- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

This is the amount of income from your K-1 that is qualified business income (QBI) for the qualified business income deduction (QBID).

Based on the box number in the question it is assumed you are referring to a 1065 K-1.

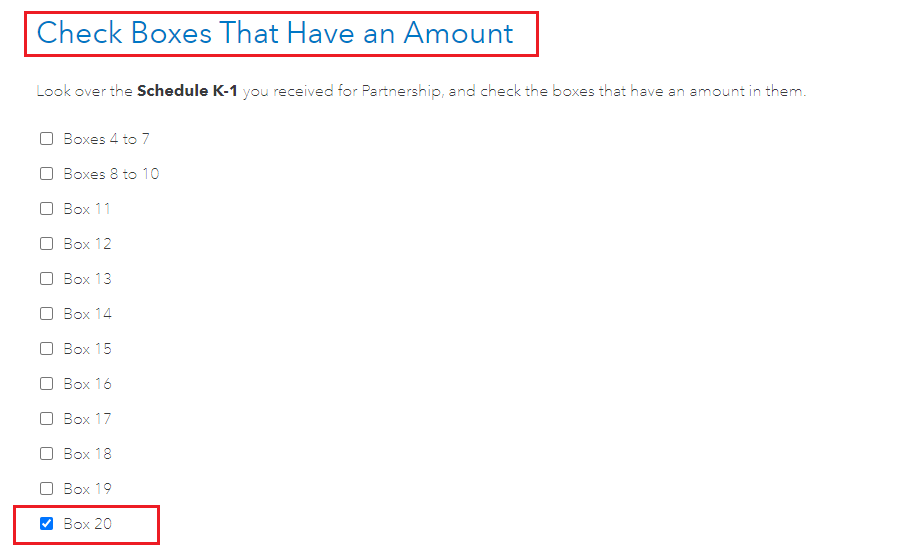

- First make sure that when you see the screen 'Check Boxes That Have an Amount' that you check box 20.

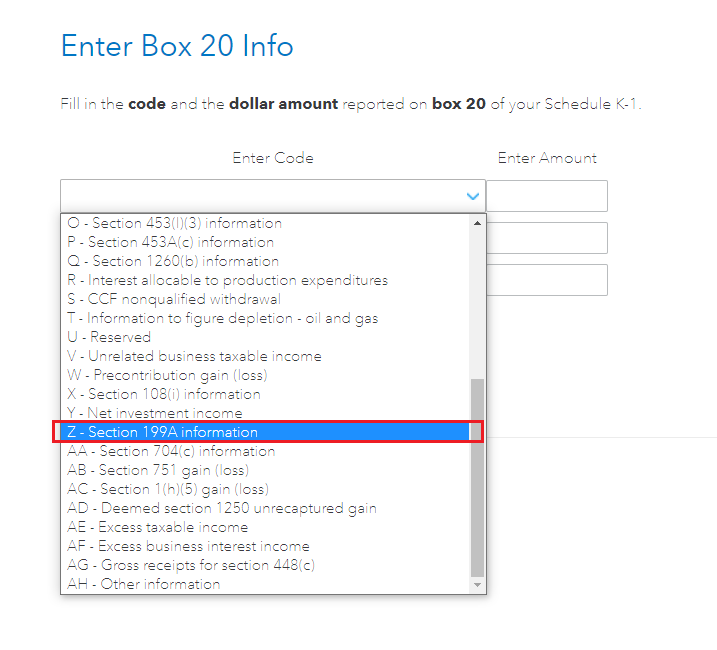

- Next, when Box 20 comes up, you want to select Z-Section 199A from the dropdown and then enter your amount

- If that amount is a negative then use the minus sign in front of the number to indicate that

- See the images below.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 14, 2021

11:54 AM