- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Net passive loss on Schedule K-1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net passive loss on Schedule K-1

I bought units in two MLPs in 2020 and continue to own these units. My 2020 Schedule K-1's show a net passive loss (i.e., the sum of lines 1, 9a, and 10 is negative) for both MLPs. Furthermore, the K-1 states:

"The tax law characterizes ordinary income, gain, loss and deductions from a publicly traded partnership interest as passive income or loss. If you have a net passive loss, you should generally not report that loss on your federal or state tax returns unless you disposed of ALL your interest in [name of MLP] prior to January 1, 2021, in a fully taxable transaction."

What does "not report" mean? Should leave boxes 1, 9, and 10 empty or perhaps not enter K-1's for these MLPs in TT at all?

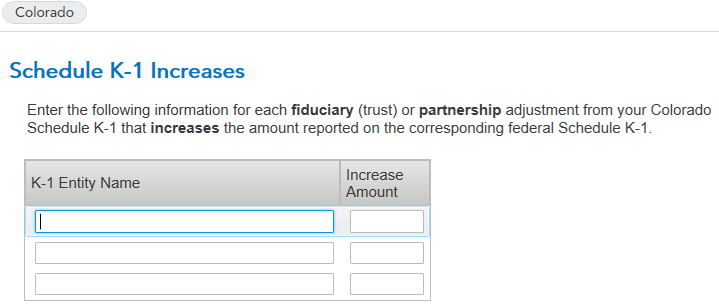

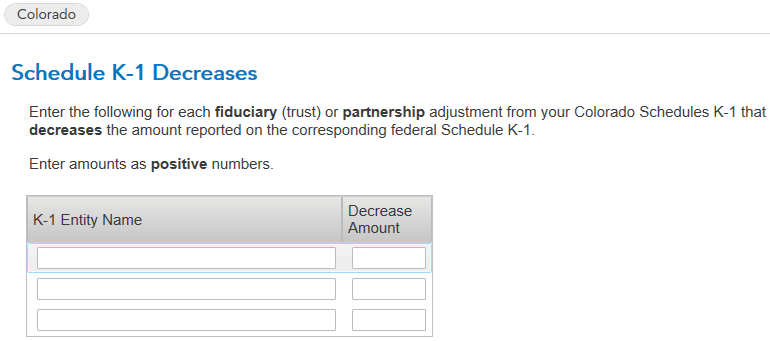

Also, what are the implications of this statement from a state tax standpoint? When starting my state tax return, TT asks to specify K-1 increases and decreases, as shown in the below screenshots. Given my net passive loss on both MLPs, is there anything I should put for these increases and decreases?

Lastly, the state-level breakdowns on my K-1's have non-zero values for my state. Specifically, one MLP's K-1 has non-zero values for "Ordinary Business Income or Loss (-) and Other Income or Loss (-)" and "Potential Bonus Adjustment to Ordinary Income or Loss (-)" while the other MLP's K-1 has a non-zero value for "Separate Ordinary Income / Loss (-) from this Activity". Where, if anywhere do these need to be entered in TT?

@Irene2805 and @nexchap, perhaps one of you know the answers to these questions 🙂?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net passive loss on Schedule K-1

You definitely want to enter all the K-1 information into TT. TT will track it and suspend any of the losses until something happens that allows you to claim them.

What the quote you referenced is discussing is when you can use those losses. By "report the loss" they mean actually net it into your income and reduce your tax. That's different from giving TT the information so it can track them for you from year to year.

On the CO questions, I'm not familiar with their forms so can't really help. But what they might be referring to is that some states require partnerships to follow different rules for reporting (one common example is depreciation). The partnerships usually identify (in the line 20 footnotes) where a number might be different on for certain states, and by how much. You'd then make the adjustments at the state level. But each state does that differently, with different forms, so that's the best I can do.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net passive loss on Schedule K-1

Thanks for your input on my first question, @nexchap. I will report all information on the K-1's in TT, as you suggested.

As it relates to my other two questions / how to enter the information from the K-1's on my Colorado tax return, I decided to contact the CO DOR. Unfortunately, they were only of limited help, as they indicated they are "examiners" not "preparers". They did however confirm that if I had a net passive loss at the federal level, this would "trickle down" to the state and I would not have to report it. They also stated that they are "not aware of" any increases or decreases that I would need to apply at the state level as it pertains to the federal K-1 amounts. Doing some googling on the subject, I found that Colorado conforms to the federal treatment of bonus depreciation (see here). As such, even though my K-1 shows a non-zero amount in the aforementioned "Potential Bonus Adjustment to Ordinary Income or Loss (-)" column, it appears the keyword is "potential" and I don't need to do anything with that amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net passive loss on Schedule K-1

So if I have a net loss on my K-1 for this year, will TT carry the loss forward to next year's return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net passive loss on Schedule K-1

@bigbadjohnnytheo Yes. When you start the return next year, and import this year's return, it will carry the loss forward and track it until you're able to report it on your return.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nirbhee

Level 3

DallasHoosFan

New Member

rhartmul

Level 2

rpaige13

New Member

user17525224124

New Member