- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Need help with K1 and it's 199A with TurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 and it's 199A with TurboTax

Hello - This is my first K1 (partnership REIT) so have few questions. I will appreciate your help.

(Numbers are FAKE. )

Here is the scenario

- My K1's section L has "Current year net income (loss) = -20.00"

- Because number 20 has code Z, it came with 199A. 199A has couple of entries that kind of look like this

- Rent / Rental overhead --> rent income (loss) = 1.0

- Rent - [some property]

- Rental income (loss) = -12.00

- UNADJUSTED BASIS OF ASSETS = 61.00

- Pass through - [some property 2]

- Rental income (loss) = -13.00

- UNADJUSTED BASIS OF ASSETS = 62.00

Question I have is

Turbo tax has few questions for 199A and one is "[my company] has business income (loss)" with following sub questions. What do i answer there based on the data above?

- Ordinary business income (loss) : ???

- Rental income (loss): ???

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 and it's 199A with TurboTax

Your K-1 is reporting rental income and loss, and there is a place in TurboTax to enter that, which is explained later in this response.

Because your K-1 is reporting Section 199A information for both the "main" partnership, and also one or more pass-through entities, you'll have to enter multiple K-1s for the single K-1 you actually received. One K-1 will be for the "main" partnership and have only the box 1-20 amounts related to that main partnership. The additional K-1s will be for the "pass-through" entity and possibly the "some property" entity (only if "some properties" is a separate entity). These additional K-1s will have only the box 1-20 amounts related to that pass-through entity.

If you can't figure (deduce) that "split" from the information you have, you will need to contact the preparer of the K-1 to get those amounts.

For all these K-1s, use the same identifying information for the "main" partnership that sent you the K-1 (e.g., name of partnership, address, EIN, etc) when you begin the K-1 entry. Later, when you tell TurboTax that one of the K-1s is for the pass-through entity (and "some properties" if it is a separate entity instead of the main partnership), TurboTax will ask for the name and EIN of the pass-through entity.

Note that when you enter each K-1, you'll encounter the question "Is the business that generated the Section 199-A income a separate business owned by the partnership?" screen, TurboTax is asking if the Section 199-A income was passed through to the partnership sending you the K-1 by another partnership, S-Corp, or trust; versus being generated by the business operations of the partnership that sent you the K-1. So, on one of the K-1s you enter you will answer that it is from the partnership, and on the others you will enter that it is from the pass-through entity. TurboTax will ask for the name and EIN of each pass-through entity.

Note that UBIA is an acronym for Unadjusted Basis in Assets.

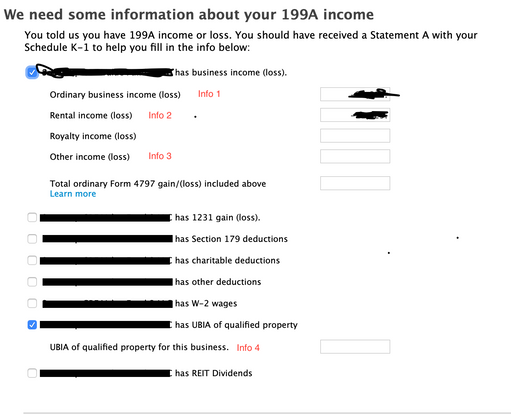

For both K-1s you enter, enter the code Z when you enter the K-1 box 20 screen, but you don't need to enter an amount on that screen. Continue on, and you'll eventually find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Statement or STMT that came with your K-1. The applicable category (or categories) on this screen (and the following "Let's check for some uncommon adjustments" screen, if applicable) must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here are the "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens where you enter the information from your K-1 Section 199A Statement/STMT:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 and it's 199A with TurboTax

Firstly, only the amounts from the Section 199A statement are reported on the "We need some more information about your 199A income or loss" screen. You do not pull amounts from the K-1 boxes to populate this screen, only amounts from that Section 199A statement.

Secondly, I did not see anything designated as "ordinary business income" on your Section 199A statement. All three items on your Section 199A statement are rental income (loss). As a result, I don't see any basis to report QBI ordinary income (loss) for this K-1, only rental income (loss).

Thirdly, I don't understand what a Section 199A statement would use the term "passthrough" for QBI information, if that QBI information was not being passed from another entity. Normally, information reported as passthrough on a Section 199A statement is from a separate entity, and as such should be entered into TurboTax on a separate K-1.

That being said, if is true that all this QBI information was generated by the activities of the main partnership, you would have ($24) of rental loss and $123 of UBIA reported on the "We need some more information about your 199A income or loss" screen. If instead there is a separate passthrough entity, the separate K-1 for the passthrough would report the ($13) rental loss and $62 UBIA and the other ($11) rental loss and $61 UBIA would be on the "main" partnership K-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 and it's 199A with TurboTax

Your K-1 is reporting rental income and loss, and there is a place in TurboTax to enter that, which is explained later in this response.

Because your K-1 is reporting Section 199A information for both the "main" partnership, and also one or more pass-through entities, you'll have to enter multiple K-1s for the single K-1 you actually received. One K-1 will be for the "main" partnership and have only the box 1-20 amounts related to that main partnership. The additional K-1s will be for the "pass-through" entity and possibly the "some property" entity (only if "some properties" is a separate entity). These additional K-1s will have only the box 1-20 amounts related to that pass-through entity.

If you can't figure (deduce) that "split" from the information you have, you will need to contact the preparer of the K-1 to get those amounts.

For all these K-1s, use the same identifying information for the "main" partnership that sent you the K-1 (e.g., name of partnership, address, EIN, etc) when you begin the K-1 entry. Later, when you tell TurboTax that one of the K-1s is for the pass-through entity (and "some properties" if it is a separate entity instead of the main partnership), TurboTax will ask for the name and EIN of the pass-through entity.

Note that when you enter each K-1, you'll encounter the question "Is the business that generated the Section 199-A income a separate business owned by the partnership?" screen, TurboTax is asking if the Section 199-A income was passed through to the partnership sending you the K-1 by another partnership, S-Corp, or trust; versus being generated by the business operations of the partnership that sent you the K-1. So, on one of the K-1s you enter you will answer that it is from the partnership, and on the others you will enter that it is from the pass-through entity. TurboTax will ask for the name and EIN of each pass-through entity.

Note that UBIA is an acronym for Unadjusted Basis in Assets.

For both K-1s you enter, enter the code Z when you enter the K-1 box 20 screen, but you don't need to enter an amount on that screen. Continue on, and you'll eventually find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Statement or STMT that came with your K-1. The applicable category (or categories) on this screen (and the following "Let's check for some uncommon adjustments" screen, if applicable) must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here are the "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens where you enter the information from your K-1 Section 199A Statement/STMT:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 and it's 199A with TurboTax

Thank you very much @DavidS127 for the detailed reply.

About some more information for "199A" screen what is applicable to me is

- Ordinary business income (loss)

- Rental business income (loss)

I reached out to my K1 producer company and they suggested me that

- "Ordinary business income (loss)" comes from K1's (Part III Partner’s Share of Current Year Income,

Deductions, Credits, and Other Items) --> line 1 - "Rental business income (loss)" comes from K1's (Part III Partner’s Share of Current Year Income,

Deductions, Credits, and Other Items) --> line 2

So I am little confused now. Do i need to do anything with the numbers on 199A form?

I will get back to my K1 producer company and ask them the same questions (plus separate k1 form as you mentioned in your reply). But meanwhile, feel free if I misunderstood anything.

Thank you very much. Really appreciated.

-Parthik

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 and it's 199A with TurboTax

The numbers from your 199A statement go on the "We need some more information about your 199A income or loss" screen, not the numbers from the "regular boxes" on the K-1.

The numbers on your 199A statement are all rental income, no ordinary income that I see. What is not clear to me is if the #1 and #2 items on your 199A statement are from activities of the "main partnership" or from activities of a separate entity. If both those activities are for the "main partnership" (ostensibly the case, because not identified as "passthrough") combine amounts for line #1 and #2 and report them as rental income (and UBIA) on the We need some more information about your 199A income or loss screen. Otherwise, use a separate K-1 for each separate entity reporting information on that Section 199A statement.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 and it's 199A with TurboTax

Thank you very much @DavidS127 . I think I am getting closer to this now and need to verify this one more time about my understanding.

1. I confirmed with my K1 producer that all the activities on 199A statement are from activities of the "main partnership". So, no need to divide up k1 into multiple.

2. Now, reading this entire thread again and emails I got from K1 producer, this is what I am concluding. Please let me know (correct me) if I am wrong somewhere. In the image below (at the bottom of the thread), I have placed label (info 1 to 4). Am I correct about the source of that information (considering the sample 199A I pasted in this thread)

- Info 1: (From K1 --> Part III --> number 1 (ordinary business income) ). This is listed as 0 for me. I think this info should come from somewhere from 199A. right? if 199A, from where? how do I calculate this?

- Info 2: Add all the rental income (loss) from 199A. So in my case it will be 1 - 12 -13 = -24.00

- Info 3: Nothing

- Info 4: Add all UBIA listed in 199A. In my case this is 61 + 62 = 123.00

- Anything else I should be adding?

Thank you very much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 and it's 199A with TurboTax

@DavidS127, I think your input on my last question above will conclude the thread and helpful for rest of the community. Will appreciate your input.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 and it's 199A with TurboTax

Firstly, only the amounts from the Section 199A statement are reported on the "We need some more information about your 199A income or loss" screen. You do not pull amounts from the K-1 boxes to populate this screen, only amounts from that Section 199A statement.

Secondly, I did not see anything designated as "ordinary business income" on your Section 199A statement. All three items on your Section 199A statement are rental income (loss). As a result, I don't see any basis to report QBI ordinary income (loss) for this K-1, only rental income (loss).

Thirdly, I don't understand what a Section 199A statement would use the term "passthrough" for QBI information, if that QBI information was not being passed from another entity. Normally, information reported as passthrough on a Section 199A statement is from a separate entity, and as such should be entered into TurboTax on a separate K-1.

That being said, if is true that all this QBI information was generated by the activities of the main partnership, you would have ($24) of rental loss and $123 of UBIA reported on the "We need some more information about your 199A income or loss" screen. If instead there is a separate passthrough entity, the separate K-1 for the passthrough would report the ($13) rental loss and $62 UBIA and the other ($11) rental loss and $61 UBIA would be on the "main" partnership K-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 and it's 199A with TurboTax

That helped with the Need more info about the 199A. Thank you. I did that wrong...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 and it's 199A with TurboTax

Great response to solving the multiple passthru entities rolling into a single K-1. Thank you.

Taking it one step further though. By creating multiple K-1s that will roll together for federal returns, the additional K-1s are then populated into the state return forms selection. I have multiple states.

I dont believe the states track the 199A information so submitting multiple K-1s for a single entity might be confusing? Should I override the multple K-1s in the state returns and file the single "consolidated' K-1 information in the state returns?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 and it's 199A with TurboTax

With regard to the additional K-1s for the mutliple state returns, I found that if I created the additional K-1s to track the 199A pass thru information for the federal return, and then tried to delete the "extra" K-1s for the states, the deleted state K-1s would repopulate after being deleted.

So the answer is that I have to submit the additioanal K-1s for every state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 and it's 199A with TurboTax

the issue is - is the allocated income to your other states high enough to require filing? you can go online to the various state websites and read the filing requirements for non-residents. if you don't need to file. there is a file tab where you can remove those state returns

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

josht777

New Member

abarmot

Level 1

yenmde8

New Member

griverax

New Member

helenehallowell

New Member