- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

It might depend on how you entered the sale. I'm not sure if you mean there was a zero capital gain reported on the schedule K-1 in box 8 or 9(a), or if you mean you sold your partnership interest.

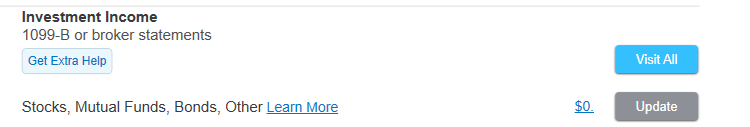

To have the sale and cost basis appear on form 8949, you would have to enter the sale in the Investment Income section of TurboTax typically. If you entered it in the K-1 entry screens, the gain or loss would normally just show up on schedule D, or not on any schedule if the net was zero.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 14, 2020

1:27 PM

1,574 Views