- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Sale of Second Home 1099-S 2020 Turbo tax Premier

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Second Home 1099-S 2020 Turbo tax Premier

I have done everything the discussion board says to do for entering the sale of a second home .... there is no type of sale for a second home.... only asking for 1099-B. how do I enter my 1099-S?

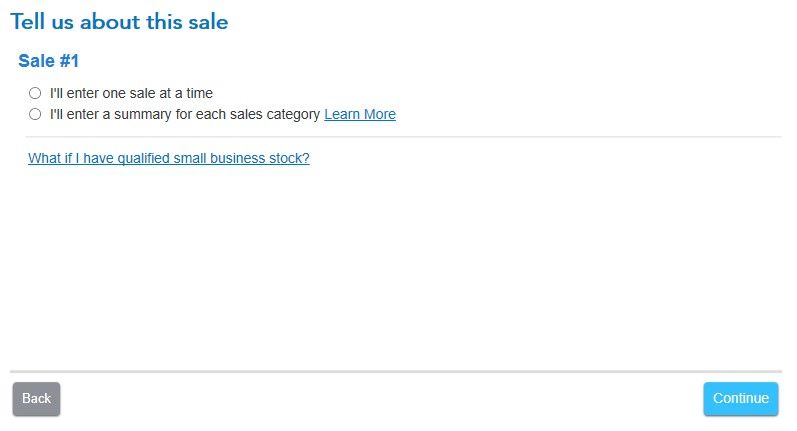

This is all I get - I have a 1099-S and need to include it. How do I do that?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Second Home 1099-S 2020 Turbo tax Premier

Select that you will enter one sale at a time and enter the transaction on the following screen (as if it were the sale of a stock or bond).

If you have a loss, make sure you check the appropriate box on a following screen since losses from the sales of personal use property are not deductible.

If you have ever used the second home as a rental, you will have to use a different method to enter the sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Second Home 1099-S 2020 Turbo tax Premier

It has different data boxes... and does not correlate with the sale of a second home.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Second Home 1099-S 2020 Turbo tax Premier

@Dboersma wrote:

It has different data boxes... and does not correlate with the sale of a second home.

It has all of the data boxes you need to report the sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Second Home 1099-S 2020 Turbo tax Premier

The sale of a second home is entered just like stock sales on the same screen and will be reported on the Sch D & 8949 ... there is no direct 1099-S entry screen because the IRS doesn't require it ... the sale on the 1099 just needs to be reported on the Sch D so don't get hung up on the box labels.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Second Home 1099-S 2020 Turbo tax Premier

@Anonymous_ I’m also stuck on this section. I sold my second home at a loss ...i filled everything out but it’s still saying I can use $3000 capital loss for 2020 and $110k to carry forward for 2021 but you had mentioned to make sure I click on the correct box since losses can’t be deducted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Second Home 1099-S 2020 Turbo tax Premier

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

BaliAgnes

New Member

GaGirl55

Level 2

Lukas1994

Level 2

friskytrisk

New Member

kaylinmarcum14

New Member