- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Do I report the 2nd stimulus amount his year if I didnt actually receive the money until 1/2021?

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I report the 2nd stimulus amount his year if I didnt actually receive the money until 1/2021?

Topics:

posted

January 31, 2021

2:35 AM

last updated

January 31, 2021

2:35 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

2 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I report the 2nd stimulus amount his year if I didnt actually receive the money until 1/2021?

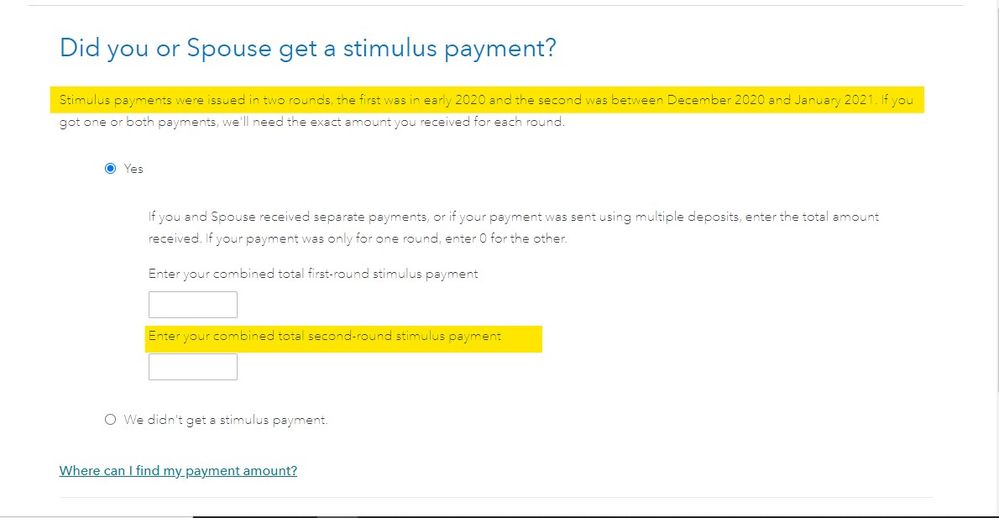

Yes, you will enter both stimulus payments including the one received in 1/2021.

To do this in TurboTax, please follow these steps:

- Log into TurboTax.

- After entering all your information click "Federal Review" at the top of your screen.

- On the screen "Let's make sure you got the right stimulus amount" click "Continue".

- You will be asked about the amounts of first round and second round stimulus payments you received. If you did not receive a payment enter "0".

- TurboTax will then calculate the amount of stimulus payment remaining that you are still entitled to get.

- Any stimulus amount remaining due to you will show as a credit on line 30 of the 1040.

For additional information please see Stimulus FAQ at the end of the TurboTax article.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 31, 2021

5:05 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I report the 2nd stimulus amount his year if I didnt actually receive the money until 1/2021?

Read the screen carefully ... it instructs you to enter them both ...

January 31, 2021

6:14 AM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lada_905

New Member

lizsyms46

New Member

Wassikluke

New Member

in Education

ZorbaWL

Returning Member

wilonet

New Member