- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Does sale of rental property create a taxable event?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does sale of rental property create a taxable event?

Can you help with this matter?

I bought a property with my single ownership LLC in 2019. It was rented the same year and was always rented. For tax purposes I filed the expenses/income on my joint tax return every year.

The tenants moved out in Nov 2023 and I sold the property in April 2024.

After entering all my personal income and deductions I had a sizeable refund due to my spouse retiring.

When I entered the income/expenses for the rental and indicating I sold the property, my tax refund swung back to the red nearly 28k!

I entered the purchase price from 2019 using the asset (165k) & land (30k) values from the first return.

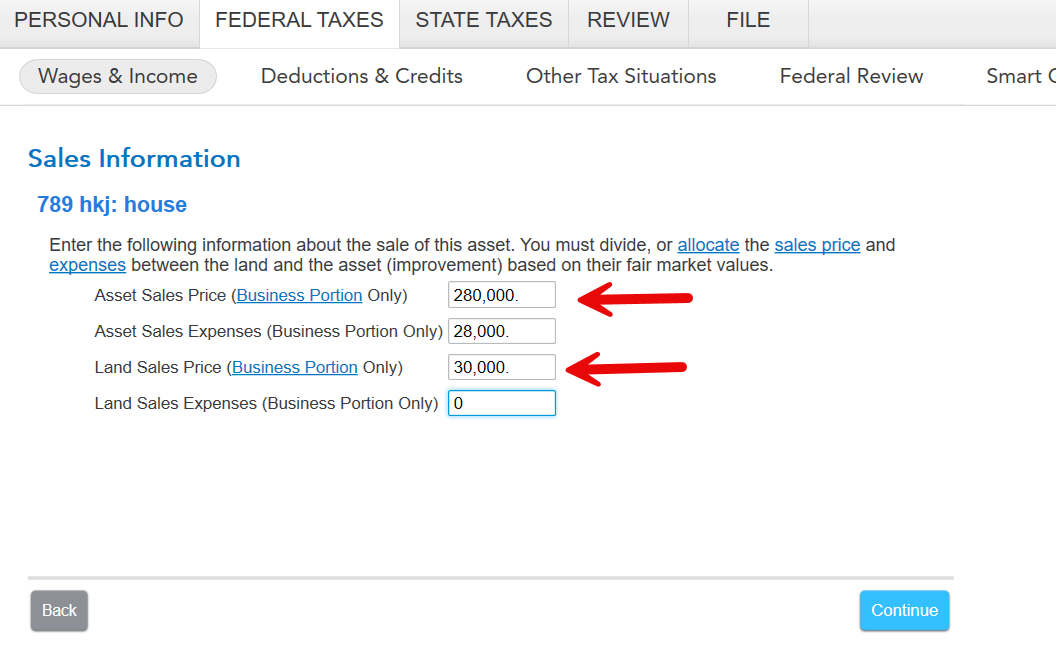

For the sale of the property I used the 1099-S form which showed the total amount (310k). I subtracted the original land (30k) value and entered the asset value (280k).

TT pulled in the previous years of depreciation which I changed (by $1000.00) after looking at last years form 4962.

TT indicates I have a gain of $163k on the disposition of the property.

I'm not following the math as to how I gained 163k when the difference between the original purchase price and sale is 115k.

Any help is appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does sale of rental property create a taxable event?

Update on the scenario I outlined in original post.

I went back to TT and under the INCOME section for Rentals and for the property in question I went through the steps again. When I checked the box indicating I didn't rent the property in 2024, TT said the property should be removed as a rental and subsequently deleted the property. This immediately swung the Amount Owed back to the original Refund Amount I had earlier.

However, I believe I need to enter the property as being sold under the BUSINESS ITEMS - SALE OF BUSINESS PROPERTY - is this correct?

The next TT screen is ANY OTHER PROPERTY SALES? The first box is "Sales of business or rental property that you haven't already reported." If I select this box then I answered YES to the next screen and then TT returns a SALE OF BUSINESS OR RENTAL PROPERTY screen with boxes for description, date acquired/sold, total sales price and cost of property along with depreciation.

Is this the correct way to list the sale of the rental?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does sale of rental property create a taxable event?

You must determine your adjusted basis.

Your adjusted basis is the price you paid plus improvements less depreciation.

Land does not depreciate. So if you are applying 30,000 to the basis of the land and also 30,000 of the sales proceeds to the land, you are only working with the rental building.

You do need to enter 30,000 towards the sale of the land to get it off the books.

The building was entered as an asset in 2019 with a basis of 165,000. That comes out to about 6,000 depreciation per year.

I assume the 1,000 you subtracted from the deprecation the program used was for the months in 2024 that it was a rental since you say it did not sell until April. You should not reduce the depreciation for that.

You also don't say how much deprecation showed on Form 4962 or if you added any other assets.

Lets say the depreciation was 31,000. That would give you an adjusted basis of 134,000 (cost 165,000 less 31,000 deprecation = 134,000)

You sell the building for 280,000. That gives you 31,000 depreciation recapture and 115,000 capital gain.

Depreciation recapture is taxed at your ordinary income tax rate and capital gain at your capital gain rate. So the total gain is 146,000. You would also subtract selling fees.

You're saying the program is showing a 163,000 gain which is 17,000 more than what I come up with, but I can't see your return and don't know what the amount of deprecation was.

If you continue the question, please tell us how much depreciation you "changed it to" and any other pertinent information such as additional assets (Appliances, carpet) you entered.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does sale of rental property create a taxable event?

Yes, that is the correct way to enter the sale. Also, the depreciation allowable on the property while it was rented is subtracted from the cost of the property to arrive at the adjusted cost used to determine the gain on sale. That may by why the gain you see in TurboTax is greater than what you were expecting.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does sale of rental property create a taxable event?

KrisD315 - thanks for the response.

I entered nearly 28k in depreciation which I took from the 2023 Form 4562. I added the prior and current amounts listed on that form to get 28k. Earlier in TT, I think I saw a depreciation amount of 27k which is why I added the 1000.

Every year the property was rented I listed out expenses such as mileage, taxes, insurance along with improvements, maintenance, etc. TT calculated depreciation every year I filed taxes.

Do I need to factor that in somehow? In the current section of TT there's not anyplace to do that.

I did not use any depreciation to adjust the sale price of 310k.

The 280k price would be the property value after taking out the land value of 31k

The tenants moved out in 11/2023 so the rental property was vacant while I waited to sell it.

Where or how would I enter the land value as being sold? Under the current section, I listed out the total sale price which was the lot and house. the 1099S doesn't break it out by land and asset value.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does sale of rental property create a taxable event?

You are selling the house, land and any other assets that were listed. You said that you had made improvements, those items need to be sold for zero -since they went with the house. This will give you some loss. For example, a new roof of $10,000 that was only depreciated $1,000 leaves a $9,000 loss.

To get the program to allow you to use the rental section, mark that it was rented for a day. If you don't need to go through that section, you can enter it all in the stocks, bond, and other income section.

To go through the rental section:

- Start by saying you rented it for a day

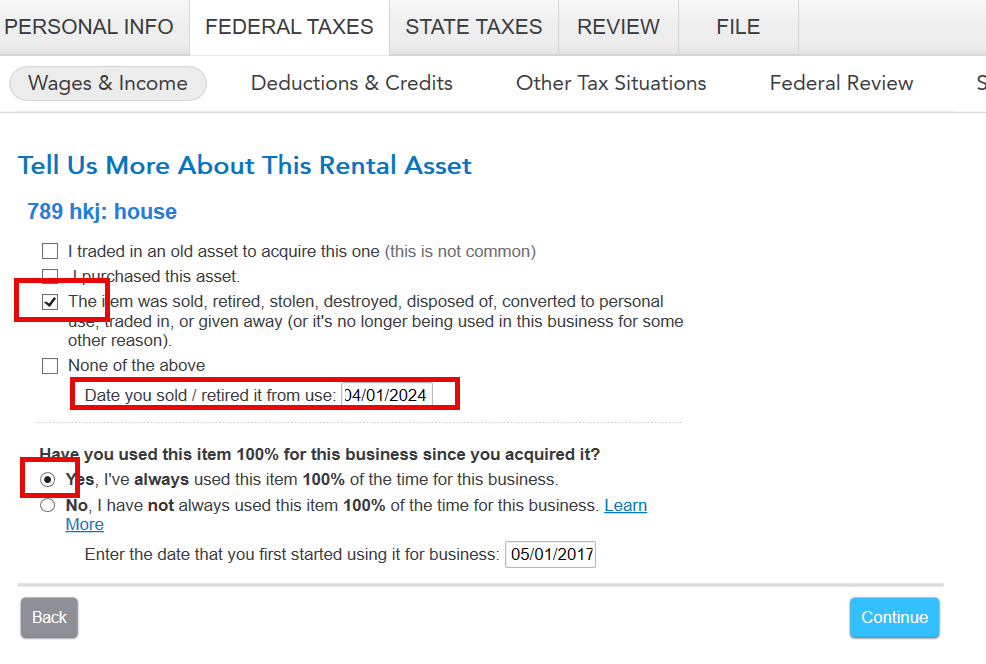

- In the asset section, mark that you sold the item and the date sold

- Special handling- select No

- Main home, select No

- Enter sales information- you have to break out the land from the house. You can use property tax valuation or another method to determine your reasonable answer.

- Continue, no,

- prior AMT depreciation - will be the same as the regular depreciation unless you are high income and have form 6251 in previous returns. If so, check them.

- continue, no to installment

- results for the house

Do this again for any other assets you had listed except mark them sold as zero.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

josephmarcieadam

Level 2

rodiy2k21

Returning Member

cm-jagow

New Member

mountainsinfall

Returning Member

mjtax20

Returning Member