- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I have a capital loss carryover that turbotax automatically applied (but not the full $3,000 max amount but it did not seem to increase my refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a capital loss carryover that turbotax automatically applied (but not the full $3,000 max amount but it did not seem to increase my refund.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a capital loss carryover that turbotax automatically applied (but not the full $3,000 max amount but it did not seem to increase my refund.

A capital loss carryover would normally affect a difference in your refund or balance due, however it all depends on the overall income level when including your other income. If your income is already below the filing requirement, then it would seem like it had no affect.

You can review your tax return (Form 1040 and Schedules 1,2,3) before you finish your return and you can also print the entire return before you file after you pay. Keep in mind that you will also have carryforward in some cases when the loss cannot be used up.

You can view your 1040 form before you e-file:

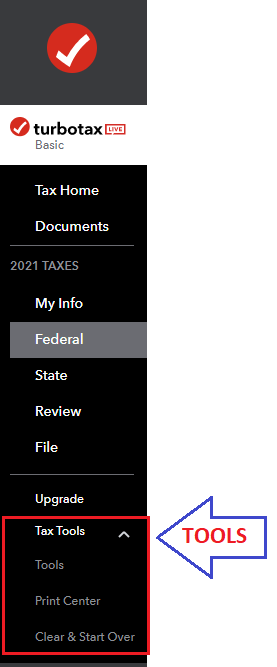

- Open or continue your return. (TurboTax Online)

- With the Tax Tools menu open, you can then:

- View only your 1040 form: Select Tools. Next, select View Tax Summary in the pop-up, then Preview my 1040 in the left menu.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kkrana

Level 1

HNKDZ

Returning Member

rsherry8

Level 3

user17545162733

New Member

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

rolfarber

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill