- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I received both 1099-B and K-1 for the same sale. 1099B cost basis is not available. How do I enter 1099B?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received both 1099-B and K-1 for the same sale. 1099B cost basis is not available. How do I enter 1099B?

You can add the income reported from your K-1 entry to the cost basis on the 1099-B entry to avoid a double taxation issue.

First, report the form 1099-B transaction like you normally do. When you enter the sale and cost basis information you will see this screen:

Click on the "I'll enter additional info on my own" option. You will then see a screen where you can add the correct cost basis, where you add the income reported on the K-1 schedule. The difference will show up as an adjustment on your schedule D.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received both 1099-B and K-1 for the same sale. 1099B cost basis is not available. How do I enter 1099B?

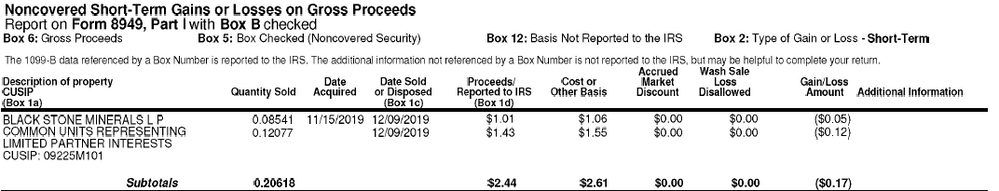

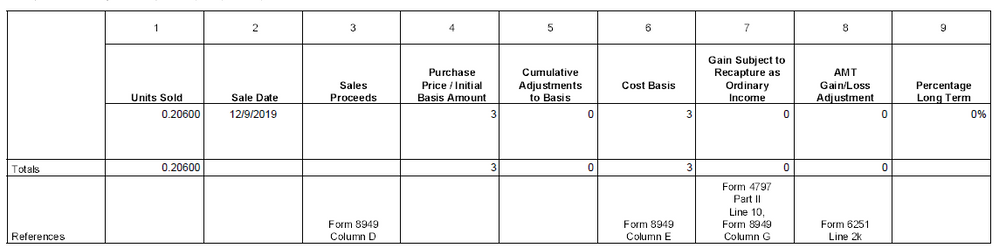

What about a situation like this where I got this on a 1099-B:

And this on the K-1:

I'm guessing they round out the number for the K-1s as the others I got are similar. Should I just leave the 1099-Bs/entries on form 8949 as they are or would I delete the two entries in TurboTax and then add one entry with something like:

Box 1c Date Sold: 12/9/2019

Box 1b Date Acquired: Various

Box 1d Sales Proceeds: 3

Box 1e Cost or Other Basis: 3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received both 1099-B and K-1 for the same sale. 1099B cost basis is not available. How do I enter 1099B?

It appears to be a duplicate entry, but since they both report zero gain, they won't affect your tax. Because the amounts are immaterial, if you have already reported them, I would suggest you leave them alone.

Otherwise, just report one of them, the 1099-B would be easier, so go with that one!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received both 1099-B and K-1 for the same sale. 1099B cost basis is not available. How do I enter 1099B?

@ThomasM125 thanks for the suggestion about entering the corrected cost basis on 1099B:

corrected cost basis = cost basis from 1099B + gain subject to recapture as ordinary income from K-1

That results in the negative adjustment in Column G of Form 8949, as suggested in instructions on K-1 for Column 7 (gain subject to recapture as ordinary income):

Column 7: The instructions to Form 8949 are unclear in the determination of capital gain where total gain on the sale of units is partially ordinary gain. Reporting this amount as a negative adjustment in Column G of Form 8949 should generally result in the correct capital gain or loss.

What I'm unclear is, I still have two 8949 forms:

- 8949 generated based on the 1099B from my broker. This is where the corrected cost basis has been applied.

- 8949 generated based on the K-1 sale interview.

Some people suggest that the 1099B sale information from the broker should be deleted. That deletes the first 8949 form.

Could you clarify what is the right approach?

- Enter the corrected cost basis on 1099B from the broker as negative ordinary income. Keep two 8949.

- Remove the sale from 1099B from the broker. Keep 8949 from the sale on K-1.

The two approaches result in different tax refund.

Appreciate your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received both 1099-B and K-1 for the same sale. 1099B cost basis is not available. How do I enter 1099B?

I am assuming that the K-1 gain is duplicated on the form 1099-B reporting. If so, you would need to adjust the cost basis of the sale reported on the 1099-B to reflect a zero gain. That way, the gain or loss reflected on the K-1 would be the only one appearing on your tax return.

I think you may have an issue with ordinary income being reflected on the K-1 form. You can't report ordinary income from a form 1099-B form, it would all be capital gain income.

So, if you try to just report the form 1099-B information, it may give you a different result that if you report the same information from a k-1 form.

So, if the form 1099-B duplicates the gain reported on the K-1 schedule, report the sale amount on the form 1099-B as stated on the form and adjust the cost basis to reduce the gain to zero.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received both 1099-B and K-1 for the same sale. 1099B cost basis is not available. How do I enter 1099B?

Question:

I have an individual owned public investment k-1 with a sale showing proceeds $17,945 with basis $11,282 sowing an ordinary income of $5,516 but states to enter on 8949. The sale on the 1099-B shows same proceed of $17,945 but basis of $21,048, a $3,103 8949 LT loss.

Are you saying to use the k-1 data that is supplement for basis vs. the 1099-B reported to IRS or enter in both sales transactions for the same sale?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received both 1099-B and K-1 for the same sale. 1099B cost basis is not available. How do I enter 1099B?

the broker 1099B does not adjust your original cost for partnership activity. the partnership provided you with a supplemental schedule that shows your tax basis and if any part of sale that is ordinary gain under section 751.

so on form 8949 show sales proceeds as $17945. basis as $11282+ $5516 which is the ordinary gain resulting in a capital gain of $1147

on the disposition part of the k-1 worksheet you will show purchase and sales dates based on the 1099B. you will show sale price of $5516 on line 5 and ordinary income of $5516 on line 9

also make sure you check off this is a final k-1 so any passive suspended and current losses are allowed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received both 1099-B and K-1 for the same sale. 1099B cost basis is not available. How do I enter 1099B?

I wasn't sure I would get a response so I am attaching actual info. to confirm your original reply is still correct or adjust, thank you for response!

k-1 Supplemental actual

Purchase Price $17,945, revised purchase basis = 11,282, Box 7 subject to ordinary gain 5,516

1099-B

Proceeds 16,260

cost basis 18,075

LT Loss 8949 = -1,815

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received both 1099-B and K-1 for the same sale. 1099B cost basis is not available. How do I enter 1099B?

I read another answer that said to enter all the K1 info but leave the sale and basis amounts blank, and use the basis from the K1 to fill in the sale info in the 1099 section. Is that what you mean? Because if I enter the sale figures in both places, it adds extra tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received both 1099-B and K-1 for the same sale. 1099B cost basis is not available. How do I enter 1099B?

So, enter the PLP's income info in the K1, indicate that you did dispose of (in my case partial) interest, enter the purchase and sales dates, but skip the price and basis section. Then use the K1 adjusted basis to populate the sale info in the 1099? In my case, all of my PLP sales are listed as N/A for basis in the broker's 1099, so I should update that with the basis from the K1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received both 1099-B and K-1 for the same sale. 1099B cost basis is not available. How do I enter 1099B?

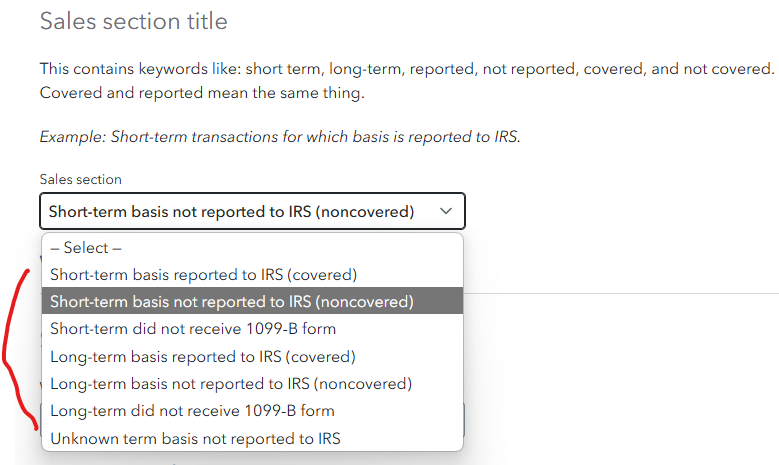

I have several sales, some short term and some long term, but TT only offers one window to enter one sale.

Should one need to go directly to form D or 8949 to enter or change the info where box B or E was checked on the download from the broker? Or what is the better solution to this problem?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received both 1099-B and K-1 for the same sale. 1099B cost basis is not available. How do I enter 1099B?

You are entering an IRS form 1099-B One by one transaction. You want to correct the Sales section title reported for the transaction.

At the screen Let's finish pulling in your investment income, click on the down arrow to the right, then click Edit.

Correct the transaction by changing the incorrect Sales section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Aowens6972

New Member

rkplw

New Member

Reynan2124

New Member

Kuehnertbridget

New Member

jjon12346

New Member