- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- $0 captial gain transaction not showing up on form 8949

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

$0 captial gain transaction not showing up on form 8949

I received a K-1 where $0 gain/loss (short term) was realized from K-1 Y (basis = sale price). I also have short term transactions from an unrelated 1099-B. In my 8949 I only see the transactions from 8949. I do not see the $0 gain transaction from K-1.

I tried to mess around with K-1 by giving it a none-zero gain/loss and it now shows up on 8949. I know $0 gain/loss is not very common in stocks and such (but it's possible say when RSU vest and you immediately sell to cover tax, and hypothetically there's no transaction/brokerage fee involve in which case your basis = sale), but is it correct that they would not be entered into 8949? So is this a bug? I do not think a transaction result in $0 gain/loss should be omitted?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

$0 captial gain transaction not showing up on form 8949

It might depend on how you entered the sale. I'm not sure if you mean there was a zero capital gain reported on the schedule K-1 in box 8 or 9(a), or if you mean you sold your partnership interest.

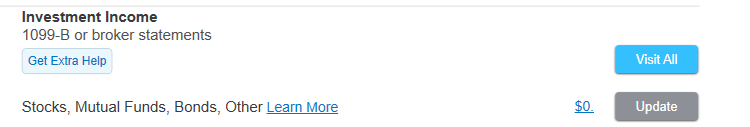

To have the sale and cost basis appear on form 8949, you would have to enter the sale in the Investment Income section of TurboTax typically. If you entered it in the K-1 entry screens, the gain or loss would normally just show up on schedule D, or not on any schedule if the net was zero.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

$0 captial gain transaction not showing up on form 8949

It might depend on how you entered the sale. I'm not sure if you mean there was a zero capital gain reported on the schedule K-1 in box 8 or 9(a), or if you mean you sold your partnership interest.

To have the sale and cost basis appear on form 8949, you would have to enter the sale in the Investment Income section of TurboTax typically. If you entered it in the K-1 entry screens, the gain or loss would normally just show up on schedule D, or not on any schedule if the net was zero.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

catdelta

Level 2

lsrippetoe

New Member

Ch747

Level 1

Davidleecox85

New Member

Joh2016

New Member