- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: How do I note I lived in 3 states?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I note I lived in 3 states?

I sold my house in State A, moved in with my partner's parents for 2.5 months while looking for a home in State B, and then purchased a primary residence in State C.

I worked the same job, however I transitioned to remote after selling the original home.

How should I reflect this in TurboTax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I note I lived in 3 states?

Yes, that is the section. Since it is only allowing you to enter 2 states, you can go further into the questions and answer yes to the question that asks, did you earn money in any other states? Say yes, to this question, this will populate another state on your return.

When you first go to the third state, you will be listed as a non residency. A few steps into the state returns, it gives you a chance to change your residency status. Here you can change it to part year resident.

If for whatever reason it does not populate a third state, you can click add a state and do it that way.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I note I lived in 3 states?

In the personal info section, you will enter your current address and state. You will then be asked if you lived in any other states, select yes and enter the other 2 states you lived in.

Since you worked in all 3 states, you would then need to file part year resident tax returns for all 3 states, allocating the income based on the state you were living and working in at the time. Your remote work will count as physically working in the state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I note I lived in 3 states?

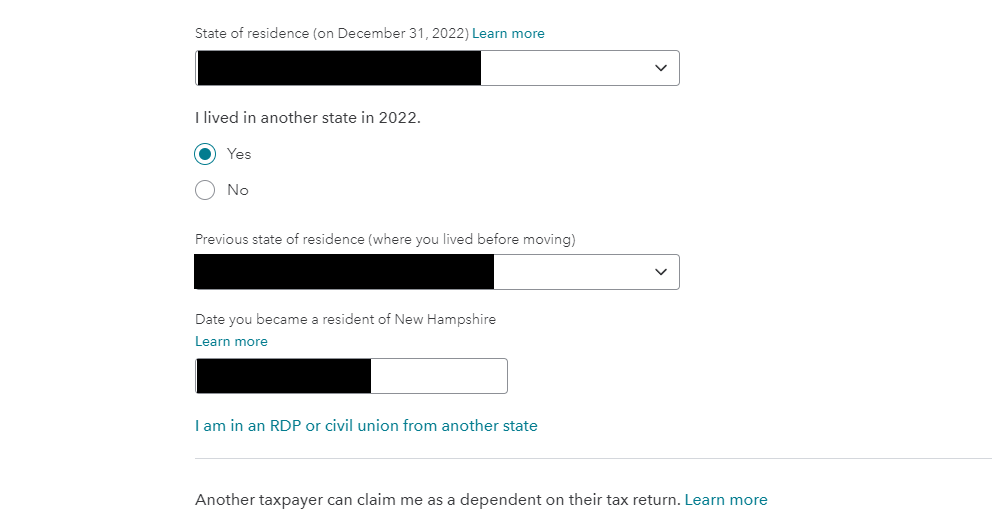

The section I believe you're referring to only allows me to enter 2 addresses.

I have attached a screenshot of the section I believe you are referring to below.

Thanks for the reply!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I note I lived in 3 states?

Yes, that is the section. Since it is only allowing you to enter 2 states, you can go further into the questions and answer yes to the question that asks, did you earn money in any other states? Say yes, to this question, this will populate another state on your return.

When you first go to the third state, you will be listed as a non residency. A few steps into the state returns, it gives you a chance to change your residency status. Here you can change it to part year resident.

If for whatever reason it does not populate a third state, you can click add a state and do it that way.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jackkgan

Level 5

warrenjen

New Member

rsherry8

Level 3

TEAMBERA

New Member

russellkent7

New Member