- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

reload the 2019 program, transfer the 2018 info to then transfer to the 2020 program

That may or may not give you the right numbers, depending on to many variables to discuss here. You'd basically have to re-do the entire 2018 return *exactly* matching the one you filed in order to be absolutely certain all the numbers are right.

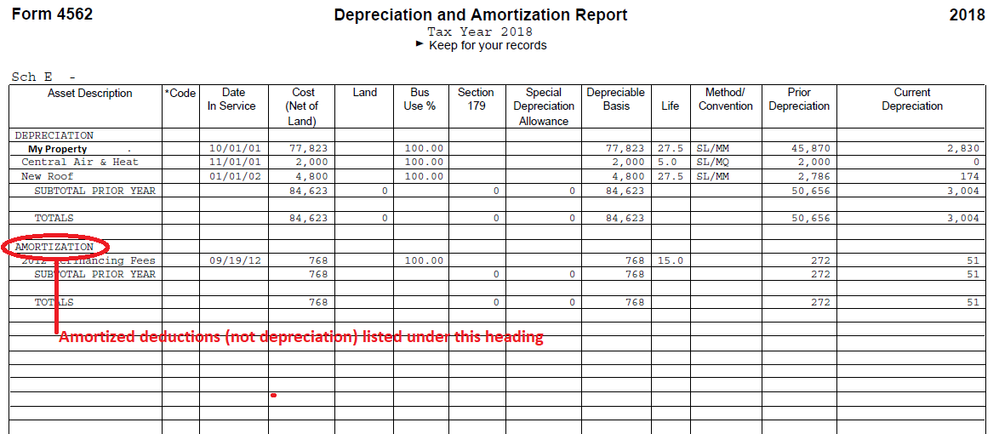

Lets start with the printout of the 4562 you have for that property from your 2018 tax return. Be aware that there are two IRS Form 4562's for that property that both print in landscape format. One is tittled "Depreciation and Amortization Report" and is most likely the one you will need. The other is called "Alternative Minimum Tax Depreciation" and you will only need it if the program specifically asks you for any AMT amounts.

Take a look at the "in service" date on each listed asset. If that date is in 2017 or before, then this will be easy. I am going to assume that each listed asset has an in service date of 2017 or before.

If each asset was 100% business use in 2018 and 2019 with no personal use, and the asset was in service for the entire year in both 2018 and 2019, then the "current year depr" will be about the same for 2018 and 2019. But the trick is going to be getting the correct figures on the property itself. On top of that, if the 2018 form 4562 lists any amortized intangibles, you'll have to manually enter them a specific way to keep the numbers correct and on track. See example below.

For the property, add together the amount in the Cost (net of land) and Land column. In TurboTax 2020 this is the amount you will enter in the "Cost" box. Then enter the amount in the "land" column in the "Cost of Land" box in TTX 2020.

Now double the amount in the "current depreciation" column (to account for 2019 depreciation taken) and add that to the amount in the "Prior Depreciation" column. The total is what you enter in TTX2020 when asked for depreciation already taken on the asset.

For all the other assets, you probably don't have anything in the "Land" column. Just double the amount in the "Current Depreciation" column, add it to the amount in the "Prior Depreciation" column, and that total is what you enter in TTX 2020 when asked for the amount of prior depreciation already taken on that asset.

Get all that done. Then if you have any amortized items listed on your 4562 let me know and I'll walk you through getting those entered correctly. I will assume they will be for financing or refinancing fees unless you tell me otherwise. (it will matter for correct reporting.)