- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Bring back manual entry for 1099 Div, 1099 Int

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bring back manual entry for 1099 Div, 1099 Int

What happened to the old way of entering 1099-DIV, 1099-INT, and so on

I have TT Deluxe Fed + E file & State. I want to start entering dividends. I clicked on Update on the dividends line but instead of getting a list of the institutions like in previous years I get a jumbled list of dividends, interest, and whatever else and TT wants to import each item. If I say skip import , nothing happens. I want to enter my items manually like I have done in previous years. I hate this interface. Why did Intuit change Turbo Tax interface without doing proper testing and regression testing? Make it go away. I want to enter manually with as few screen clicks as possible.

To get around it, I enter the forms mode, add information to the form and save the form. Then that form can be brought up the old way.

Please fix this bug. It is ridiculous.

I don't like those new desktop screens either. I even went to the Manage Import Options screen and placed a checkmark for each type of 1099 to not be asked to import. Well, even after I did that, it ignores it. I still get asked to import on each 1099-DIV/INT, etc., but I skip it each time since I want to enter manually.

Fix this bug!!! It is not an improvement!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bring back manual entry for 1099 Div, 1099 Int

You can follow these steps on the Desktop Software.

To edit or update a 1099-INT or 1099 DIV, follow these steps

- Select Wages & Income

- I'll choose what I work on

- Scroll and select Interest and Dividend

- Click Update

- Any previously entered 1099 will appear

- Click Review

- Post the edit or updated information

To post a new 1099-INT or 1099-DIV

- Select Wages & Income

- I'll choose what I work on

- Scroll and select Interest and Dividend

- You may see either Start or Update

- Do you have investment income in 20XX - Yes

- Import options appear - Skip Import

- Click on the type of 1099 that you have - Continue

- Enter the new information

- If you wish to Add an Investment, you will repeat these steps

I hope this will help you to navigate the program

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bring back manual entry for 1099 Div, 1099 Int

These steps worked in all the previous years of Turbo Tax. These steps do not work in my windows desktop version of TurboTax 2024. In previous years always did it that way but it does not work this way:

- Click Update

- Any previously entered 1099 will appear

- Click Review

- Post the edit or updated information

This is not how my 2024 Turbo Tax program works. (Definitely worked this way in previous years). Even when I go through and say skip import, it does not give me the option to edit and update. It just goes to next step.

I want it to work like in the past and the way that you documented the procedure. This way no longer works. I have all the latest updates to desktop TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bring back manual entry for 1099 Div, 1099 Int

Please Clarify

After you click Skip Import do you get a screen with five boxes?

Can you click on the investment type and select continue?

Edited 02/04/2024 9:50 PST

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bring back manual entry for 1099 Div, 1099 Int

yes i get the 5 boxes, but when I click on continue it REQUIRES me to import a 1099B which I do not have. I can't skip the 1099B import.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bring back manual entry for 1099 Div, 1099 Int

When you get the five boxes, make sure you click on "Dividends", the box will turn green and it will have a checkmark on it. Make sure you did not click on the next box, "Stocks, Bonds. Mutual Funds" which would ask you for a Form 1099-B. (See screenshots below for additional guidance)

You can manually enter your Form 1099-DIV as follows:

- Click on "Search" at the upper right of your screen.

- Enter "1099-DIV"

- Select "Jump to 1099-div"

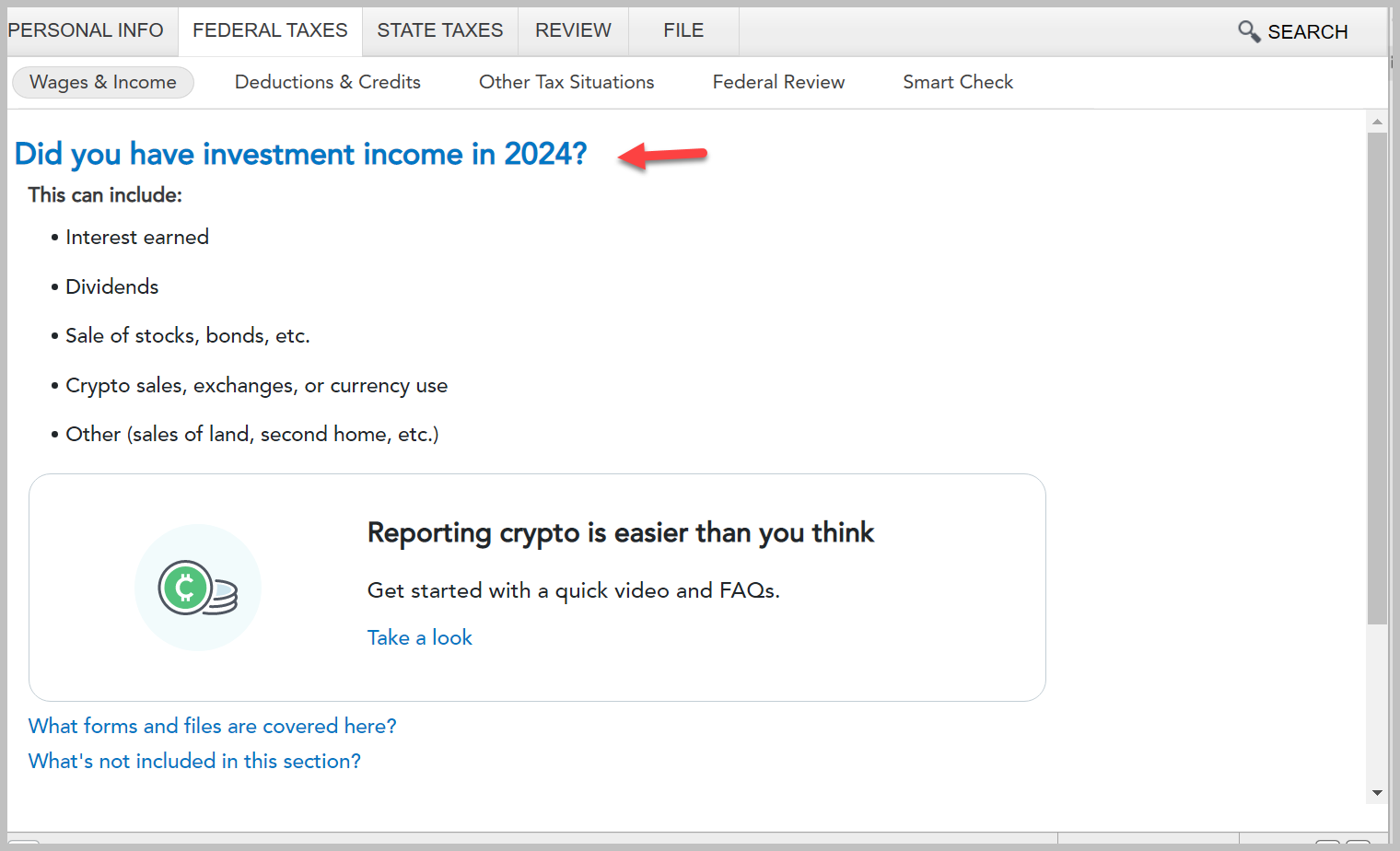

- Answer "Yes" to "Did you have investment income in 2024?"

- Select "Skip Import" on the screen that asks "Let Us Enter Your Bank and Brokerage Tax Documents"

- Select the box that says "Dividends 1099-Div" (the box will turn green with a checkmark on it)

- And "Continue"

- Enter your 1099-DIV information and select "Continue"

- Answer the follow-up screens about your dividend interest

Search 1099-DIV

Answer "Yes"

Skip Import

Select "Dividends"

Enter your 1099-DIV information

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bring back manual entry for 1099 Div, 1099 Int

2024 Desktop Premium works differently on return started new and return transferred from 2023.

Return started new I can easily enter 1099-INT manually.

Return transferred in from 2023, I click on "1099-INT box" and it goes to "import 1099-B" and will not allow me to skip or to go back. I have to get out of the return & start again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bring back manual entry for 1099 Div, 1099 Int

You can delete the information transferred and then enter the current year manually. Here's How to Update or Delete Imported Data.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bring back manual entry for 1099 Div, 1099 Int

(2024 Desktop Premium) Catina... you did not read my post. I do NOT want to import anything.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bring back manual entry for 1099 Div, 1099 Int

I know. I don't like how to enter Interest, Dividends, Sales etc. Too many clicks and screens to click on and go through. Go to the bottom and +Add Investments, then import or skip import, THEN....should be a screen with 5 boxes, pick Interest, Dividends, Stocks Bonds Mutual Funds, Cryptocurrency, or Other. Oh and Interest, Dividends and Sales are listed in the same list on the screen alphabetically. If I go to Interest I only want to see Interest!

You can switch to Forms Mode and enter them directly into Schedule B using the Dividend Income Smart Worksheet. But then they won't show up in the Step-by-Step list.

So go to the bottom and click on +Add Investments

Then to Import enter the bank or financial institution in the search box

Then double click on the item below

OR to manually enter, don't enter the bank name and click Skip Import at the bottom

THEN....should be a screen with 5 boxes, Interest, Dividends, Stocks, Bonds, Mutual Funds, Cryptocurrency and Other.

If you transferred from last year you get to a list of all your 1099s. To enter the amount click on Review which takes you to the beginning screen to import your tax info or go to the bottom and Skip Import. Then you get the screen with 5 boxes. Pick the kind of 1099 and Continue. Then that 1099 will show up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bring back manual entry for 1099 Div, 1099 Int

I'm not sure where this will be posted so let met provide some details regarding this thread. There was a conclusion that importing data and then trying to updated it without importing it didn't work. I found that too. I had filed my taxes in 2023 using TurboTax. So when I was asked if I wanted to import my 2023 data I thought sure, that will mean less work. They had me importing data from my investment accounts like I did lasts year. Then when I tried up update my data for my wife's Comcast stock account (which has no was of importing, I was not given a way to "manually" enter it. I entered it manually in 2023. TurboTax copied it into 2024. But now I have too delete it because it doesn't work as a customer would expect. Why give me the option to bring it in from 2023 and then force me to delete it and create it another way.

Is this really how Intuit wants TurboTax to work? I don't think so. So who is opening a problem ticket with the programmers so they can fix it so works ???? Does the community expert do that? Do they post that they have taken such actions.

I bought the product to do my taxes, and do them quicker than before. But now I've have to start over, and do it all manually like last year.

Who's answering all my questions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bring back manual entry for 1099 Div, 1099 Int

I read through this thread with great interest because the ability to update 1099-X entries from previous years has been removed, at least from the desktop version which I'm using. The current TTX desktop state machine seems to assume that if you've brought 1099-x information over from the previous year, when updating these 1099s you will, by default, use the import option to populate these these prior-year 1099's. For example, if the user selects "Update" for an existing 1099-X, and the user doesn't want to import their data, the only option is to select the "Skip Import" button. At this point TTX presents the user with a pallet of 1099 types to select from. If the user selects a 1099 from the pallet, the information the user enters appears as a new "1099-X account". Thus updates to an existing 1099-X results in two entries, the original (which is not updated) and the "new" (i.e. , TTX 2024) 1099-X. Not only is this inefficient, but tracking any given 1099's amounts from year to year is greatly complicated. Please look into this and consider changing the 1099-X update state machine back to the process used in previous years. The current implementation is a huge step backwards because it greatly complicates data entry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bring back manual entry for 1099 Div, 1099 Int

I agree! This sucks! I have all the tax forms but I can't fill in the information. I'm out of the country with weak wifi connection so unable to download into file. There doesn't seem to be any workaround to fill it in myself. So super frustrating! Can't fill out 1099 Div or my Int from managed sweep. I want to see with my own eyes what is being reported. CHANGE THIS!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bring back manual entry for 1099 Div, 1099 Int

I've never used TT on Windows, but always have on desktop for Mac and I think this is just the way the software is changing. But you should still be able to add any 1099-DIV or INT you want and work on it manually, it's just the screens got way more convoluted than they used to be. I do drafts of my 1099's, and even major brokerage trades at the end of the year for 4th quarter tax planning, so it's there, just not as user-friendly as it was before.

I played around with TurboTax's online product and a lot of the screens we're seeing are reflective of its online design, but obviously others are still legacy (very legacy...). It's becoming some sort of hybrid of desktop and online, and the online design seems to be what one would expect if they're doing their taxes on their cellphones. Common sense is telling me that the target audience of tax apps has become people who do their taxes on their phones, not us relics who type in, or at least CHECK our forms, and save a copy of their tax returns on their hard drives (amongst other places).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bring back manual entry for 1099 Div, 1099 Int

This does not work. I imported my int & div from Charles Schwab. All looks good. But it didn't enter the amounts on the tax form. So I deleted the imports one at a time. As soon as import/dividend/and capital gains were all deleted I was able to manually enter one of them on the form----- but when I tried to enter the next one it reverted back to the already entered category on the 'income page'. [I'm using Win10 on a laptop if that affects anything]

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sierrahiker

Level 2

ericbeauchesne

New Member

in Education

matto1

Level 2

hero123

Level 2

jasondholloway

New Member