- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net passive loss on Schedule K-1

I bought units in two MLPs in 2020 and continue to own these units. My 2020 Schedule K-1's show a net passive loss (i.e., the sum of lines 1, 9a, and 10 is negative) for both MLPs. Furthermore, the K-1 states:

"The tax law characterizes ordinary income, gain, loss and deductions from a publicly traded partnership interest as passive income or loss. If you have a net passive loss, you should generally not report that loss on your federal or state tax returns unless you disposed of ALL your interest in [name of MLP] prior to January 1, 2021, in a fully taxable transaction."

What does "not report" mean? Should leave boxes 1, 9, and 10 empty or perhaps not enter K-1's for these MLPs in TT at all?

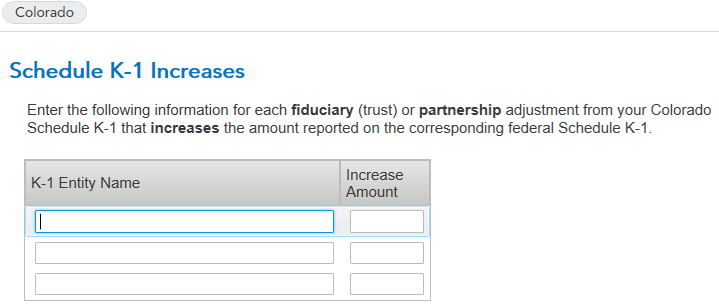

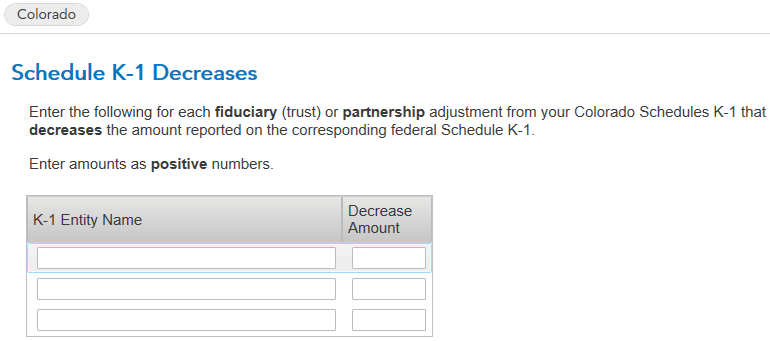

Also, what are the implications of this statement from a state tax standpoint? When starting my state tax return, TT asks to specify K-1 increases and decreases, as shown in the below screenshots. Given my net passive loss on both MLPs, is there anything I should put for these increases and decreases?

Lastly, the state-level breakdowns on my K-1's have non-zero values for my state. Specifically, one MLP's K-1 has non-zero values for "Ordinary Business Income or Loss (-) and Other Income or Loss (-)" and "Potential Bonus Adjustment to Ordinary Income or Loss (-)" while the other MLP's K-1 has a non-zero value for "Separate Ordinary Income / Loss (-) from this Activity". Where, if anywhere do these need to be entered in TT?

@Irene2805 and @nexchap, perhaps one of you know the answers to these questions 🙂?