- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: ISO selling price was much lower than FMV at exercise but higher than the grant value. Paid AMT at exercise. 1099-B reported basis as the grant value, meaning a capital gain. How to get the AMT cr...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ISO selling price was much lower than FMV at exercise but higher than the grant value. Paid AMT at exercise. 1099-B reported basis as the grant value, meaning a capital gain. How to get the AMT credit back?

For simplicity, I've truncated the numbers and only use rounded numbers below.

In 2019, I was granted 1000 shares of incentive stock option (ISO) at $2/share.

In 2021, I exercised and held them at FMV of $40/share. I received form 3921. I also exercised other shares and thus triggered AMT. So I paid AMT for unrealized gain: ($40-$2)x1000=$38000.

In 2023, I sold the 1000 shares at $10/share. The 2023 1099-B reported the basis as the grant value ($2x1000=$2000).

Does that mean I need to pay long term capital tax gain (($10-$2)x1000=$8000)? That seems so unreasonable because it's double taxed.

How do I get the AMT credit back? Can TurboTax look back 2021's tax return and automatically adjust? I'm using the desktop version of TurboTax. Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ISO selling price was much lower than FMV at exercise but higher than the grant value. Paid AMT at exercise. 1099-B reported basis as the grant value, meaning a capital gain. How to get the AMT credit back?

I think there is no need to upgrade to TT Home & Business (not TT Business - that is for corporations, trusts, etc.). TT Premier handles the 6251/8801. Whether the interview handles your case is a different question.

I can't advise you on the differences between the Mac and PC versions. I don't have access to the Mac version to test it out.

I would try entering the adjustment and then go into forms mode and see where you numbers flow. (Sometimes I enter really big numbers so it will stand out). Sometimes it is an art to figuring out how the interview answers get to the forms. Or perhaps it would be easier to just go into forms mode as described below.

I have done a test return with your numbers and made up dates (please of course carefully verify) and attached PDFs of a couple of forms. Look to see if you can make yours look similar. (There is other income/exclusion data in the file so the non-employee stock stuff will be different of course and could materially change things.)

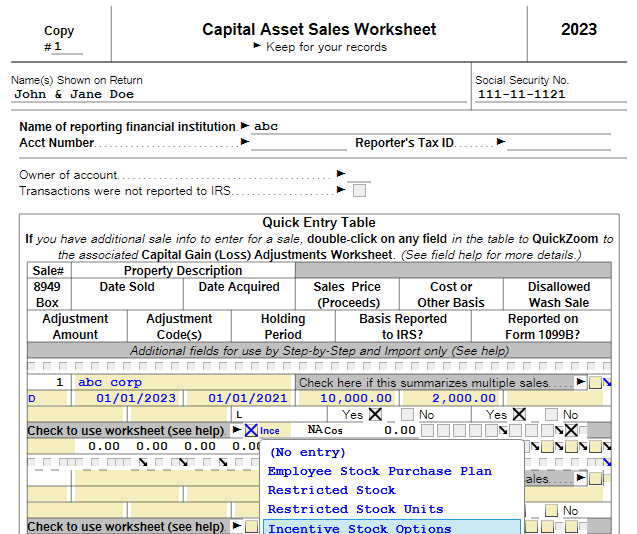

I found the the key place to start was with the 1099-B/Cap Asset Sale worksheet. On that I checked the box below and chose ISO from the pulldown.

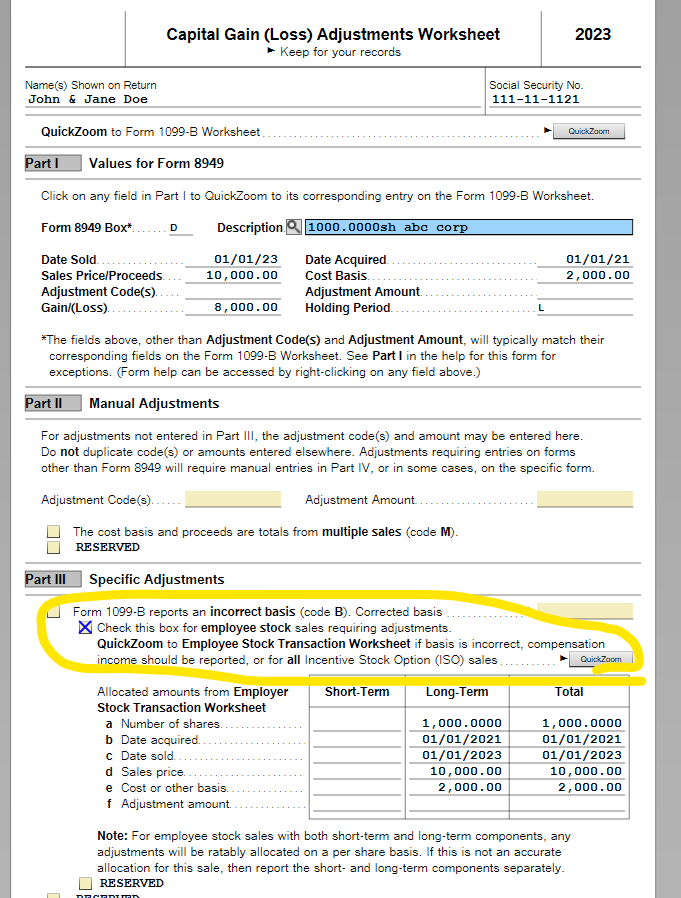

Double clicking (on PC don't know about Mac) on any of the fields there (or selecting the field and clicking the magnifying glass) got me to the Capital Gain (Loss) Adjustments Worksheet. Part II has a checkbox and link to the Employee Stock option Worksheet.

That worksheet then lets you check Part II, line 10b (stock option) and in Part IV you enter the grant/exercise/sale info. It will then flow the different AMT gain to the Schedule D AMT and the 6251.

However, in my test file I am seeing the AMT capital loss limited to $3k per year. And I have not figured out how to get the AMT credit form 8801 to work. That will be critical to getting you any credit. Sorry to say you might not actually get any credit if your AMT loss is limited to $3k and your AMT is not a lot less than your regular tax. But I have not figured out the 8801, so I just don't now.

I hope that helps a little bit more. This is so very complicated and I haven't dealt with it in quite a few years.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ISO selling price was much lower than FMV at exercise but higher than the grant value. Paid AMT at exercise. 1099-B reported basis as the grant value, meaning a capital gain. How to get the AMT credit back?

First this is super complicated. You might well want to ask a professional CPA, enrolled agent, or tax attorney for advice. One who deals with incentive equity everyday not just does 1040s.

For good background this is the goto book on all things equity option related:

Their website is also excellent:

https://fairmark.com/compensation-stock-options/incentive-stock-options/exercising-isos/

So what happens is that you have to think of the AMT as a totally separate tax system. You compute your regular taxes. Then you compute your AMT. You pay the higher of the two taxes. Under some circumstances you can get a credit to offset your regular taxes if your regular tax is higher than your AMT. See below.

For ISO sales you have a different regular tax and AMT basis for the shares. (Gain/loss on sale of a capital asset is sales proceeds minus basis. Basis is usually the cost of acquisition.)

Using your numbers for your ISO shares your regular tax basis is $2k. Your AMT basis is $40k.

If you sell for all shares for $10k, you have a a regular tax capital gain of $8k and an AMT capital loss of $30k.

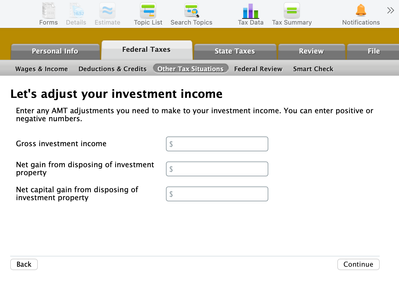

When entering sale you also need to enter an "AMT adjustment" accounting for the different basis. (Here an adjustment of $38k because to get your 2023 AMT gain you take your regular gain of $8k and subtract $38k to get a AMT capital loss of $30k.).

You enter that here (or in forms mode enter the form "Schedule D AMT: Capital Gains & Losses AMT")

You cannot go back to 2021 and change anything. It appears that you handled the year of exercise correctly. The issue is whether or not you can get an AMT credit to offset your regular tax in the year of sale (or thereafter). That seems to happen if your regular tax is greater than your AMT and you had prior AMT because of timing issues. It appears to be limited to your current year regular tax - your current year AMT. I'm not sure of the details (haven't dealt with ISOs in a decade) anymore. Take a look at

https://www.irs.gov/forms-pubs/about-form-8801

In particular the 8801 (and TT interview) require numbers from your prior year 6251 (AMT). Do you have that? Or just a 6251 for 2021? So I'm not sure how that works if you don't have it for the prior year. I'd suggest you carefully review the 8801 instructions and/or seek professional advice.

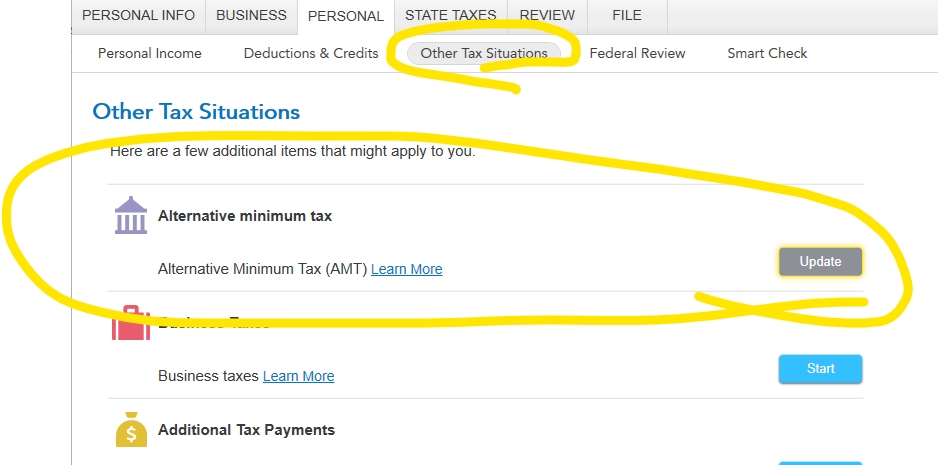

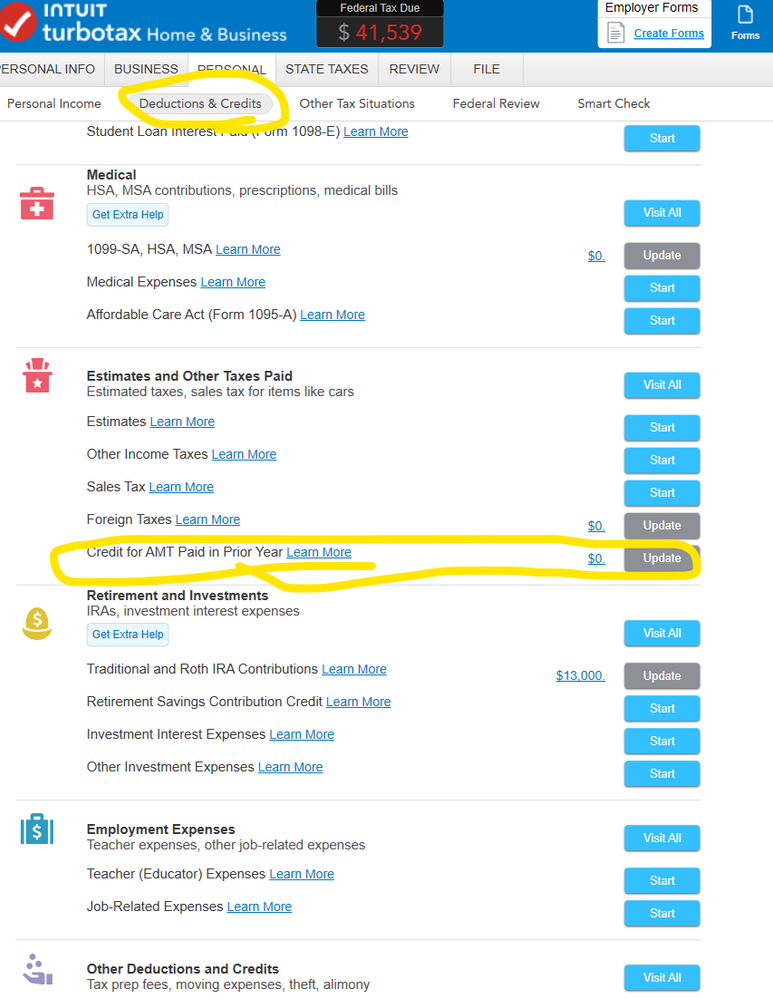

You get to the AMT credit section of TT here:

Some other interesting discussion:

https://www.esofund.com/blog/amt-credit-iso

https://www.bogleheads.org/forum/viewtopic.php?t=398288

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ISO selling price was much lower than FMV at exercise but higher than the grant value. Paid AMT at exercise. 1099-B reported basis as the grant value, meaning a capital gain. How to get the AMT credit back?

Thanks for the thorough explanation! I'll go through the references you listed and review the TT interview to see if I can get some credit.

I do have 6251 for both 2021 and 2022. However, it seems TT only looks back at 2022, but the exercise traction happened in 2021. That's why I wondered if TT can look back at 2021's 6251 and automatically credits back the AMT. I didn't mean to adjust the 2021 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ISO selling price was much lower than FMV at exercise but higher than the grant value. Paid AMT at exercise. 1099-B reported basis as the grant value, meaning a capital gain. How to get the AMT credit back?

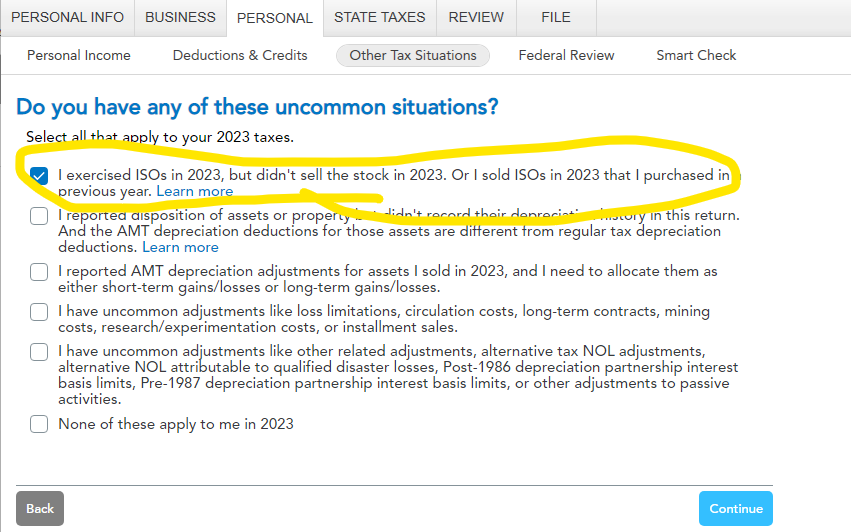

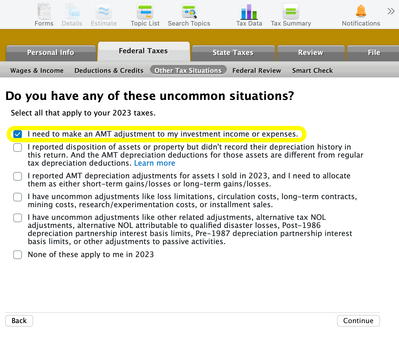

@jtax I have a TT premier Mac version, and my interview interface for this AMT adjustment is different from your business version

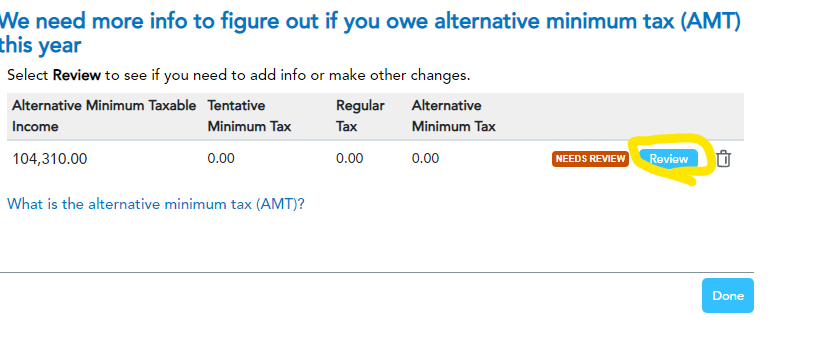

It seems the 1st option is the most reasonable for my purpose. After clicking continue, I got this

Now, how should I manually enter the numbers if using the example in my original post? Is the TT premier supposed to handle this situation, or I have to upgrade to the business version?

Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ISO selling price was much lower than FMV at exercise but higher than the grant value. Paid AMT at exercise. 1099-B reported basis as the grant value, meaning a capital gain. How to get the AMT credit back?

I think there is no need to upgrade to TT Home & Business (not TT Business - that is for corporations, trusts, etc.). TT Premier handles the 6251/8801. Whether the interview handles your case is a different question.

I can't advise you on the differences between the Mac and PC versions. I don't have access to the Mac version to test it out.

I would try entering the adjustment and then go into forms mode and see where you numbers flow. (Sometimes I enter really big numbers so it will stand out). Sometimes it is an art to figuring out how the interview answers get to the forms. Or perhaps it would be easier to just go into forms mode as described below.

I have done a test return with your numbers and made up dates (please of course carefully verify) and attached PDFs of a couple of forms. Look to see if you can make yours look similar. (There is other income/exclusion data in the file so the non-employee stock stuff will be different of course and could materially change things.)

I found the the key place to start was with the 1099-B/Cap Asset Sale worksheet. On that I checked the box below and chose ISO from the pulldown.

Double clicking (on PC don't know about Mac) on any of the fields there (or selecting the field and clicking the magnifying glass) got me to the Capital Gain (Loss) Adjustments Worksheet. Part II has a checkbox and link to the Employee Stock option Worksheet.

That worksheet then lets you check Part II, line 10b (stock option) and in Part IV you enter the grant/exercise/sale info. It will then flow the different AMT gain to the Schedule D AMT and the 6251.

However, in my test file I am seeing the AMT capital loss limited to $3k per year. And I have not figured out how to get the AMT credit form 8801 to work. That will be critical to getting you any credit. Sorry to say you might not actually get any credit if your AMT loss is limited to $3k and your AMT is not a lot less than your regular tax. But I have not figured out the 8801, so I just don't now.

I hope that helps a little bit more. This is so very complicated and I haven't dealt with it in quite a few years.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ISO selling price was much lower than FMV at exercise but higher than the grant value. Paid AMT at exercise. 1099-B reported basis as the grant value, meaning a capital gain. How to get the AMT credit back?

@jtax Much appreciation of your patient answer. When I switched to the Forms mode (never used that mode before), I realized that TT did already carry over that specific lot from previous 6251, so I don't need to adjust any more. After proceeding to the Deduction and Credits interview, here are what I found:

1. For 2023, my AMT is below regular tax, so I don't owe AMT, thus cannot use the AMT credit to offset new AMT. However, I did get ~$1300 credit to offset regular tax. You're correct that $3000 is the max you can use past AMT credit to offset regular tax (based one of the references you cited in the 1st reply). Since I sold other equities, my credit is reduced to $1300, for the reason I could not figure out.

2. TT did use the the difference between unrealized gain and the final gain ($8000-$38000=-$30000) as LT capital loss to offset my LT gain generated by other equity disposition.

3. It seems after above credit and adjustment, there is no more carry over for the specific lot, thus I may not be able to recover all the AMT credit I originally paid.

Anyway, I consider this question has been answered. Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ISO selling price was much lower than FMV at exercise but higher than the grant value. Paid AMT at exercise. 1099-B reported basis as the grant value, meaning a capital gain. How to get the AMT credit back?

@breezyhorse glad this was helpful. I am also glad that you are getting some credit, albeit small.

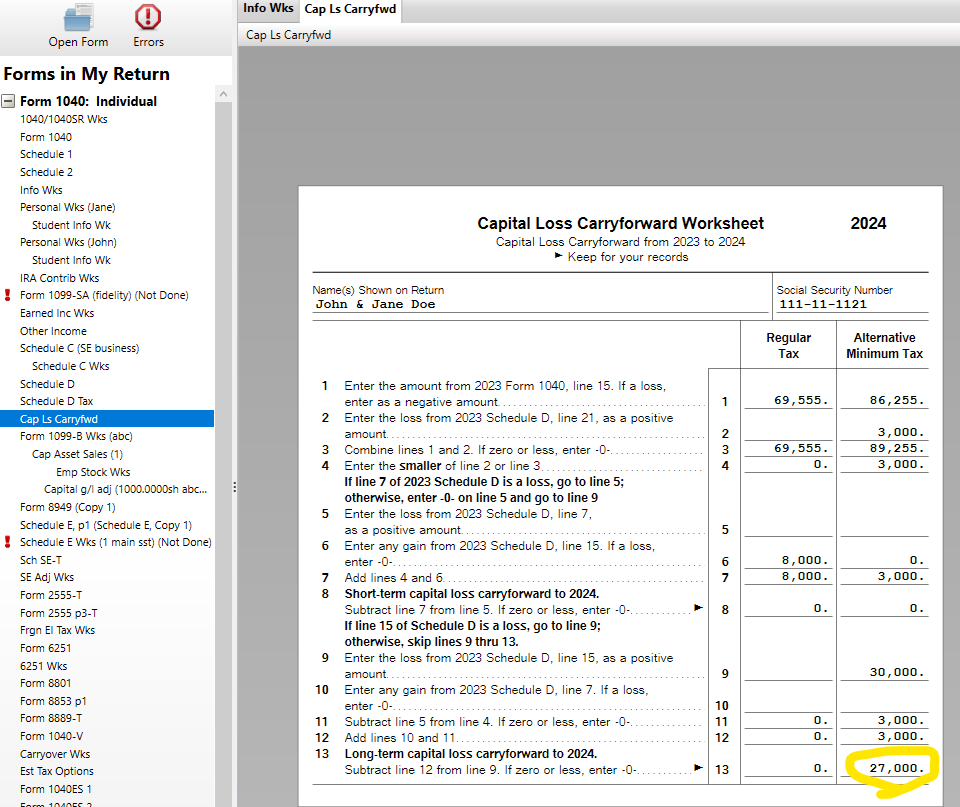

I do think you might see more in future years. Take a look at the "Cap Ls Carryfwd" form (see example below). The AMT loss beyond the $3k allowed will come back next year (and subsequent years). Depending upon your regular tax and your AMT tax in those years you might get more back.

Also the $3k capital loss limitation (for regular and AMT tax) does not limit you to a $3k deduction. You can use your entire loss to offset other capital gains. But if your loss exceeds your gains, only $3k of the loss can be used to offset non-capital gain income (called "ordinary" income). So absent large capital gains (perhaps only large AMT capital gains, I'm not sure), you'll only be able to take $3k of the AMT loss each year (against AMT income).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ISO selling price was much lower than FMV at exercise but higher than the grant value. Paid AMT at exercise. 1099-B reported basis as the grant value, meaning a capital gain. How to get the AMT credit back?

Thank you for the explanation with screenshots. It was very helpful in getting me to that "Employee Stock Transaction Worksheet" where I could enter the information from my previous year (year of exercise) Form 3921's. Unfortunately, as you seem to have found in your experimentation as well, it didn't seem to work. I *believe* that the results at the bottom of part IV of that worksheet (line 21(b)(4), computations of AMT, Regular Tax, and Adjustment, should be transferred (automatically?) to the Form 6251 worksheet, Disposition of Property, Line 2k, sub-line 3, Ordinary income from sale of Incentive Stock: AMT, Regular Tax, and Difference. But they aren't. Those numbers stubbornly remain zero and have no click-able source. If I over-ride and insert the numbers from the worksheet, then I get the result I expect (a substantial reduction in my taxes), but why isn't TurboTax doing this correctly for us?

Can anyone who understands what numbers should be on Form 6251, line 2k weigh in and advise where they should be coming from, since we can't seem to get TurboTax to populate them correctly?

For those who might be exploring this avenue, note that I found another more general bug in the "Employee Stock Transaction Worksheet". If you have more than 5 lines of input (I had nine), then the calculations in line 21 are incorrect; with fewer lines (I tested with 3), then the calculations are correct. Argh.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ISO selling price was much lower than FMV at exercise but higher than the grant value. Paid AMT at exercise. 1099-B reported basis as the grant value, meaning a capital gain. How to get the AMT credit back?

@ssfrancis This is all very complicated and hard to explore without your exact data in front of us. But here are some more quick thoughts that might or might not help you. I might not be understanding your exact situation, if so I apologize.

The Emp Stock Wks part IV numbers flow to Schedule D (regular and AMT -- 2 separate schedule D's because basis is different).

Re: 6251 Part I, line 2k. See the 6251 Wks (page 2). if there is no compensation income (just a qualifying disposition with a different AMT basis) the numbers (sub line 1) come from schedule D (& D AMT). They don't come directly from the Emp Stock Wks because there could be other AMT gains/losses and it is the totals that matter.

I'm not sure what happens if you have a disqualifying disposition that generators ordinary income. When I enter that I see and entry on the 6251 Wks page 2 line 2k sub line 3 for regular tax (zero for AMT) and the totals are adjust and flow to 6251 line 2k. (from sub line 4).

That seems to work as I would expect. Perhaps your situation is different.

You could try mocking up a return to show (without personal information or perhaps running it through the Online Meno -> Send File to Agent function (that will save a .diag2023 file, which you can open in TT) or by sharing the appropriate PDFs.

Same suggestion to report the over 5 entry bug. Either go through support of if you make file showing the error, we (volunteers) can try get it into the TT system. No guaranties though.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

stolencry

New Member

irelajohnson

New Member

Siumai

New Member

annvp

Returning Member

Alan Ru

New Member