- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Form 1099-B Worksheet (Interactive Brokers LLC): Sales Price must be entered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-B Worksheet (Interactive Brokers LLC): Sales Price must be entered.

I imported my 1099b form from Interactive Brokers today. Then, at "Federal review" step, I'm getting this warning message:

"Form 1099-B Worksheet (Interactive Brokers LLC): Sales Price must be entered."

I'm not sure what to do. The form was automatically imported.

Did anyone else see that message?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-B Worksheet (Interactive Brokers LLC): Sales Price must be entered.

It is possible that the form imported does not list a sales price for one or more of the investment sales. You need to review the entries in TurboTax and if there are entries that don't have a sale amount, you can look at the printout of the form 1099-B and find the missing sales amounts and then manually enter them in TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-B Worksheet (Interactive Brokers LLC): Sales Price must be entered.

I looked at the entries in TurboTax -- everything looks good.

And I imported the information automatically from my InteractiveBrokers account - it should have everything to generate a proper 1099-B form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-B Worksheet (Interactive Brokers LLC): Sales Price must be entered.

I'm having this same issue. Any idea what to input here?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-B Worksheet (Interactive Brokers LLC): Sales Price must be entered.

A tax expert from TurboTax team suggested to delete the imported form, and then type all required information manually. In many cases, you don't need to type all trades --- TurboTax will ask just a few total numbers. But, they require to attach a copy of 1099b in PDF format. You can download a consolidated 1099 form from your IB account. I'm not sure if it's the right form because it's not just 1099b. It has information about dividends, stocks, etc... I'll talk to TurboTax today about that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-B Worksheet (Interactive Brokers LLC): Sales Price must be entered.

Yes I have the same issue. And I think I may have found a solution.

If you have many trades in your 1099-B (I had about 270) it will actually just take a really long time for the turbotax site to load. I feel bad for traders trying to file on turbotax with just twice as many trades as I have.

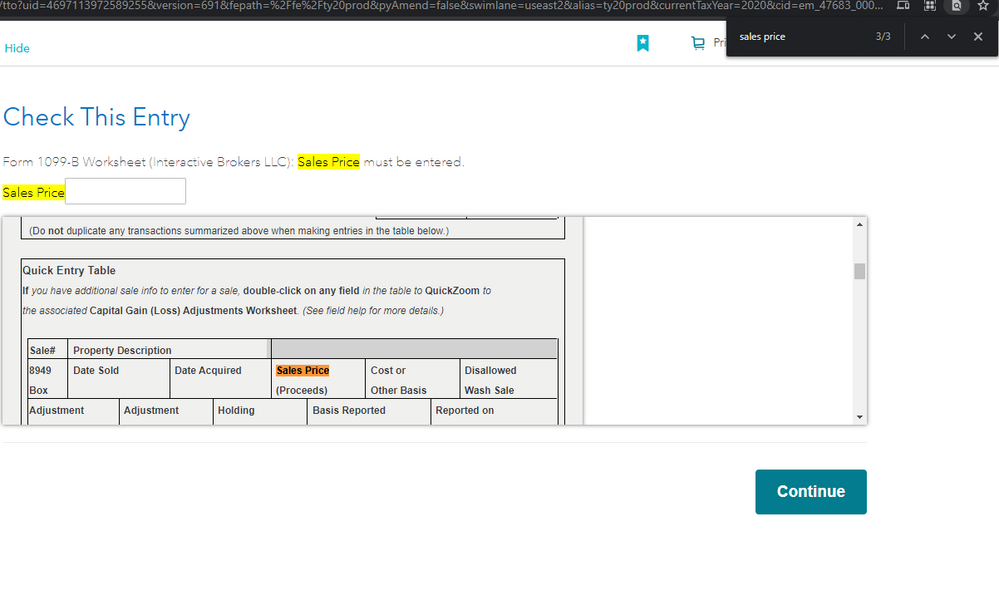

Anyway, I've attached an image showing all 3 references of "sales price" found on the page we're getting stuck on.

As you can see the "Sales Price" highlighted in orange with "(Proceeds)" under it is referring to the standard "Proceeds" column label in our 1099-Bs.

@ThomasM125 or another turbotax expert could you jump in and tell us if this is asking for the the Gross Proceeds amount? A proceeds amount for a particular trade? Or perhaps net proceeds?

**EDIT** In my particular case the issue ultimately had to do with turbotax not recognizing options trades as an "options type" of security and not being able to recognize which ones had expired. Therefore I had to manually update each entry that had expired. I would hope this gets fixed or else I don't know if turbotax would make sense for me in the future if I had just twice as many trades.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-B Worksheet (Interactive Brokers LLC): Sales Price must be entered.

Yes, the review screen ("Check This Entry") is asking for the gross proceeds for a particular trade.

(The only exception would be if the 1099-B entry was reporting cumulative numbers for a group of trade - this would be something you, the customer, had chosen to do).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

anth_edwards

New Member

newmansown2001

New Member

tcondon21

Returning Member

garne2t2

Level 1

afoote

New Member