- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: My sister and I have jointly owned stock certificate. We cashed out the remaining stock and t...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My sister and I have jointly owned stock certificate. We cashed out the remaining stock and the proceeds were split between us. The 1099-DIV is in my name. How to handle?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My sister and I have jointly owned stock certificate. We cashed out the remaining stock and the proceeds were split between us. The 1099-DIV is in my name. How to handle?

You would file a 1099-DIV form with the IRS showing who actually received the payment. You are the Nominee in this situation and you name who received the payment. Then, when you file your return, you show all of the income in your return. Then you will back out your sister's share as “nominee amount.” Thus only your portion of the income is included in your taxable income which will be one half of the dividends

Nominee Actions/Returns:

Generally, if you receive a Form 1099 for amounts that actually belong to another person or entity, you are considered a nominee recipient. You must file a Form 1099 with the IRS (the same type of Form 1099 you received). You must also furnish a Form 1099 to each of the other owners.

File the new Form 1099 with Form 1096 (this is a transmittal for the 1099) by mailing to the Internal Revenue Service Center for your area. (Provided on the Form 1096)

- On each new Form 1099, list yourself or the original Payee as the payer and the other owner, as the recipient. On Form 1096, list yourself or the original Payee as the nominee filer, not the original payer. The nominee is responsible for filing the subsequent Forms 1099 to show the amount allocable to each owner.

The forms filed with the IRS should be the red copy so if you don't have a color printer, go to the IRS website and order the forms here:

Split the amount as needed and enter only the necessary portions on the appropriate returns.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My sister and I have jointly owned stock certificate. We cashed out the remaining stock and the proceeds were split between us. The 1099-DIV is in my name. How to handle?

Thank you. I am still rather confused.

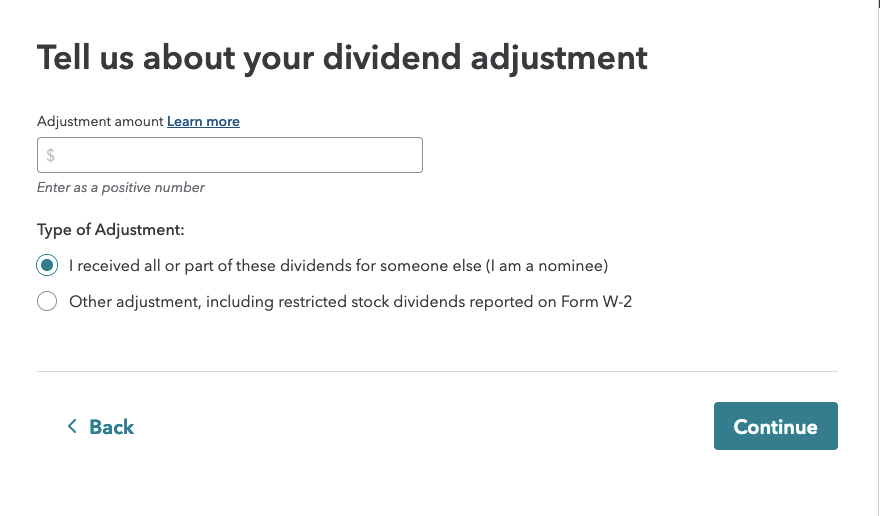

I had gotten to the screen attached. Do I put 1/2 the amount of the liquidation in the "adjusted amount" box.

You mention giving a 1099 form to the other recipients (my sister). Do I make a copy? How will she be handling this on TurboTax if she is the recipient?

Am I the only one filing the new 1099 form and 1096 form. That can only be mailed in?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My sister and I have jointly owned stock certificate. We cashed out the remaining stock and the proceeds were split between us. The 1099-DIV is in my name. How to handle?

Yes, enter one-half the amount. The adjustment you are making on this screen is that part of the dividend that will go to your sister.

Yes, you do have to prepare the 1099-DIV and give it to your sister. Your sister will report, as dividend income, the amount reflected on the 1099-DIV that you prepared. And yes, you will mail the 1099-DIV and 1096 Transmittal to the IRS. Your sister does not need to mail anything. Your sister just needs to report the dividend income on her return.

Just a reminder, as the previous post noted, the 1099-DIV form has to be the red copy from the IRS website. In other words, you will need a color printer to make the 1099-DIV you will file with the IRS. The one you give your sister can just be a copy of what you provide to the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My sister and I have jointly owned stock certificate. We cashed out the remaining stock and the proceeds were split between us. The 1099-DIV is in my name. How to handle?

Thanks. I just ordered both forms from the IRS since you can't seem to use the .pdf versions.

I may be back with questions once they arrive.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rmsaliba

New Member

kater832

Level 1

sandyreynolds

Level 1

naomicanale

New Member

splitting927

Returning Member