- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

It is not clear if your K-1 is from a partnership. Assuming it is from a partnership below is some guidance.

- "Box 20—Codes Z through AD that were previously used to report section 199A information has been changed. Only code Z will be used to report section 199A information.

- Partnerships should use Statement A—QBI Pass-Through Entity Reporting, or a substantially similar statement, to report information for each partner’s distributive share from each trade or business, including QBI items, W-2 wages, UBIA of qualified property, qualified PTP items, and section 199A dividends by attaching the completed statement(s) to each partner’s Schedule K-1. The partnership should also use Statement A to report each partner’s distributive share of QBI items, W-2 wages, UBIA of qualified property, qualified PTP items, and section 199A dividends reported to the partnership by another entity.

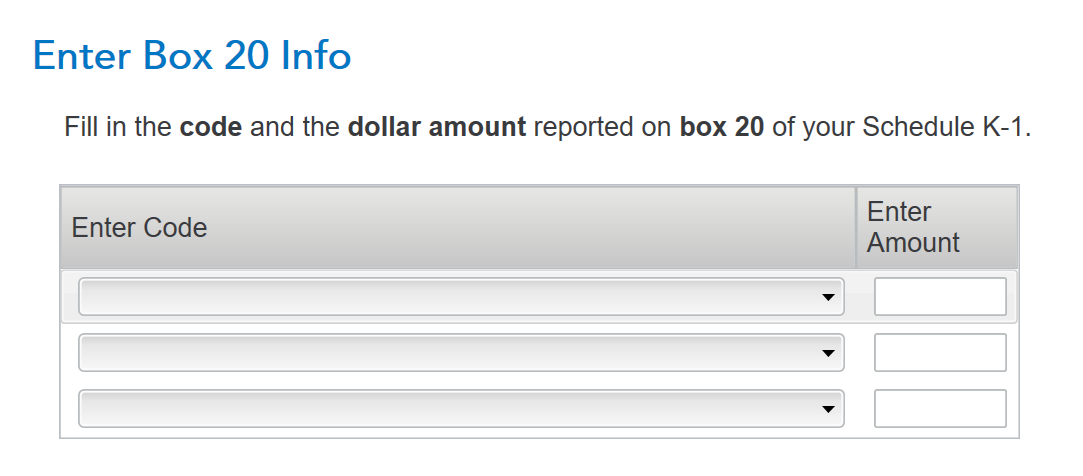

Please see the screenshots below. You will be asked a series of questions that you can answer based on the Schedule K-1 you received. You may need to follow up with the Tax Preparer for a partnership return if you do not have a Statement showing the section 199 information.

Below is additional guidance from the IRS regarding

Schedule K-1 (Form 1065)

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 24, 2023

11:31 AM