- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

I think there is no need to upgrade to TT Home & Business (not TT Business - that is for corporations, trusts, etc.). TT Premier handles the 6251/8801. Whether the interview handles your case is a different question.

I can't advise you on the differences between the Mac and PC versions. I don't have access to the Mac version to test it out.

I would try entering the adjustment and then go into forms mode and see where you numbers flow. (Sometimes I enter really big numbers so it will stand out). Sometimes it is an art to figuring out how the interview answers get to the forms. Or perhaps it would be easier to just go into forms mode as described below.

I have done a test return with your numbers and made up dates (please of course carefully verify) and attached PDFs of a couple of forms. Look to see if you can make yours look similar. (There is other income/exclusion data in the file so the non-employee stock stuff will be different of course and could materially change things.)

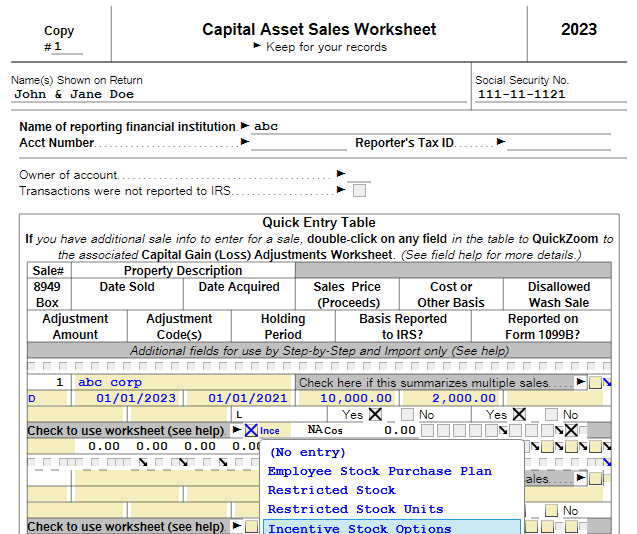

I found the the key place to start was with the 1099-B/Cap Asset Sale worksheet. On that I checked the box below and chose ISO from the pulldown.

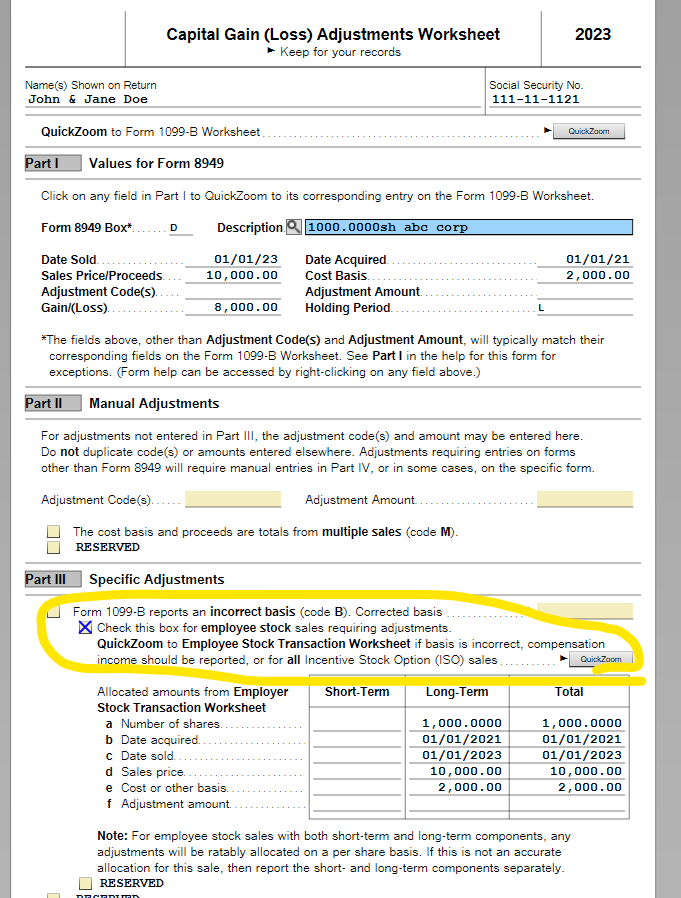

Double clicking (on PC don't know about Mac) on any of the fields there (or selecting the field and clicking the magnifying glass) got me to the Capital Gain (Loss) Adjustments Worksheet. Part II has a checkbox and link to the Employee Stock option Worksheet.

That worksheet then lets you check Part II, line 10b (stock option) and in Part IV you enter the grant/exercise/sale info. It will then flow the different AMT gain to the Schedule D AMT and the 6251.

However, in my test file I am seeing the AMT capital loss limited to $3k per year. And I have not figured out how to get the AMT credit form 8801 to work. That will be critical to getting you any credit. Sorry to say you might not actually get any credit if your AMT loss is limited to $3k and your AMT is not a lot less than your regular tax. But I have not figured out the 8801, so I just don't now.

I hope that helps a little bit more. This is so very complicated and I haven't dealt with it in quite a few years.

**Mark the post that answers your question by clicking on "Mark as Best Answer"