- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- 1099-B doesn't support negative value in box 1d

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B doesn't support negative value in box 1d

Imported stock transactions from TD Ameritrade and all the entries that have a negative value in the 1099-B Sales proceeds line 1d causes Turbo tax to generate an error with Smart Check.

Getting Error: "Form 1099-B Worksheet: Sales Price is not between the prescribed upper and lower limits."

This looks to be a similar problem as last year. Called Support and they couldn't help. Too many entries to manually entered. Please , can someone from Turbo Tax software development please correct this issue for this year (tax year 2020).

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B doesn't support negative value in box 1d

Check out this article: How do I fix my 1099-B negative values?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B doesn't support negative value in box 1d

To be able to post a negative value to form 1099-B box 1d follow these steps.

- Select the option for a 1099-B

- Select to type it yourself

- Enter Bank

- I'll enter one sale at a time

- Enter the stock data and leave 10d BLANK

- When you hit Continue you will get a RED error message

- At the bottom of the screen select Allow me to continue with incomplete information. [Continue]

- Any less common items will be blank. Select Done

- No this is not employee stock

- Select the last item An adjustment is required for reasons not already covered.

- Enter the negative number that you had in Box 1d.

- This will complete the transaction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B doesn't support negative value in box 1d

Hello,

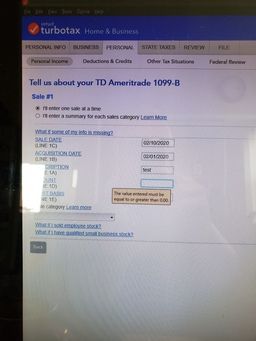

Thanks for the reply. However, what you suggested to manually enter the negative entries does not work (CD windows version). You still get "error: Value must be equal to or greater than zero."

And even if it does work, this would not be an acceptable solution since I have over 100+ Entries.

This is a software bug that it does not accept negative number. Can you please forward to TTX software development team to have this corrected ?

Thank-you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B doesn't support negative value in box 1d

I have the same issue. I have two forms with more than 200 entries from TD. Why should I do manual entry when I pay for automated software with premium price? TT folks, you have to fix this or do manual entry for us. Ridiculous service.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B doesn't support negative value in box 1d

the problem is not Turbo Tax it's your broker reporting negative proceeds. if the amount in 1d represents proceeds it should be positive. if it's cost then it's in the wrong box and then proceeds would be in 1e which is also the wrong box. even a short sale should report proceeds as positive in 1d. the other possibility is that if the actual 1099-B shows positive proceeds your broker didn't follow the instructions that Turbo Tax gave them for formatting the numbers for transmission. if the problem was at Turbo Tax's end everyone who imported from their broker would be reporting this problem. I've only seen a couple of complaints about this. I did not have this problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B doesn't support negative value in box 1d

If the TD’s 1099-B format is wrong, why your expert has given instructions to enter negative data in box 1d manually to ignore the error for each proceeds? It has to be corrected in the TTX software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B doesn't support negative value in box 1d

Every year I used to have the same format having negative numbers for short sale in box 1d. Only problem is happening this year with TTX

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B doesn't support negative value in box 1d

The negative proceeds (line 1d) from TD Ameritrade are for Short closing positions that resulted in a net loss. I went back to last year (2019)'s 1098B from TD, for these entries, it also has a negative entries. But last year, Turbo Tax did not have trouble importing them. So some thing is not working the same in this year's TTX.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B doesn't support negative value in box 1d

Turbo tax does not allow negative numbers in 1099-B box 1d

Some brokers now reports losses of short options on 1099B as a negative number for proceeds in box 1d and a zero value for cost basis, rather than separate values for cost basis and proceeds that show a loss.

The broker explanation is: "We are now updating our reporting of short options on the 1099-B to reflect how the IRS is now requesting that these transactions be reported. In this new format, the cost basis and proceeds for short options is consolidated into Box 1d in a net amount."

To be able to post a negative value to form 1099-B box 1d follow these steps.

- Select the option for a 1099-B

- Select to type it yourself

- Enter Bank

- I'll enter one sale at a time

- Enter the stock data and leave 10d BLANK

- When you hit Continue you will get a RED error message

- At the bottom of the screen select Allow me to continue with incomplete information. [Continue]

- Any less common items will be blank. Select Done

- No this is not employee stock

- Select the last item An adjustment is required for reasons not already covered.

- Enter the negative number that you had in Box 1d.

- This will complete the transaction.

From <https://turbotax.response.lithium.com/console/agent/5784093?>

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B doesn't support negative value in box 1d

Hi John,

Thanks for the replies, really appreciate it. I tried using your manual workaround three times now but still can't enter negative values manually. I keep getting the following pop up message: "The value entered must be equal to or greater than 0.00" .

Even tried using parentheses to start the negative number (wouldn't take). I am using window's desktop version of TTX home/business. Not sure why this doesn't work for me. Is it because it is a desktop version. Any thoughts ?

Thanks, Kim

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B doesn't support negative value in box 1d

You cannot enter a negative number in either the cost basis or proceeds fields.

The IRS (and TurboTax) will not accept negative numbers in either the cost basis or proceeds fields. You will have to manually edit any imported negative entries in order to proceed with e return and e-file.

Starting with the 2020 tax returns, the IRS will reject any return filed with a negative number reported in the proceeds or cost basis fields for Schedule D. TurboTax is flagging these situations ahead of time before the return is filed in order to prevent the IRS rejection. Some brokers are still using the old convention for reporting negative values and have not updated their reports to match the IRS.

The error message reported by TurboTax is telling you that the number entered cannot be negative.

Gains from expired options are reported by entering the gain amount in the proceeds column and no amount in the cost basis column. This will result in a gain.

Losses from expired options are reported by entering the loss amount as a positive number in the cost basis column and no amount in the proceeds column. The end result here would be a loss.

No negative numbers should be entered in either the cost basis or proceeds fields.

If negative numbers have been imported through your brokerage statement, you will need to edit the entries to make the correction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B doesn't support negative value in box 1d

Thanks ToddL99,

After two hours of trying to get help on the phone, and the absurd online chat asst, I finally ran into this help blog. Your solution works - e.g. no negative numbers in basis or proceeds, and simply list the loss amount as basis, and proceeds as zero, will get you the loss in the correct column on Sched D. And yes, the brokers aren't doing us any favors here, either is TT, but at least there is a workaround.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B doesn't support negative value in box 1d

Finally, an explanation and solution that makes sense! Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B doesn't support negative value in box 1d

Hi, ToddL99:

Other forums are showing that this is a Turbo Tax error. Can you share where you saw “ Starting from 2020, IRS will reject (no longer allow) negative proceeds..... My situation is I first sold naked puts and bought it back later for a loss (paid more than what I initial sold it for). TD Ameritrade is showing a zero cost basis and a negative proceeds. No problem for previous years. Thanks much if you could elaborate

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B doesn't support negative value in box 1d

Here is what worked for me. First I imported the data from my TD Ameritrade 1099B. Wherever there was a negative value for the proceeds in the box 1d, I entered that same value as a positive number in the cost basis box 1e and in the proceeds box 1d I entered 0. A blank in 1d might also work. This way the gain is still negative or correct as it was before or should be. The overall total for gain/loss is the same as before, but now when doing the smart check, everything works out error free.

Yes this is manual, but it only means changing two boxes per transaction. I had to change 26 entries, about 15 min work. I have not seen any other instructions on this board work. I hope this helps.

Yes, TD Ameritrade should change their form to avoid negative proceeds and TurboTax should be smart enough to recognize this error and deal with it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

NADamewood

Level 1

Ed-tax2024

New Member

smithap195

New Member

daedrabeing

New Member

JanDv

Returning Member