- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: How do I figure rental depreciation when my computer crashed and Turbotax lost all the previous depreciation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure rental depreciation when my computer crashed and Turbotax lost all the previous depreciation

My computer crashed last winter after I did my 2019 tax return. I have been using the Premier version download of Turbotax since 2013 when I first started rentals. The first year, I printed out all the information for schedule E. In 2018, thankfully, I printed out Form 4562, which shows Depreciation & Amortization Report. This shows, among other things, the date in service, the cost, the depreciable basis, the life of the basis, method, prior depreciation amounts and current depreciation. I can get the amount of 2019 depreciation from my printed out copy of 2019 tax return. But I am at a loss as to how to go from here inputting everything back in as though the program didn't lose it in order to figure my depreciation for 2020. How would I enter those accumulated values up until 2019 so Turbotax can continue to automatically keep track of it, as well as determine what my depreciation should be for this year? Or do I need to start over without inputting all the previous depreciation? If so, then how do I figure what this year's depreciation should be based on all previous depreciation? Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure rental depreciation when my computer crashed and Turbotax lost all the previous depreciation

Easy fix ... if you are not transferring in the prior year assets then enter them fresh ... using the prior year depreciation worksheet just put in the same date of service and amount and the program will fill in the blanks automatically. OR reload the 2019 program, transfer the 2018 info to then transfer to the 2020 program ... entering the 2019 info is also optional.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure rental depreciation when my computer crashed and Turbotax lost all the previous depreciation

reload the 2019 program, transfer the 2018 info to then transfer to the 2020 program

That may or may not give you the right numbers, depending on to many variables to discuss here. You'd basically have to re-do the entire 2018 return *exactly* matching the one you filed in order to be absolutely certain all the numbers are right.

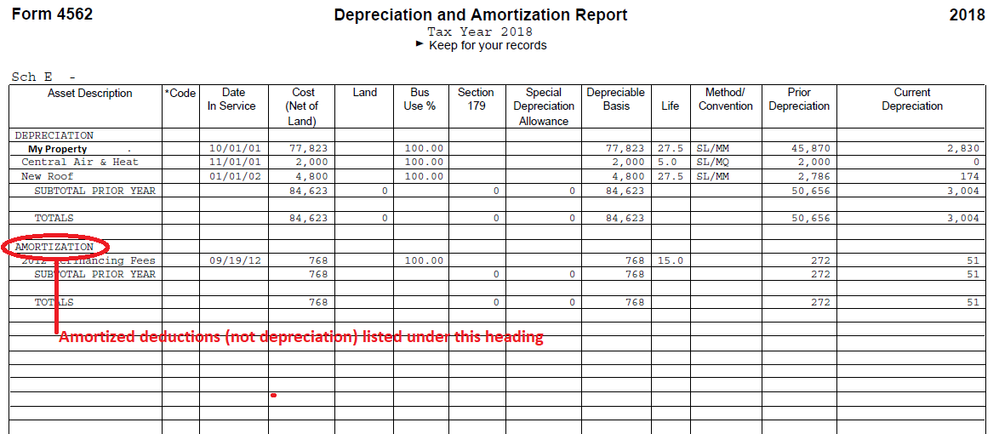

Lets start with the printout of the 4562 you have for that property from your 2018 tax return. Be aware that there are two IRS Form 4562's for that property that both print in landscape format. One is tittled "Depreciation and Amortization Report" and is most likely the one you will need. The other is called "Alternative Minimum Tax Depreciation" and you will only need it if the program specifically asks you for any AMT amounts.

Take a look at the "in service" date on each listed asset. If that date is in 2017 or before, then this will be easy. I am going to assume that each listed asset has an in service date of 2017 or before.

If each asset was 100% business use in 2018 and 2019 with no personal use, and the asset was in service for the entire year in both 2018 and 2019, then the "current year depr" will be about the same for 2018 and 2019. But the trick is going to be getting the correct figures on the property itself. On top of that, if the 2018 form 4562 lists any amortized intangibles, you'll have to manually enter them a specific way to keep the numbers correct and on track. See example below.

For the property, add together the amount in the Cost (net of land) and Land column. In TurboTax 2020 this is the amount you will enter in the "Cost" box. Then enter the amount in the "land" column in the "Cost of Land" box in TTX 2020.

Now double the amount in the "current depreciation" column (to account for 2019 depreciation taken) and add that to the amount in the "Prior Depreciation" column. The total is what you enter in TTX2020 when asked for depreciation already taken on the asset.

For all the other assets, you probably don't have anything in the "Land" column. Just double the amount in the "Current Depreciation" column, add it to the amount in the "Prior Depreciation" column, and that total is what you enter in TTX 2020 when asked for the amount of prior depreciation already taken on that asset.

Get all that done. Then if you have any amortized items listed on your 4562 let me know and I'll walk you through getting those entered correctly. I will assume they will be for financing or refinancing fees unless you tell me otherwise. (it will matter for correct reporting.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure rental depreciation when my computer crashed and Turbotax lost all the previous depreciation

Thank you so much! You are the best! As soon as Turbotax puts out the 2020 Schedule E for rentals, I will follow your advice carefully. Thank you again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure rental depreciation when my computer crashed and Turbotax lost all the previous depreciation

Thank you so much! I will try that!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure rental depreciation when my computer crashed and Turbotax lost all the previous depreciation

the above subject is exactly what i am dealing with. i need to know how to proceed with 2020 return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure rental depreciation when my computer crashed and Turbotax lost all the previous depreciation

NO PREVIOUS YEAR PROGRAMS ARE AVAILABLE TO RELOAD

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure rental depreciation when my computer crashed and Turbotax lost all the previous depreciation

@edseeber do you have a printout with a depreciation schedule from any year to use as a reference?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure rental depreciation when my computer crashed and Turbotax lost all the previous depreciation

yes, i have printouts of all the previous yrs

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure rental depreciation when my computer crashed and Turbotax lost all the previous depreciation

There should be depreciation worksheets in the printout that show the assets, date placed in service and cost, and all the depreciation that has been claimed to present. You can then add the assets back into TurboTax and your depreciation will be up to date.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

reece-davidj

New Member

planetkreitlow

New Member

amit_soneji

New Member

howverytaxing

Returning Member

user17667634167

New Member