- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

Hello,

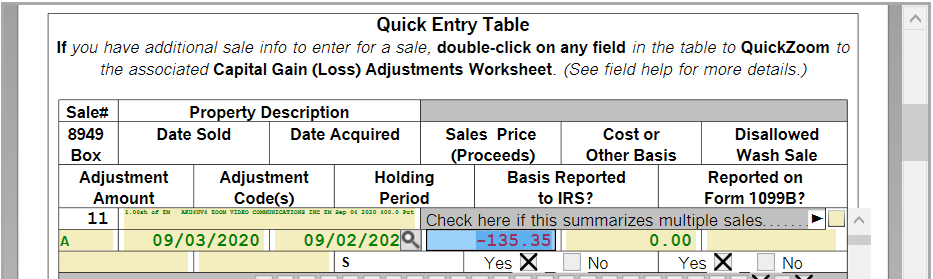

I sell/write options that I collect premiums for, but TurboTax keeps generating an error message asking to correct the negative number. I double checked the TD Ameritrade statement, and indeed, the number is correct. Please advise.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

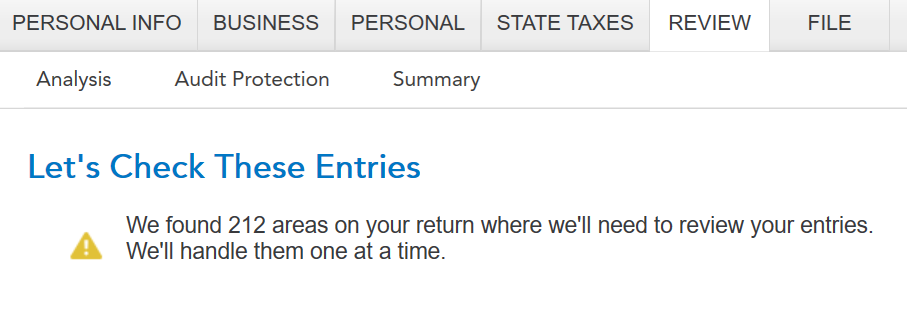

If you imported your options transactions from brokers and you got an error stating that the values are not between prescribed limits, then that means there is a negative number being reported by the broker. The IRS will reject the return if it gets that far.

TT is flagging the error and not allowing it to be filed. Here is an answer that may give some guidance:

There has been a change by the IRS starting with the 2020 tax returns that will reject any return filed with a negative number reported in the proceeds or cost basis fields for Schedule D. TurboTax is flagging these situations ahead of time before the return is filed in order to prevent the IRS rejection. Some brokers are still using the old convention for reporting negative values and have not updated their reports to match the IRS.

The error message reported by TurboTax is telling you that the number entered cannot be negative.

Gains from expired options are reported by entering the gain amount in the proceeds column and no amount in the cost basis column. The end result here would be positive.

Losses from expired options are reported by entering the loss amount in the cost basis column and no amount in the proceeds column. The end result here would be negative.

No negative numbers should be entered in either the cost basis or proceeds fields.

If negative numbers have been imported through your brokerage statement, you will need to edit the entries to make the correction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

Please be aware that you can aggregate covered transactions without adjustments on Schedule D Line 1a.

or Line 8a.

Form 8949 is not required and no mailing is necessary.

There is no reason to key in or import those transactions.

Option writes that expire are covered transactions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

Having same issue with Td with same error. Mine are with short sale options which were closed before expiration showing cost basis zero and negative for proceeds.

Do i correct by moving negative proceed to cost making it positive and saying proceed is zero?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

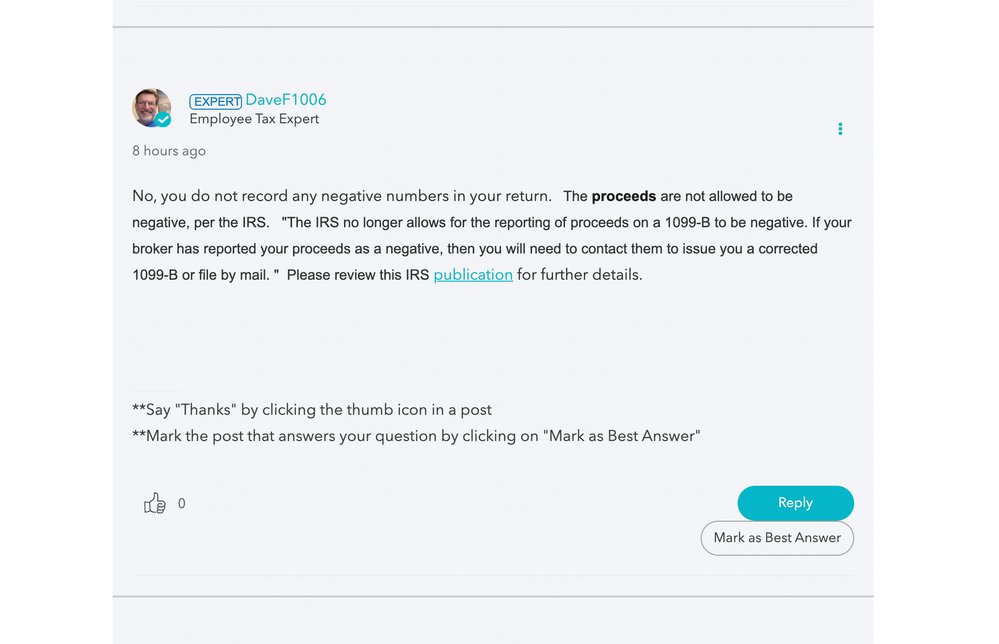

No, you do not record any negative numbers in your return. The proceeds are not allowed to be negative, per the IRS. "The IRS no longer allows for the reporting of proceeds on a 1099-B to be negative. If your broker has reported your proceeds as a negative, then you will need to contact them to issue you a corrected 1099-B or file by mail. " Please review this IRS publication for further details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

@quantbone2020. This is the correct link.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

@DaveF1006 thank you for the link!

I just scanned the entire document (page by page), and I can't find anywhere in the document wherein the IRS states the information below? Would you mind copying and pasting where you saw the below cited information? Thank you again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

Here is a LINK that takes you to 2020 Instructions for Schedule D.

RS schedule D instructions . On page 6, it describes how to report options sales. The take away is that gains from expired options are reported with the gain amount in the proceeds column and no amount in the cost basis column, while losses from expired options are reported with the loss amount in the cost basis column and no amount in the proceeds column.

No negatives should ever be used in either columns. The use of negative proceeds was a very old reporting regime that the IRS accommodated until Ty20. For Ty20, they've updated the schema to disallow negative values for proceeds or basis. Any brokers still reporting negative values for proceeds or basis need to updated their reporting schema to match the IRS'.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

E-Trade claims this is a new regime, not an old regime and they are still doing it

So is TD Ameritrade.

The brokers don't follow and have not followed those reporting instructions in any case or any way you look at it.

Meanwhile, why doesn't TurboTax allow you to enter "Expired" into form 8949 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

The error is a TurboTax import error. TT is importing the "Gain or Loss" from TD Ameritrade into the Sales Price field in TT and therefore throwing an error whenever the gain/loss was a loss. Fix the import or scrap your 1099-B worksheets. It has nothing to do with TD Ameritrade reporting.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

I retract my previous comment. I see now what you are saying. Needless change by the IRS that we all need to suffer through.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

CollenD3

Other forums are saying that this is a Turbo Tax error that has occurred in previously years. Can you share where you saw “ Starting from 2020, IRS will reject (no longer allow) negative proceeds....“. My situation is I first sold naked puts and bought it back later for a loss (paid more than what I initial sold it for). TD Ameritrade is showing a zero cost basis and a negative proceeds. No problem for previous years. Thanks much if you could elaborate

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

CollenD3

Other forums are saying that this is a Turbo Tax error that has occurred in previously years. Can you share where you saw “ Starting from 2020, IRS will reject (no longer allow) negative proceeds....“. My situation is I first sold naked puts and bought it back later for a loss (paid more than what I initial sold it for). TD Ameritrade is showing a zero cost basis and a negative proceeds on their 1099-B. No problem for previous years. Thanks much if you could elaborate. According to IRS, what is on the tax return needs to match what is on the 1098-B which was sent to IRS. 1099-B is clearing now the negative numbers and brokers are saying they are not correcting them because they were correct.

best regards,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Issue on "Sales Price is not between the prescribed upper and lower limits"

Other forums are saying that this is a Turbo Tax error that has occurred in previously years. Can you share where you saw “ Starting from 2020, IRS will reject (no longer allow) negative proceeds....“. My situation is I first sold naked puts and bought it back later for a loss (paid more than what I initial sold it for). TD Ameritrade is showing a zero cost basis and a negative proceeds. No problem for previous years. The IRS instructions say that what is on the return needs to match what has been reported by the brokers to the IRS. Most brokers if not all are still showing negative proceeds and claim that they are correct. Thanks much if you could elaborate

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rkhattak

New Member

ltandblondie

New Member

cindyxsun

New Member

iamthekat

New Member

iamthekat

New Member