- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Thank you very much @DavidS127 . I think I am getting closer to this now and need to verify this one more time about my understanding.

1. I confirmed with my K1 producer that all the activities on 199A statement are from activities of the "main partnership". So, no need to divide up k1 into multiple.

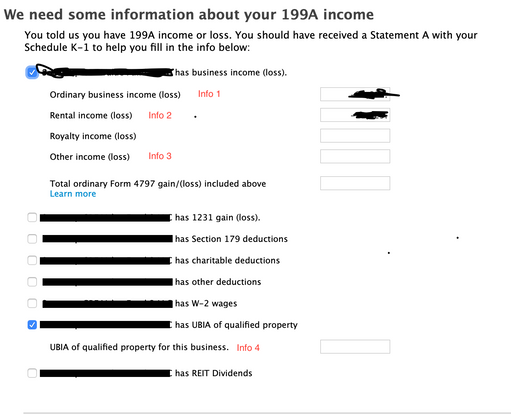

2. Now, reading this entire thread again and emails I got from K1 producer, this is what I am concluding. Please let me know (correct me) if I am wrong somewhere. In the image below (at the bottom of the thread), I have placed label (info 1 to 4). Am I correct about the source of that information (considering the sample 199A I pasted in this thread)

- Info 1: (From K1 --> Part III --> number 1 (ordinary business income) ). This is listed as 0 for me. I think this info should come from somewhere from 199A. right? if 199A, from where? how do I calculate this?

- Info 2: Add all the rental income (loss) from 199A. So in my case it will be 1 - 12 -13 = -24.00

- Info 3: Nothing

- Info 4: Add all UBIA listed in 199A. In my case this is 61 + 62 = 123.00

- Anything else I should be adding?

Thank you very much.

June 9, 2020

11:20 PM