- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Day Trading losses with CMEG

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Day Trading losses with CMEG

Ok so I can just enter my summary as if it were a 1099 manual entry? That seems to be my only option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Day Trading losses with CMEG

Yes, you can enter the summary totals manually.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Day Trading losses with CMEG

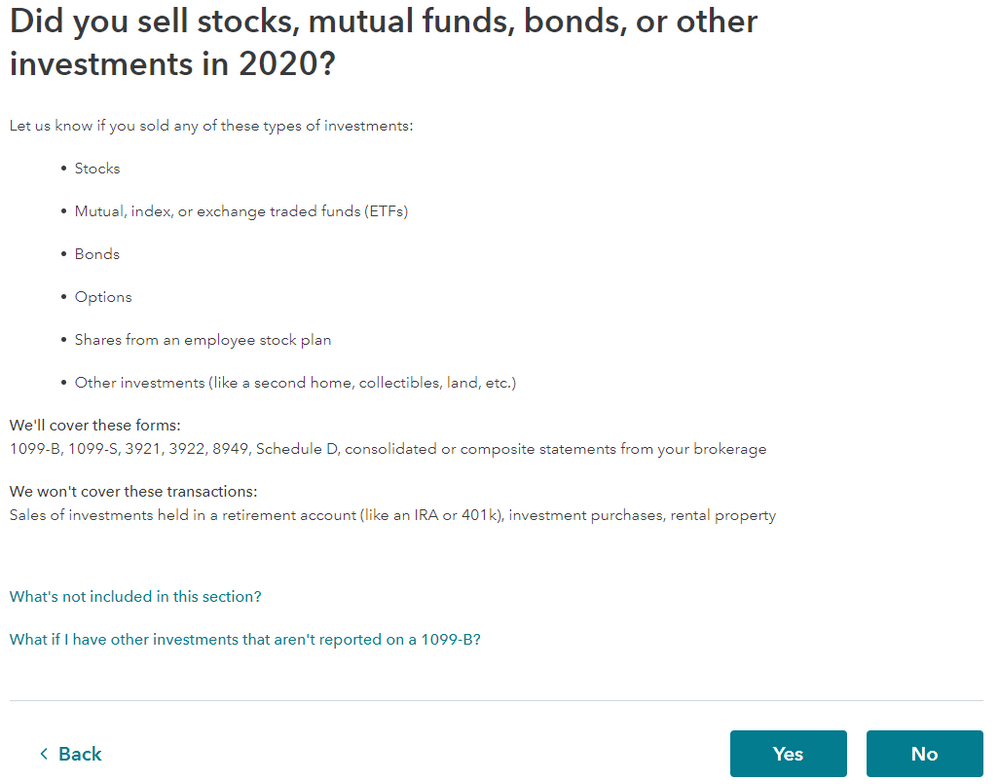

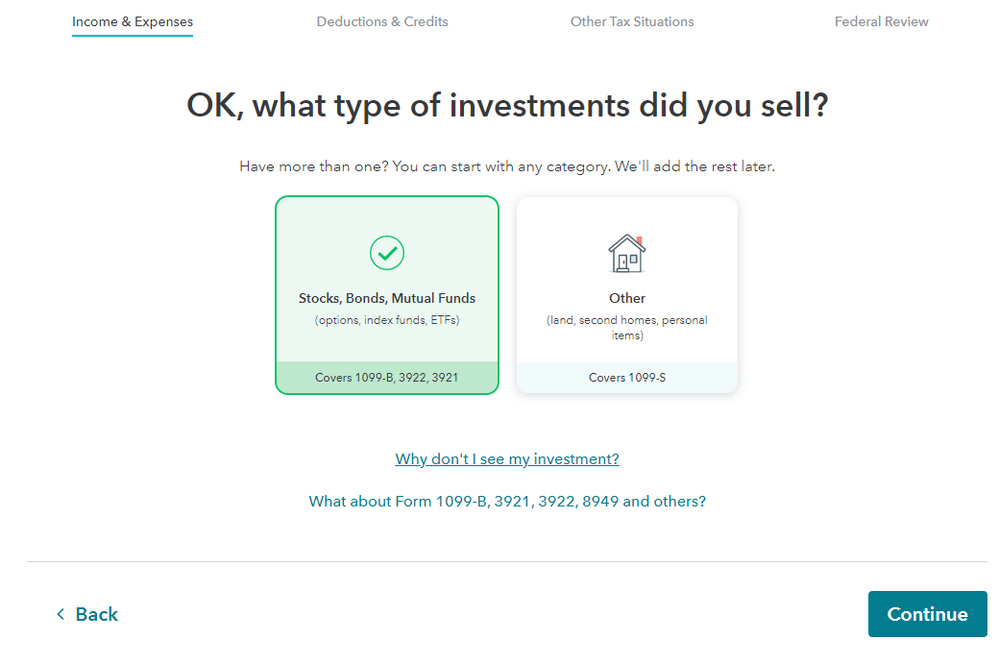

That's the problem I'm having, I never see the section to:

Indicate that you don't have a 1099-B or a brokerage statement for these sales. Then choose the I'll enter a summary for each sales category option. Then enter the proceeds, cost basis and indicate the holding period as Short Term or Long Term.

Maybe it has something to do with using the Self Employed version of TurboTax, but these are the screens I get...

Nowhere does it say, "don't have a 1099-B or a brokerage statement for these sales".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Day Trading losses with CMEG

Yeah same here lol. So I'm guessing I just throw the summary in there and call it a day...seems like nobody actually knows. Seems like there is no consistency here between what everyone sees....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Day Trading losses with CMEG

You can do a summary of long term and then short term combinations. Make one entry for each (long term / short term). You can then send the worksheets or statement with Form 8949 after your return is accepted, attached to Form 8453.

To eliminate difficulty, make sure the date acquired reflects the correct holding period. It's not important other than to have the correct holding period for the results to be calculated accurately for tax on your return.

- Long term is a holding period of more than one year and receives capital gain tax treatment (0%, 10%, 15%, 20% depending on your regular rate of tax)

- Short term is a holding period of one year or less and receives ordinary gain tax treatment (your regular rate)

- Sale date can be the last date a sale occurred or 12/31/2020

- Purchase date can be 'Various'

- When I walk through the steps, as you can see from the image below, you must select the check beside 'Something other than a date'.

If you are e-filing your tax return, then mail your statements along with Form 8453 to:

Internal Revenue Service

Attn: Shipping and Receiving, 0254

Receipt and Control Branch

Austin, TX 73344-0254

If you need a blank Form 8453, you can download this pdf, enter your address information and check the box for Form 8949 (this form is really just a cover sheet).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Day Trading losses with CMEG

So do I have to enter every single day trade that I made?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Day Trading losses with CMEG

As DianeW777 tells you above, you will make 2 entries. One for long term and another for short term.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Day Trading losses with CMEG

Okay thanks! That is what I've done so far. My long term trades are taken care of. Then, from my CMEG account statement, I put my P/L summary which equals my total losses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Day Trading losses with CMEG

Yes, That is correct if this is the summary of your short term holdings transactions (since you indicated the long term trades were already entered).

Then follow the instructions above for sending your detailed statements to the IRS after your return has been accepted. The mailing should take place within three days after acceptance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Day Trading losses with CMEG

Okay perfect! Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Day Trading losses with CMEG

DianeW777,

Apologies for responding to an older post, but I just need one point of clarification as I'm basically in the same situation as the poster of the original question. When filling out Form 8949, do I really need to fill out a line for every individual trade or can I summarize my losses on one line and then attach my account statement? Last year, I only took about 40 trades, but this year I'll take hundreds of trades, and filling in so many forms doesn't seem like the best way to report.

Thanks for your help,

Kevin

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dack18

New Member

darwin-baird

New Member

taxxat

Returning Member

karenbritt89

New Member

MB232

Level 2