- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Schedule K-1, Section 199A, Box 20, Code Z: What do I enter in TT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1, Section 199A, Box 20, Code Z: What do I enter in TT?

I have a description in my 199A called "SELF-EMPLOYMENT EARNINGS(LOSS)" with an amount of -79... This doesn't match up with any of the descriptions on the "We need some information about your 199A income" screen. Where should this go?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1, Section 199A, Box 20, Code Z: What do I enter in TT?

This is the amount of income from your K-1 that is qualified business income (QBI) for the qualified business income deduction (QBID).

Based on the box number in the question it is assumed you are referring to a 1065 K-1.

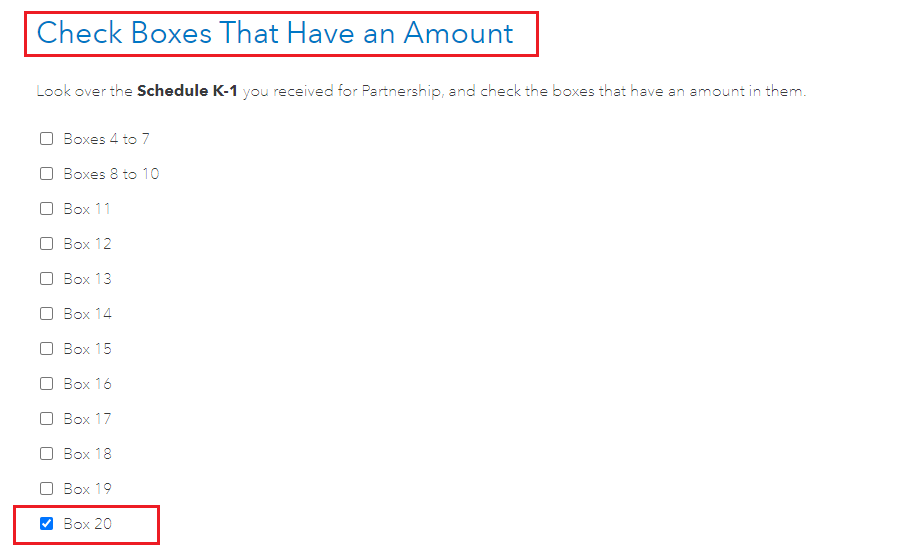

- First make sure that when you see the screen 'Check Boxes That Have an Amount' that you check box 20.

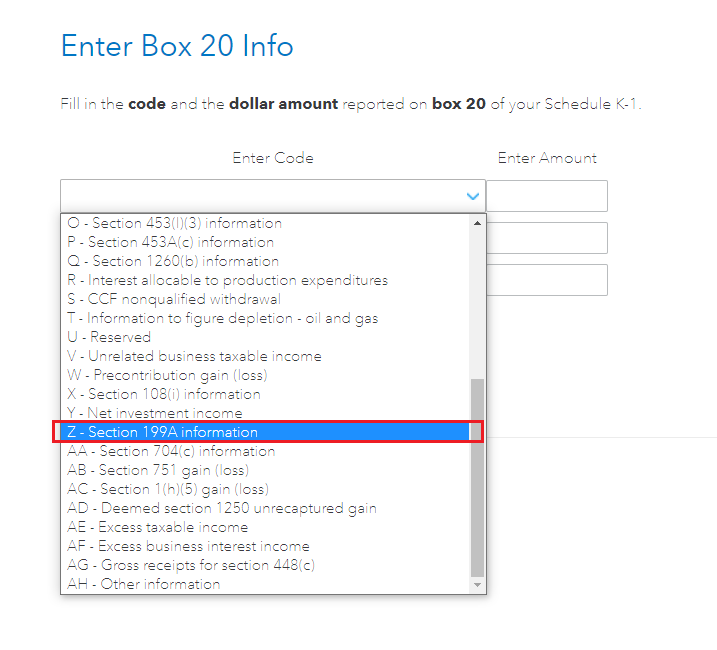

- Next, when Box 20 comes up, you want to select Z-Section 199A from the dropdown and then enter your amount

- If that amount is a negative then use the minus sign in front of the number to indicate that

- See the images below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

iyeruv

New Member

tmv96

New Member

vypatern

Level 1

JayGFargo

New Member

user17674020775

New Member