- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Received a K-1 Error Message for Box 20 Code Z

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a K-1 Error Message for Box 20 Code Z

It says Code Z has been selected but no Section 199A income has been entered on Statement A. There is an amount listed on Box Z, do I have to enter that number on a "Statement A" as well? If so, where is it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a K-1 Error Message for Box 20 Code Z

Yes, TurboTax should ask you for more information about Section 199A relating to Box 20 Code Z at the end of the Schedule K-1 interview. Please return to that section of your Federal tax return and review your entries for this investment. Look for a page called "We see you have Section 199A income."

The easiest way to find this section In TurboTax Online, is to go to Tax Tools in the left column >> Tools >> Topic Search. Type in your topic, then click the topic in the list and then GO to go directly to the start of that section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a K-1 Error Message for Box 20 Code Z

Yes, TurboTax should ask you for more information about Section 199A relating to Box 20 Code Z at the end of the Schedule K-1 interview. Please return to that section of your Federal tax return and review your entries for this investment. Look for a page called "We see you have Section 199A income."

The easiest way to find this section In TurboTax Online, is to go to Tax Tools in the left column >> Tools >> Topic Search. Type in your topic, then click the topic in the list and then GO to go directly to the start of that section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a K-1 Error Message for Box 20 Code Z

Yes, I went back to the K-1 questions and realized that I had only provided the amounts for 2 of the 3 listed codes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a K-1 Error Message for Box 20 Code Z

I keep getting the "no section 199A income has been entered on statement A" error. I have tried several of the methods on here to fix this glitch with no resolution. I have a K-1 with a Box 20 Z and STMT. I have left the Box 20 amount blank.

Under "we see you have section 199A income", I select income comes from the partnership.

My Box 2 statement from the K-1 is for Type 4 commercial rental real estate. It lists a gross income, expenses, and a passive net income. I'm not sure what box to check when they ask for more information about the 199A. I had been checking the UBIA, as there are carryover losses.

I'm not sure how to get the program to correct this error. I just have one number to enter

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a K-1 Error Message for Box 20 Code Z

Hopefully, the preparer of your K-1 provided section 199A information that allows you to claim the Qualified Business Income Deduction. In many cases, (but not all) you report:

- Ordinary business income,

- W-2 wages for the business, and

- UBIA of qualified property for the business.

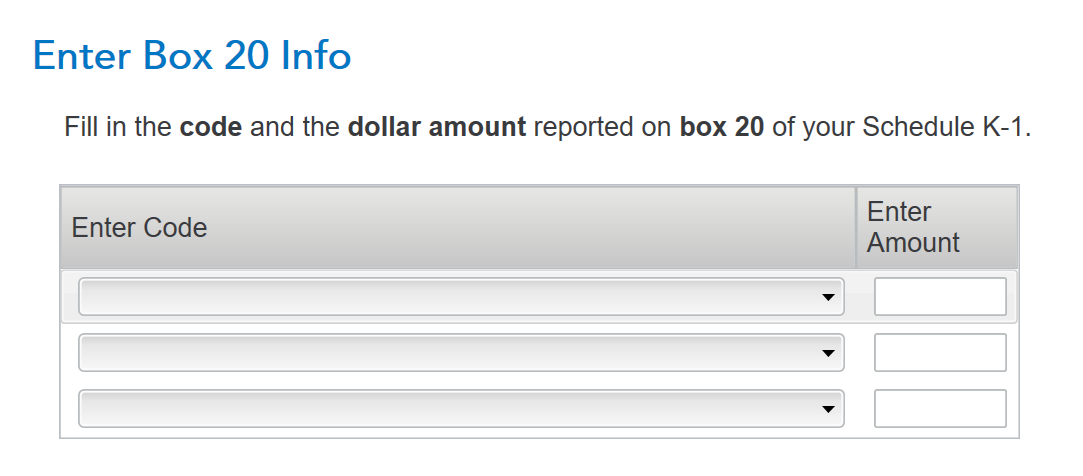

At the screen Enter Box 20 info,

- You select Code Z Section 199A information.

- Click Continue.

- At the screen We need some information about your 199A income, you would enter the information that the preparer of your K-1 provided.

- Enter these values for the qualified business income deduction to be calculated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a K-1 Error Message for Box 20 Code Z

Yes, he supplied all the information. There is no ordinary business income or W-2 wages for this LLC. I select UBIA box and enter the amount from my K-1 statement. I still end up with same the error when I run the check, which prevents me from filing. Very frustrating as there must be a simple fix or something simple I'm missing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a K-1 Error Message for Box 20 Code Z

This problem arises every year. You can enter the correct information, select box 20, code z, enter the amount when requested and Turbotax still creates an error message. I too would also like to know how to fix this, and Turbotax needs to put in an update to software because this issue has existed every year over the last 4.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a K-1 Error Message for Box 20 Code Z

I second that. Had the same issue in 2021, but somehow managed to resolve it (QBI) . The resolution does not work in 2022.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a K-1 Error Message for Box 20 Code Z

I am also having a same issue. the amount is entered, but still gets an error.

Did anyone figure out a workaround?

This is first year that I have with K-1 and I want to make sure I am entering things right, but at this point, I am feeling like it is the program (after two days of pulling hair out on this issue).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a K-1 Error Message for Box 20 Code Z

It is not clear if your K-1 is from a partnership. Assuming it is from a partnership below is some guidance.

- "Box 20—Codes Z through AD that were previously used to report section 199A information has been changed. Only code Z will be used to report section 199A information.

- Partnerships should use Statement A—QBI Pass-Through Entity Reporting, or a substantially similar statement, to report information for each partner’s distributive share from each trade or business, including QBI items, W-2 wages, UBIA of qualified property, qualified PTP items, and section 199A dividends by attaching the completed statement(s) to each partner’s Schedule K-1. The partnership should also use Statement A to report each partner’s distributive share of QBI items, W-2 wages, UBIA of qualified property, qualified PTP items, and section 199A dividends reported to the partnership by another entity.

Please see the screenshots below. You will be asked a series of questions that you can answer based on the Schedule K-1 you received. You may need to follow up with the Tax Preparer for a partnership return if you do not have a Statement showing the section 199 information.

Below is additional guidance from the IRS regarding

Schedule K-1 (Form 1065)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a K-1 Error Message for Box 20 Code Z

Thank you for your reply.

Indeed it is a K1-Partnership, and I was able to get rid of the error

The "shortcoming" of Turbotax is that it does not automatically carry-over the business income (in that case rental income) from box 2 on my K-1 into section 199A.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a K-1 Error Message for Box 20 Code Z

Okay I figured it out. The problem is that TurboTax Home and Business does not have a section to enter the Rental Income Loss. So. Run the Smart Check and it will take you to the error. Click inside the form that shows up and scroll down until you reach the form Statement A (199A). Now you can see the line Rental Income Loss. Input this value (should be -) into the box. Once you have done this, the error disappears and you can now submit your finished taxes online. You’re welcome.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a K-1 Error Message for Box 20 Code Z

Okay I figured it out. The problem is that TurboTax Home and Business does not have a section to enter the Rental Income Loss. So. Run the Smart Check and it will take you to the error. Click inside the form that shows up and scroll down until you reach the form Statement A (199A). Now you can see the line Rental Income Loss. Input this value (should be -) into the box. Once you have done this, the error disappears and you can now submit your finished taxes online. You’re welcome.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a K-1 Error Message for Box 20 Code Z

Solved. The problem is that TurboTax Home and Business does not have a section to enter the Rental Income Loss. So. Run the Smart Check and it will take you to the error. Click inside the form that shows up and scroll down until you reach the form Statement A (199A). Now you can see the line Rental Income Loss. Input this value (should be -) into the box. Once you have done this, the error disappears and you can now submit your finished taxes online. You’re welcome.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a K-1 Error Message for Box 20 Code Z

Hello. Can you please help Intuit edit this section of TurboTax Home and Business? Many customers using it have the same problem. In the K-1 section where if the Box 20 has Z checked, the next section is the 199A or Statement A categories, the Rental Income Loss is missing. Since it’s missing, we will always get an error through Smart Check. I figured it out by going through the error and finding the Rental Income Loss section myself by scrolling down to it and inputting it myself. The edit would be to have it in the categories for the 199A section so that when inputted here, it will show up in the actual form later and won’t trigger the error. Please fix this which will help many, many people using your product. Thank you.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

noellematthews

Returning Member

user17714535891

New Member

j.colombo

Returning Member

user17714484965

New Member

zinj

Level 3

in Education