-resident return because of an Indiana-based partnership I have. The Indiana K-1 form (IT-20S/IT-65 2019 Schedule IN K-1) I received from the partnership's CPA has a negative number in line 19 (under Part 4 - State Modifications); the associated "code" for this K-1 entry is 142. When I try to enter this number into Turbotax (in the Indiana state tax tab, directly on the form) I get an error message saying "the value entered must be equal to or greater than 0."

Any guidance would be appreciated.

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2019 does not allow negative number in Indiana K-1 form line 19

Code 142 is for Excess Federal Interest Deduction Modifications per the IN Form 65 instructions (see on page 9 of this PDF:(

"Excess Federal Interest Deduction Modification (3-digit code: 142) - IRC Section 163(j) limits the federal interest deduction for most business interest to 30% of adjusted taxable income plus business interest. However, Indiana decoupled from this provision. Subtract an amount equal to the amount disallowed as a federal deduction for excess business interest in the year in which the interest was first paid or accrued. Add back any amount of excess taxable income (as defined in IRC Section 163(j)(4)(C)) determined at the entity level.business interest expense deduction limited (i.e., not allowed) for federal purposes, but allowable as deduction for Indiana."

Because your entry is a negative number, it is a subtraction and thus is likely the excess business interest you couldn't deduct for federal purposes. Try to enter the amount without the minus sign in the section on subtractions, and check to make sure that amount was subtracted from federal income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2019 does not allow negative number in Indiana K-1 form line 19

Hello,

I have the same problem this year. If I enter the negative number without the minus sign (i.e. as a positive number) the amount is added to the other lines which is wrong --- it should be subtracted. Consequently the AGI in line 10 of the Indiana K-1 form does not match the number Turbotax calculates.

Any suggestions would be appreciated.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2019 does not allow negative number in Indiana K-1 form line 19

Anyone solve this issue? I had/have the same issue on the 2020 tax return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2019 does not allow negative number in Indiana K-1 form line 19

In computer parlance, negative numbers do not always have a minus sign in front of them. Sometimes a number enclosed in parenthesis is considered to be and treated as a negative number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2019 does not allow negative number in Indiana K-1 form line 19

In TurboTax, a negative number is virtually always entered with a minus sign before it, not parentheses.

Regardless, I suspect, due to the nature of the form, that the section presented will have to be completed in Forms Mode, which is only supported in the desktop (installed on a computer) versions of TurboTax.

The lines on the K-1 in that section will most likely have to be entered and calculated manually.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2019 does not allow negative number in Indiana K-1 form line 19

Thanks for all your suggestions. For context at the time:

- It was on the desktop version of TurboTax

- I tried both with minus sign and with parentheses

- I tried in forms mode

- This is not a number which TurboTax needed to calculate for me; it's a number I had to copy from a given K-1

- ...

You get the picture. In fact I called TurboTax support on the phone. They checked internally and admitted that it was a known bug in the software. At the time they couldn't commit to a fix date. Since there was no way to work around this TurboTax bug they gave me a refund for the state product --- one has to use some other product or file a paper return.

HTH.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2019 does not allow negative number in Indiana K-1 form line 19

I even tried ignoring the error and e-filing with Indiana. Indiana rejected it and sent me instructions that if it's negative to just use zero, I think bc it doesn't affect the taxes owed if it's a negative or zero income amount

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2019 does not allow negative number in Indiana K-1 form line 19

you have an issue that you need to resolve with the preparers. line19 should be positive. you need to find out why a negative amount was reported.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2019 does not allow negative number in Indiana K-1 form line 19

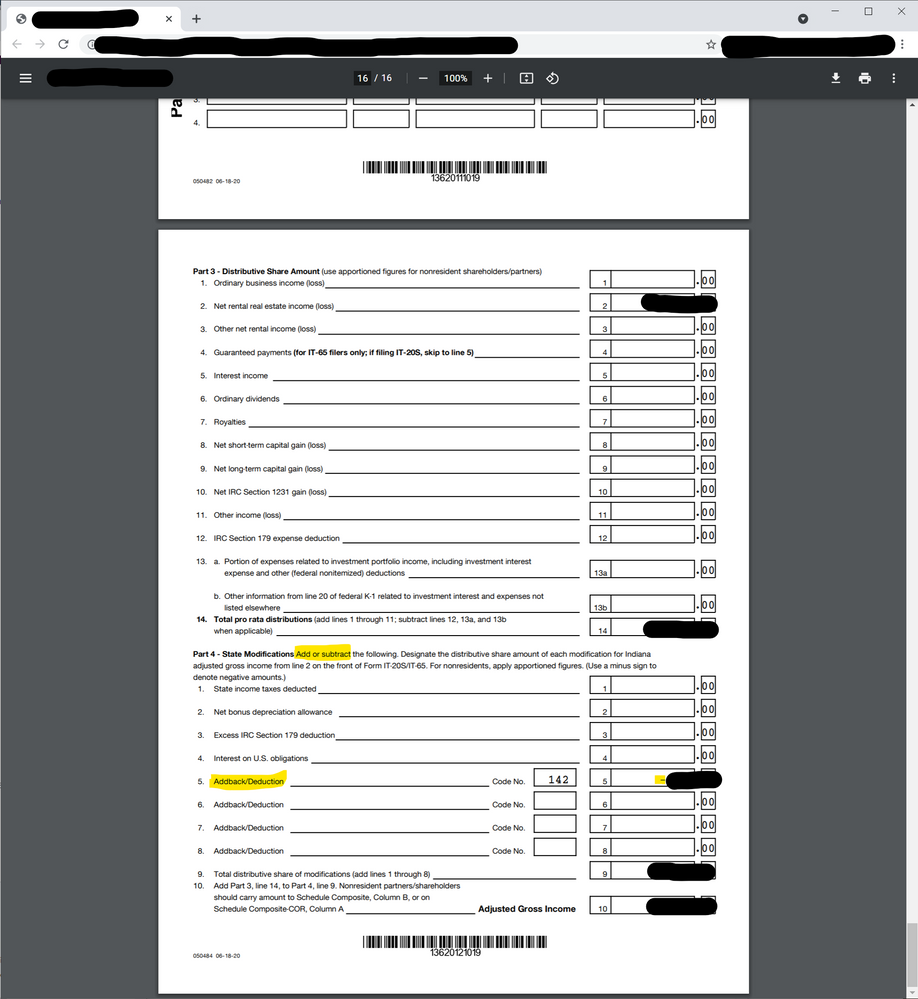

The numbers on line 19 in TurboTax comes from Indiana IT-20S/IT-65 2020 Schedule IN K-1 form, Part 4 "State Modifications", line 5. The instructions for Part 4 and the text for line 5 clearly say that numbers can be negative. See the attached screenshot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2019 does not allow negative number in Indiana K-1 form line 19

@Koala Bear wrote:

The instructions for Part 4 and the text for line 5 clearly say that numbers can be negative.

Negative or positive, according to the form, and TurboTax clearly has an issue with the former.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2019 does not allow negative number in Indiana K-1 form line 19

This error in turbotax is still occurring with the 2021 latest update. How does one resolve this issue? A valid deduction is a negative number and this is not processed correctly for IN state taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2019 does not allow negative number in Indiana K-1 form line 19

Are you able to enter the value at the screen COVID-related Employee Retention Credit Disallowed Expenses Deduction as a positive amount?

If so, the entry will be found on

- Schedule 2: Deductions on line 11 code 634, and

- Indiana IT-40 line 4.

View the entries at Tax Tools / Print Center / Print, save or preview this year's return.

@RAiken

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2019 does not allow negative number in Indiana K-1 form line 19

Yes! And this seems to work into the forms and lines cited.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax 2019 does not allow negative number in Indiana K-1 form line 19

I have the same issue now in Oct/2024. TurboTax never fixed the bug.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Omar80

Level 3

kkrana

Level 1

FroMan

New Member

patamelia

Level 2

nstuhr

Returning Member