- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Real Estate Pro can not offset ordinary income with passive loss

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Real Estate Pro can not offset ordinary income with passive loss

Hi All,

My wife is a real estate professional and I'm a W-2 earner.

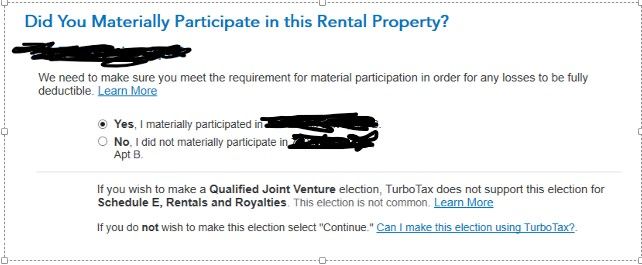

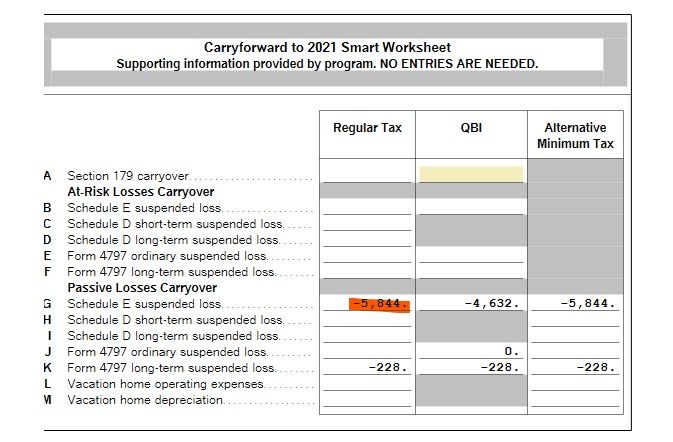

Having followed various threads on this forum, I believe i've properly checked the right boxes to recognize her "real estate Professional" status in Turbotax, I was expecting that any carry-over passive loss from rental activity can be used to offset my "active (W-2)" income. However, it appears that we still have passive activity losses that's "disallowed (see last screenshot from Schedule E Worksheet where it says $5844 is still disallowed)."

Is there somewhere else I didn't do properly?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Real Estate Pro can not offset ordinary income with passive loss

@schumia I believe you stated it correctly and have the correct understanding of the scenario.

In short, if you are a real estate professional who materially participates in a given year, then you are not limited by the passive activity loss rules; you can use your losses to offset all other income.

In any year in which you are not a real estate professional who materially participates, your PALs may be suspended.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Real Estate Pro can not offset ordinary income with passive loss

Per Section 469(c)(7), the election is applicable to each taxable year and would not impact suspended losses (i.e., PAL carryovers from a prior tax year).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Real Estate Pro can not offset ordinary income with passive loss

Tks tagteam for your reply..

So the way I understand what you're saying "..Per Section 469(c)(7), the election is applicable to each taxable year...," this means prior years carry-over passive losses can not be used to offset this year's (2020) "active" income.

So the only way to offset "ordinary/active" income in a given year (say 2020) is to have "fresh" passive losses generate from passive activity (apartment rental in my case), and this passive loss needs to be large enough to first offset "rental income" and whatever that is leftover, can then be applied towards ordinary income?

It's a mouthful to describe, but just want to get the concept right 😃 Thanks for your explanation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Real Estate Pro can not offset ordinary income with passive loss

@schumia I believe you stated it correctly and have the correct understanding of the scenario.

In short, if you are a real estate professional who materially participates in a given year, then you are not limited by the passive activity loss rules; you can use your losses to offset all other income.

In any year in which you are not a real estate professional who materially participates, your PALs may be suspended.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nirbhee

Level 3

Cindy10

Level 1

RicN

Level 2

rpaige13

New Member

user17524923356

Level 2

in [Event] Ask the Experts: Investments: Stocks, Crypto, & More