- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

You are selling the house, land and any other assets that were listed. You said that you had made improvements, those items need to be sold for zero -since they went with the house. This will give you some loss. For example, a new roof of $10,000 that was only depreciated $1,000 leaves a $9,000 loss.

To get the program to allow you to use the rental section, mark that it was rented for a day. If you don't need to go through that section, you can enter it all in the stocks, bond, and other income section.

To go through the rental section:

- Start by saying you rented it for a day

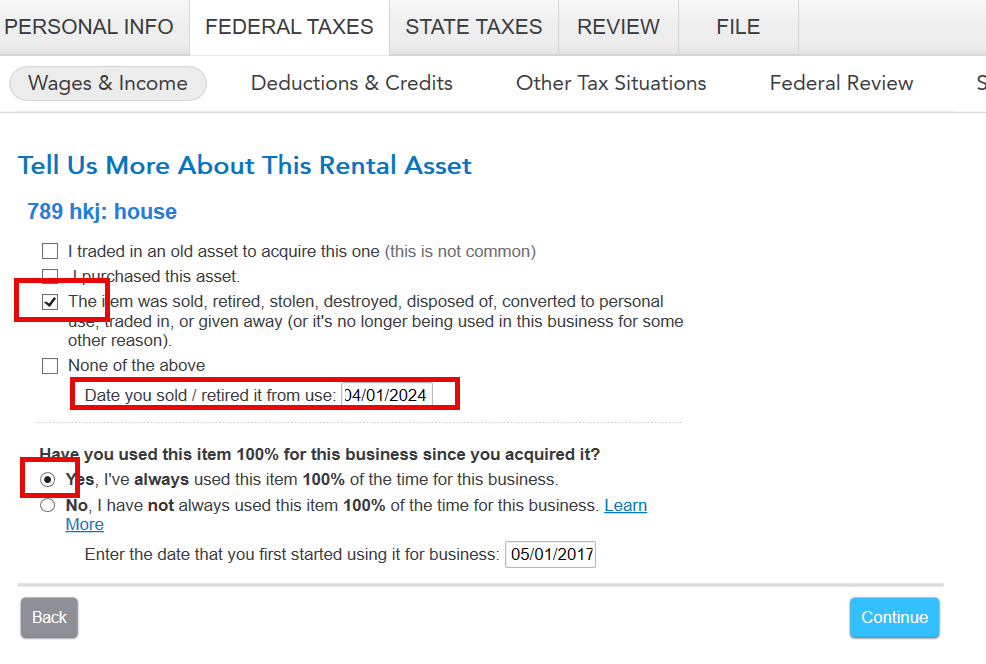

- In the asset section, mark that you sold the item and the date sold

- Special handling- select No

- Main home, select No

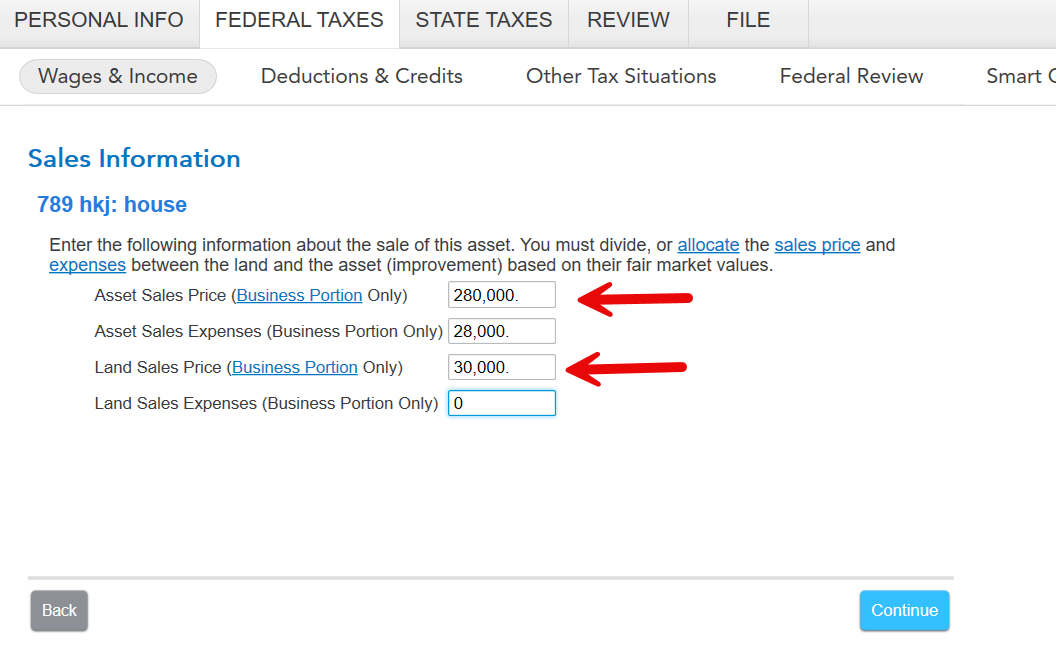

- Enter sales information- you have to break out the land from the house. You can use property tax valuation or another method to determine your reasonable answer.

- Continue, no,

- prior AMT depreciation - will be the same as the regular depreciation unless you are high income and have form 6251 in previous returns. If so, check them.

- continue, no to installment

- results for the house

Do this again for any other assets you had listed except mark them sold as zero.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 5, 2025

9:20 AM