- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

First this is super complicated. You might well want to ask a professional CPA, enrolled agent, or tax attorney for advice. One who deals with incentive equity everyday not just does 1040s.

For good background this is the goto book on all things equity option related:

Their website is also excellent:

https://fairmark.com/compensation-stock-options/incentive-stock-options/exercising-isos/

So what happens is that you have to think of the AMT as a totally separate tax system. You compute your regular taxes. Then you compute your AMT. You pay the higher of the two taxes. Under some circumstances you can get a credit to offset your regular taxes if your regular tax is higher than your AMT. See below.

For ISO sales you have a different regular tax and AMT basis for the shares. (Gain/loss on sale of a capital asset is sales proceeds minus basis. Basis is usually the cost of acquisition.)

Using your numbers for your ISO shares your regular tax basis is $2k. Your AMT basis is $40k.

If you sell for all shares for $10k, you have a a regular tax capital gain of $8k and an AMT capital loss of $30k.

When entering sale you also need to enter an "AMT adjustment" accounting for the different basis. (Here an adjustment of $38k because to get your 2023 AMT gain you take your regular gain of $8k and subtract $38k to get a AMT capital loss of $30k.).

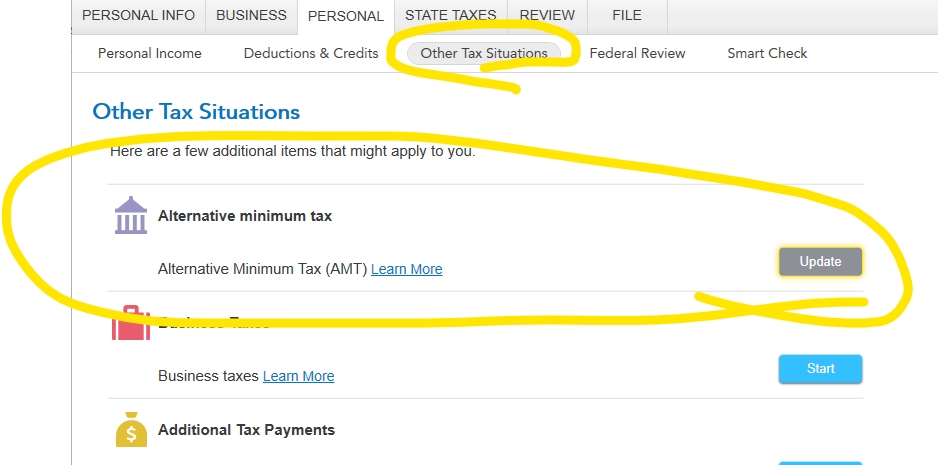

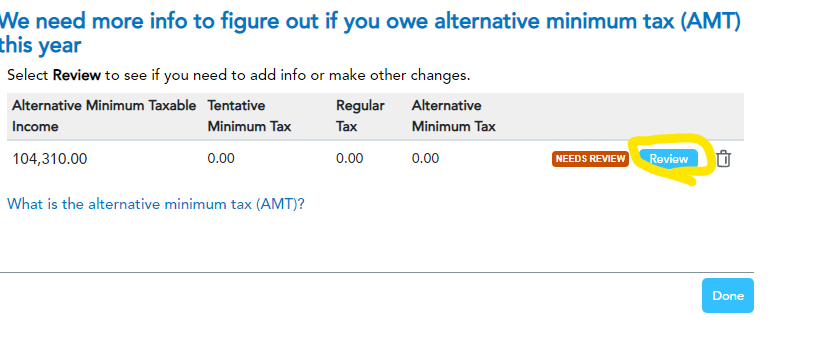

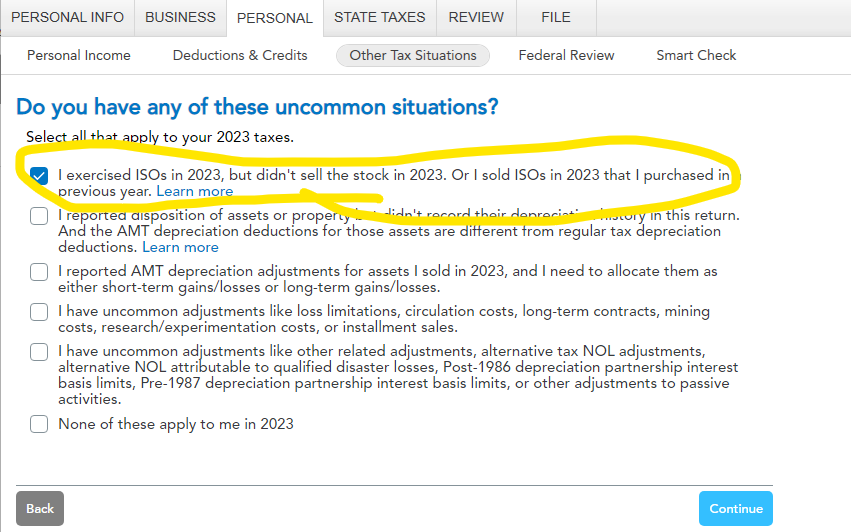

You enter that here (or in forms mode enter the form "Schedule D AMT: Capital Gains & Losses AMT")

You cannot go back to 2021 and change anything. It appears that you handled the year of exercise correctly. The issue is whether or not you can get an AMT credit to offset your regular tax in the year of sale (or thereafter). That seems to happen if your regular tax is greater than your AMT and you had prior AMT because of timing issues. It appears to be limited to your current year regular tax - your current year AMT. I'm not sure of the details (haven't dealt with ISOs in a decade) anymore. Take a look at

https://www.irs.gov/forms-pubs/about-form-8801

In particular the 8801 (and TT interview) require numbers from your prior year 6251 (AMT). Do you have that? Or just a 6251 for 2021? So I'm not sure how that works if you don't have it for the prior year. I'd suggest you carefully review the 8801 instructions and/or seek professional advice.

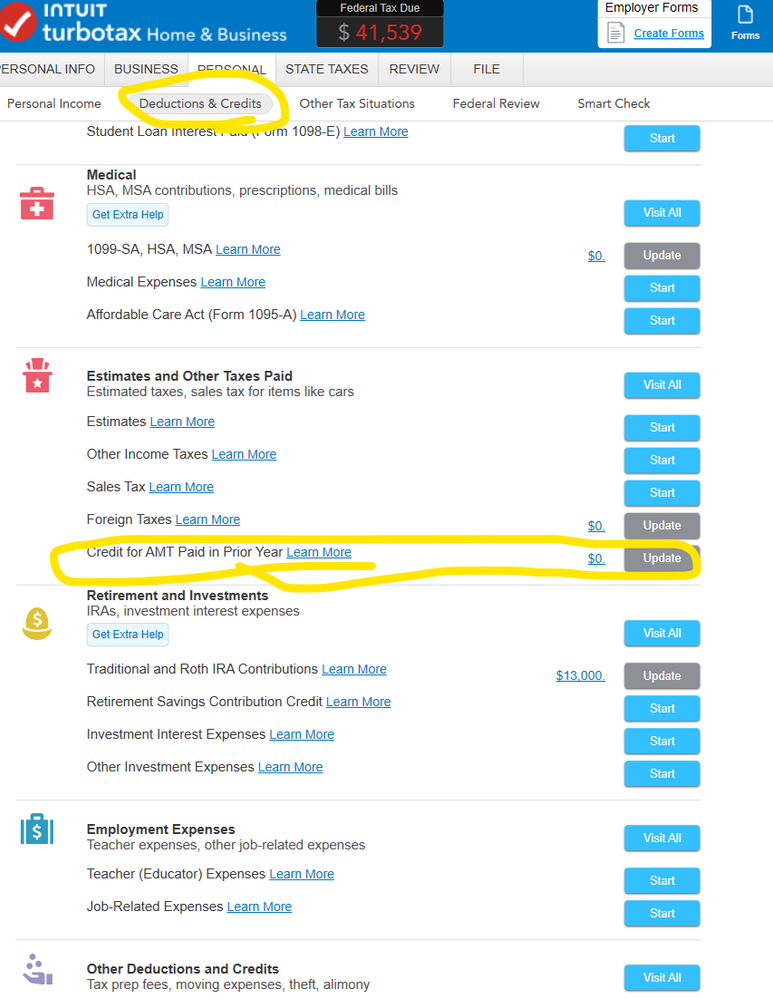

You get to the AMT credit section of TT here:

Some other interesting discussion:

https://www.esofund.com/blog/amt-credit-iso

https://www.bogleheads.org/forum/viewtopic.php?t=398288

**Mark the post that answers your question by clicking on "Mark as Best Answer"