- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- In a Part-Year Resident State Return, how do I allocate the loss on a rental property that exists in another state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In a Part-Year Resident State Return, how do I allocate the loss on a rental property that exists in another state?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In a Part-Year Resident State Return, how do I allocate the loss on a rental property that exists in another state?

If you were a resident of 2 different states during the tax year (for example, if you moved from one state to another), you'll normally file part-year returns in both states, assuming each state collects income tax and you had income in each state. Allocate the house sale only to the state where it occurred.

TurboTax handles part-year returns, but you need to make sure you've set up your personal information correctly to trigger the part-year state interviews:

- With your return open, select Personal Info.

- Click Edit next to your name.

- Select your resident state from the State of Residence drop-down.

- Answer Yes at the line below (that you lived in another state during 2017).

- Select your former state from the Previous state of residence drop-down.

- Enter the date you became a resident of your new state. This can be the date you arrived in that state.

- Select Continue to return to the Your Personal Info Summary screen.

- Repeat Steps 3-5 for your spouse, if needed.

After you finish your federal return, you'll automatically move to State Taxes, where you'll see your part-year states listed. We suggest you prepare the return for the state you currently live in, followed by your former state.

Important: If you also see a nonresident state return on the State Taxes tab, complete that return before you work on your part-year return(s) to ensure your tax credits are calculated correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In a Part-Year Resident State Return, how do I allocate the loss on a rental property that exists in another state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In a Part-Year Resident State Return, how do I allocate the loss on a rental property that exists in another state?

The gain or loss will be added to or subtracted from any income you had as a part year resident.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In a Part-Year Resident State Return, how do I allocate the loss on a rental property that exists in another state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In a Part-Year Resident State Return, how do I allocate the loss on a rental property that exists in another state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In a Part-Year Resident State Return, how do I allocate the loss on a rental property that exists in another state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In a Part-Year Resident State Return, how do I allocate the loss on a rental property that exists in another state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In a Part-Year Resident State Return, how do I allocate the loss on a rental property that exists in another state?

Sorry for the late response. I hope this answer would still help since you may still face similar issues for 2020.

The short answer is that there's no allocation of loss (probably) in the way you have imagined. You likely have made an incorrect assumption about how nonresident tax is handled.

Let's consider a simpler situation: you are a full year state B resident and you have rental income from your state A property. You should file state A nonresident return and state B resident return.

State A can only tax income from sources within state A, including rental income from state A. Standard/itemized deduction is typically calculated as if you were a state A resident, and then apportioned to state A based on the ratio of your gross income from state A and that from all sources. If the rental is a loss, then you pay zero tax to state A for that tax year. But I don't know if you still need to file a return to state A because you would need to claim expenses to claim the loss. I think it's always safe to file rather than not.

State B can tax your income from all sources, regardless of where the source is. This is because your are a state B resident. Whether the rental property is in state A or B doesn't usually affect most part of your state B return. A common affected part is that, in absence of a pertinent reciprocity agreements between the two states, your state A income tax may reduce your state B income tax via an "other tax credit" to prevent taxation over the same income twice by two states. But if it's a loss and you pay zero tax to state A, then the situs (location) of the rental property usually doesn't matter for state B tax return purpose.

If it is part-year, then effectively, you do your tax as a state A resident for the duration before you became a state B resident, and for the rest of the year as a state B resident.

Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or tax advice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In a Part-Year Resident State Return, how do I allocate the loss on a rental property that exists in another state?

I have a similar situation to the original post for 2020. I moved mid-year from Arizona to California, converted my old Arizona house to a rental, and had a net tax loss on the rental property. Like the original post, I am an active participant making below $100,000 per year and not a real estate professional. However, I have income and paid taxes in both states, and I am unsure of where to claim the losses since they are from an Arizona source and occurred when I was a California resident.

I understand how to allocate my other forms of income, and I also understand how the income would be reported if I had a net income on the rental in the future. However, I am unsure how to report the net losses for 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In a Part-Year Resident State Return, how do I allocate the loss on a rental property that exists in another state?

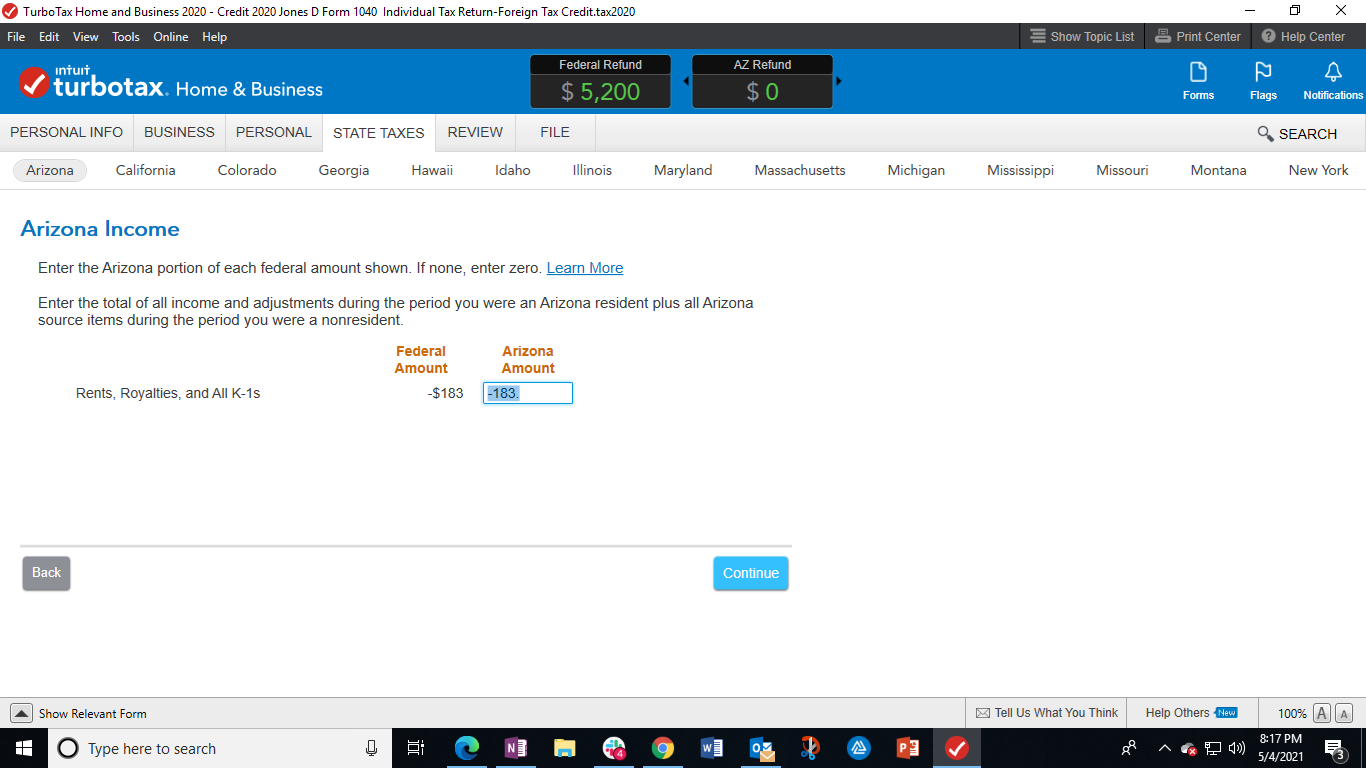

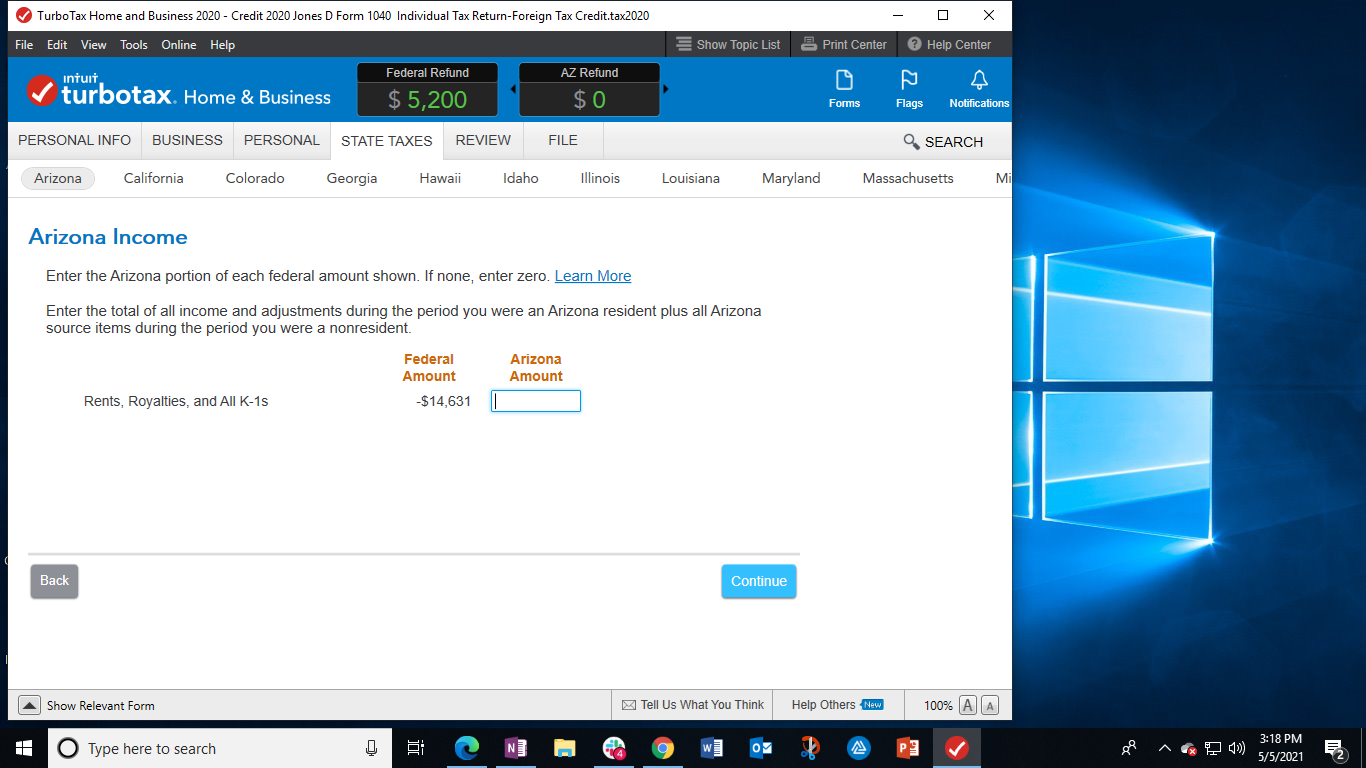

Net losses are handled in the same manner. As you proceed through your Arizona interview in Turbo Tax, you will taken to an income allocation screen. There will be a screen that mentions rents, Royalties, and all K1's and a federal amount with a negative number, if you you reported this in the federal interview. You will respond to the question by placing a negative sign next to the amount in the interview.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In a Part-Year Resident State Return, how do I allocate the loss on a rental property that exists in another state?

Thanks Dave. Does that mean I would not report any of those losses on my California return? Even though I incurred the losses as a California resident?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In a Part-Year Resident State Return, how do I allocate the loss on a rental property that exists in another state?

You can allocate part of those losses to your California return if it is is beneficial to you. You would need to determine an allocation ratio based on the time you lived in Arizona and California. It does say in the text where you enter this into your Arizona return that you would enter this while a Arizona resident plus ALL Arizona sourced items during the period you were a non-resident. From this, I would conclude you may enter the entire amount of the losses in your Arizona return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In a Part-Year Resident State Return, how do I allocate the loss on a rental property that exists in another state?

You report the losses for the days you are a California resident on California return. You report the losses for the whole year on Arizona return. Yes, you report losses during the time you are a California resident on both returns.

The allocation is about how many days you were a California resident. Because the property sits in Arizona, you report the losses for the whole year around in your Arizona return.

Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or tax advice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In a Part-Year Resident State Return, how do I allocate the loss on a rental property that exists in another state?

@investing engineer. It does say clearly in the instructions in the Arizona return that you would enter this while a Arizona resident plus ALL Arizona sourced items during the period you were a non-resident. This is definitely an Arizona sourced item. Here is the screenshot that alludes to this. Read the text within the box.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jackkgan

Level 5

masda2600

Returning Member

masda2600

Returning Member

IronWomen

Returning Member

sockfight-1

Returning Member