- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Is it common for a form within a state return to not be counted? my state said i don't have a rebate coming for my rent paid because it wasn't filed, but it's in my pdf!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it common for a form within a state return to not be counted? my state said i don't have a rebate coming for my rent paid because it wasn't filed, but it's in my pdf!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it common for a form within a state return to not be counted? my state said i don't have a rebate coming for my rent paid because it wasn't filed, but it's in my pdf!

Did YOU mail in the return as directed by the program ???

Can I file my M1PR (Minnesota Property Tax Refund) through TurboTax?

Yes, you can paper-file your M1PR when you prepare your Minnesota taxes in TurboTax. We'll make sure you qualify, calculate your Minnesota property tax refund, and fill out an M1PR form which you can print and mail.

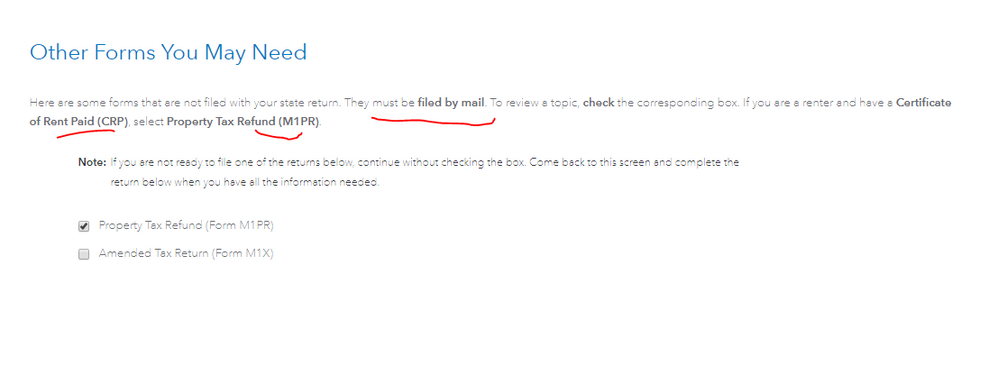

As you're preparing your Minnesota taxes, look for the Other Forms You May Need screen (towards the end of the interview, past the estimated taxes and extension topics). Check the first box and follow the onscreen instructions.

After the State Elections Campaign Fund and Nongame Wildlife Fund screens, you'll come to the Filing instructions screen. Click or tap Print Form M1PR and mail the printout by August 15 to:

Minnesota Property Tax Refund

St. Paul, MN 55145-0020

Tip: You can also file your M1PR free of charge at the MN Dept. of Revenue Property Tax Refund site, and if you're a homeowner, you can e-file it through the MN DOR's Property Tax Refund Online Filing System.

Related Information:

See this TurboTax support FAQ for an M1PR - https://ttlc.intuit.com/questions/1899893-can-i-file-my-m1pr-minnesota-property-tax-refund-through-t...

If the department receives your properly completed return and all enclosures are correct and complete, you can expect your refund:

- by mid-August if you are a renter or mobile home owner and you file by June 15, or within 60 days after you file, whichever is later.

- by the end of September if you are a homeowner and you file by August 1, or within 60 days after you file, whichever is later.

Track the refund here : http://www.revenue.state.mn.us/Pages/FAQDetail.aspx?WebId=c73a0089-8c72-4576-94cd-73415b8a5c31&FaqId...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it common for a form within a state return to not be counted? my state said i don't have a rebate coming for my rent paid because it wasn't filed, but it's in my pdf!

Did YOU mail in the return as directed by the program ???

Can I file my M1PR (Minnesota Property Tax Refund) through TurboTax?

Yes, you can paper-file your M1PR when you prepare your Minnesota taxes in TurboTax. We'll make sure you qualify, calculate your Minnesota property tax refund, and fill out an M1PR form which you can print and mail.

As you're preparing your Minnesota taxes, look for the Other Forms You May Need screen (towards the end of the interview, past the estimated taxes and extension topics). Check the first box and follow the onscreen instructions.

After the State Elections Campaign Fund and Nongame Wildlife Fund screens, you'll come to the Filing instructions screen. Click or tap Print Form M1PR and mail the printout by August 15 to:

Minnesota Property Tax Refund

St. Paul, MN 55145-0020

Tip: You can also file your M1PR free of charge at the MN Dept. of Revenue Property Tax Refund site, and if you're a homeowner, you can e-file it through the MN DOR's Property Tax Refund Online Filing System.

Related Information:

See this TurboTax support FAQ for an M1PR - https://ttlc.intuit.com/questions/1899893-can-i-file-my-m1pr-minnesota-property-tax-refund-through-t...

If the department receives your properly completed return and all enclosures are correct and complete, you can expect your refund:

- by mid-August if you are a renter or mobile home owner and you file by June 15, or within 60 days after you file, whichever is later.

- by the end of September if you are a homeowner and you file by August 1, or within 60 days after you file, whichever is later.

Track the refund here : http://www.revenue.state.mn.us/Pages/FAQDetail.aspx?WebId=c73a0089-8c72-4576-94cd-73415b8a5c31&FaqId...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

breanabooker15

New Member

bkecosamba

New Member

in Education

jaredadwyer

New Member

bretjlee

New Member

karleathafelton2

New Member