- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I have capital gains from redemption of company stock. I do not have nor will I get a 1099-B. How do I report this?

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have capital gains from redemption of company stock. I do not have nor will I get a 1099-B. How do I report this?

This is a non-public company and totally an internal transaction.

Topics:

posted

March 27, 2023

3:41 PM

last updated

March 27, 2023

3:41 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have capital gains from redemption of company stock. I do not have nor will I get a 1099-B. How do I report this?

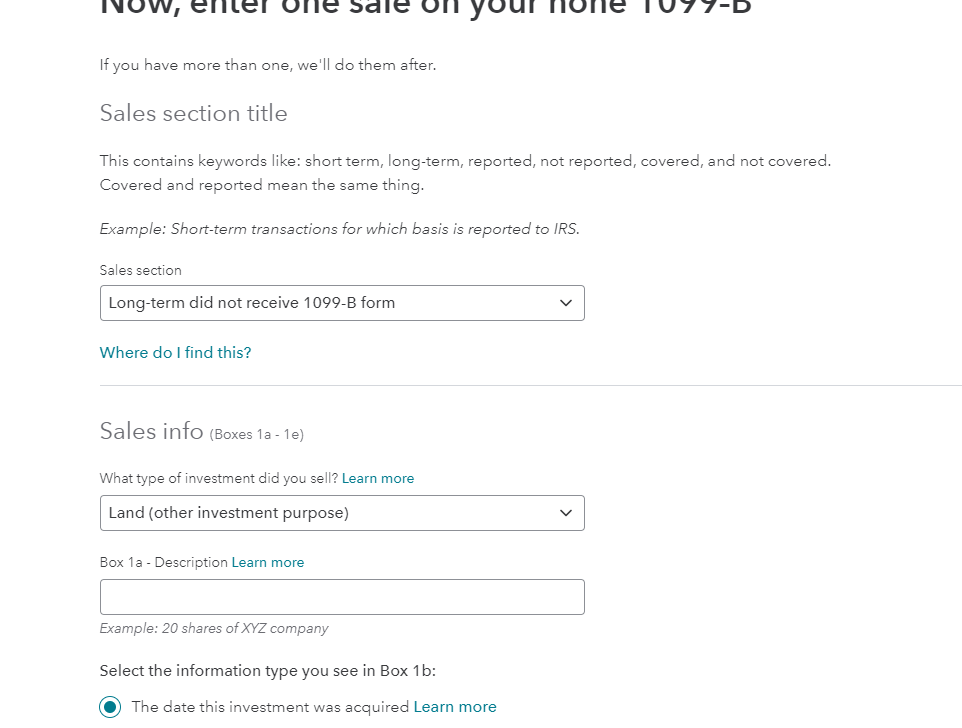

You can report the stock redemption as an investment sale even though you did not receive a 1099-B

To enter the information without a 1099-B:

- In TurboTax, click on Wages and Income

- Scroll down to Investment Income

- Choose Stocks, Mutual Funds, Bonds, Other, and select Start or Update

- The first screen will ask if you sold any investments during the year, answer yes

- Did you get a 1099-B or a brokerage statement for these sales? Answer No

- Tell us about the sale, Click I'll enter one sale at a time

- The drop-down boxes can be filled out with the details of the stock redemption from your records

- Description

- Date sold

- Sales proceeds

- Cost basis

Please see the example below for a long-term sale without a 1099-B in TurboTax with Land as an example, use your information for the investment type

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 27, 2023

4:08 PM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

VAer

Level 4

jmeza52

New Member

claire-hamilton-aufhammer

New Member

RicN

Level 2

dpa500

Level 2