- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

@breezyhorse glad this was helpful. I am also glad that you are getting some credit, albeit small.

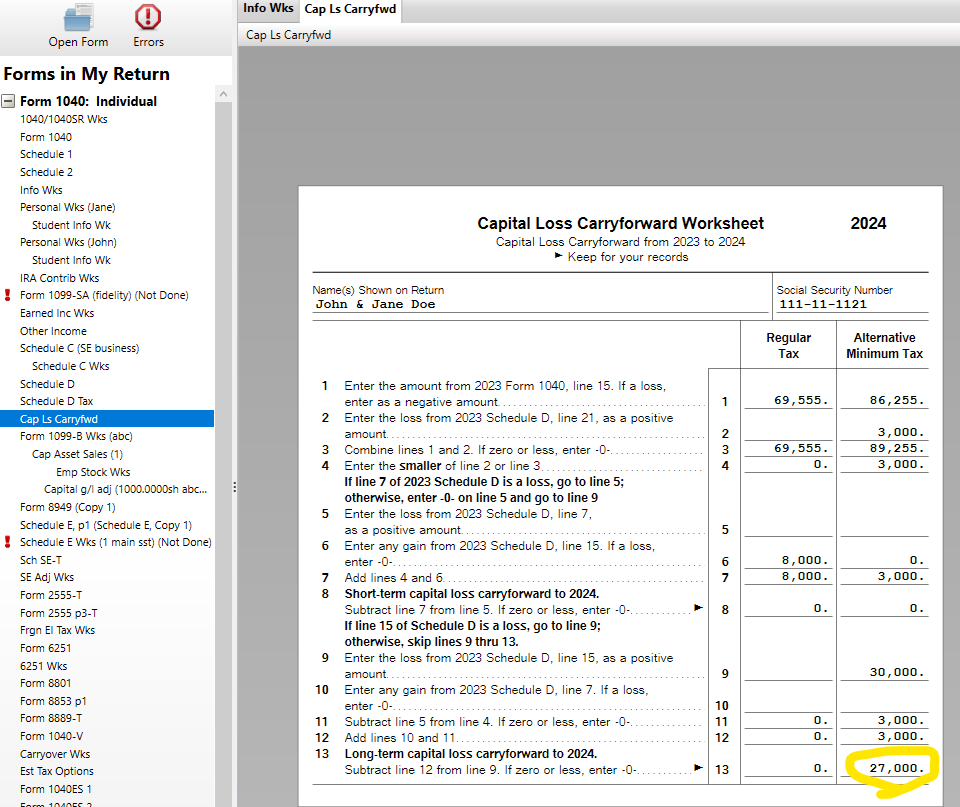

I do think you might see more in future years. Take a look at the "Cap Ls Carryfwd" form (see example below). The AMT loss beyond the $3k allowed will come back next year (and subsequent years). Depending upon your regular tax and your AMT tax in those years you might get more back.

Also the $3k capital loss limitation (for regular and AMT tax) does not limit you to a $3k deduction. You can use your entire loss to offset other capital gains. But if your loss exceeds your gains, only $3k of the loss can be used to offset non-capital gain income (called "ordinary" income). So absent large capital gains (perhaps only large AMT capital gains, I'm not sure), you'll only be able to take $3k of the AMT loss each year (against AMT income).

**Mark the post that answers your question by clicking on "Mark as Best Answer"