- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

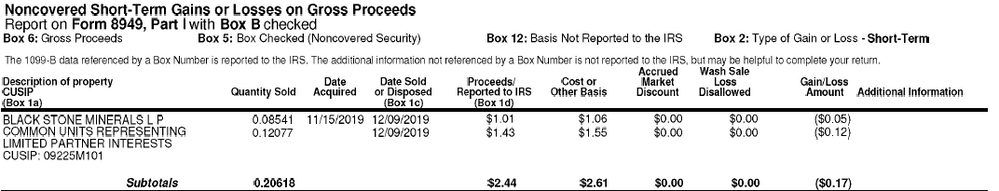

What about a situation like this where I got this on a 1099-B:

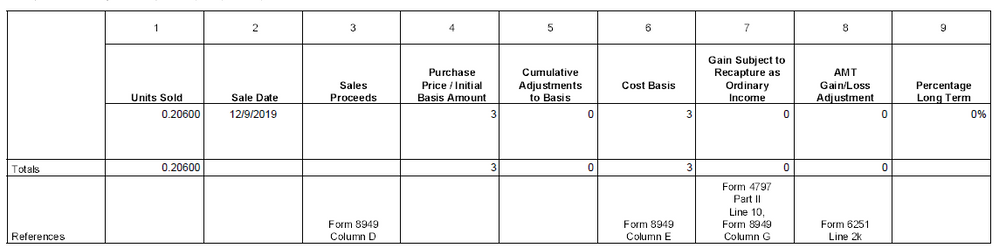

And this on the K-1:

I'm guessing they round out the number for the K-1s as the others I got are similar. Should I just leave the 1099-Bs/entries on form 8949 as they are or would I delete the two entries in TurboTax and then add one entry with something like:

Box 1c Date Sold: 12/9/2019

Box 1b Date Acquired: Various

Box 1d Sales Proceeds: 3

Box 1e Cost or Other Basis: 3

March 20, 2020

4:01 PM