- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Real Estate Pro can not offset ordinary income with passive loss

Hi All,

My wife is a real estate professional and I'm a W-2 earner.

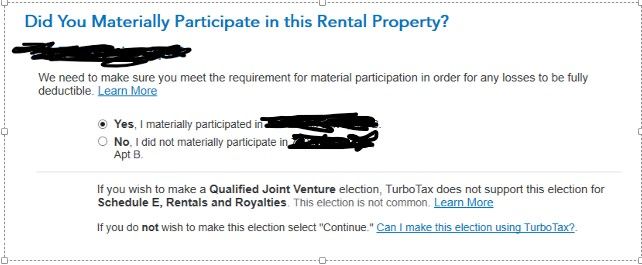

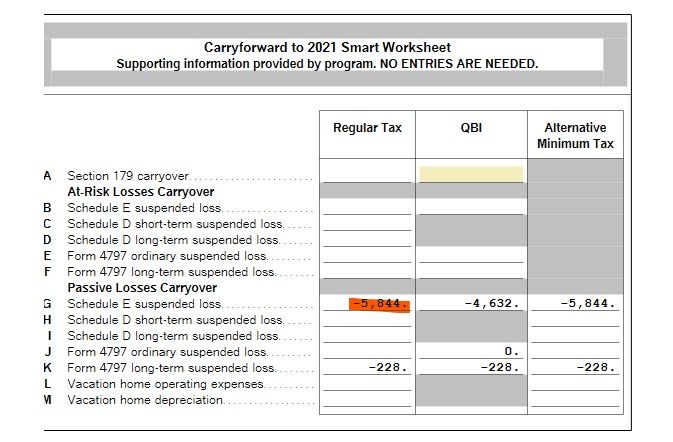

Having followed various threads on this forum, I believe i've properly checked the right boxes to recognize her "real estate Professional" status in Turbotax, I was expecting that any carry-over passive loss from rental activity can be used to offset my "active (W-2)" income. However, it appears that we still have passive activity losses that's "disallowed (see last screenshot from Schedule E Worksheet where it says $5844 is still disallowed)."

Is there somewhere else I didn't do properly?

Topics:

April 26, 2021

6:54 AM