in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: Working Fringe Benefit for Excess Tuition Assistance

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Working Fringe Benefit for Excess Tuition Assistance

My employer is a university who offers employees tuition coverage for attending courses and enrolling in degree seeking programs. I was reading the Education section on Working Fringe Benefits and saw that it indicated that employees who were pursuing education that would increase their abilities in their current role did not need to report the excess tuition payments for themselves that were over the $5250 limit. I wasn't aware of this special rule for employee who are pursuing education relevant to their current job roles. Because of that, my employer has spread the excess tuition payments across a few months of my paychecks and counted it as additional taxable income which has the effect of taking more money out of my paycheck and then withholding too much tax for the government. I have asked my employer to issue me a corrected W-2 and I'm not sure if they will do it; the law says the employer has the "option" to not report excess tuition payments as income on the employee's W-2 but doesn't require them to honor this, which seems odd. So, I'm not sure if I'll received a corrected W-2 or excess tax withholding refund from my employer. However, I read that I can basically change my W-2 to correct it to not count the excess over $5250 as income. When I do this, TurboTax says my employer has withheld too much tax from my paychecks and to contact them for a refund and a corrected W-2.

My questions to the community is:

- Assuming my employer doesn't follow through with refunding my excess tax withholdings in light of the working fringe benefit I am eligible for, how can I accurately remove the excess income when I enter my W-2 into TurboTax and make a note of the adjustment for the IRS?

- And then, how can I file the form that will request a refund from the IRS for excess withholding my employer already did?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Working Fringe Benefit for Excess Tuition Assistance

Q. how can I accurately remove the excess income when I enter my W-2 into TurboTax and make a note of the adjustment for the IRS?

A. You can't. You must enter your W-2 exactly as shown.

Q. How can I file the form that will request a refund from the IRS for excess withholding my employer already did?

A. You can't. Any non-taxable feature of your employer's plan MUST be handled thru the W-2.

You may have been reading an older version of the employee manual or your employer hasn't updated it since the 2018 tax law change. But, even under the old law, that* is not a totally true statement. Employees were allowed a deduction for job related education. There may have been a provision to allow employers to exclude the excess from the W-2. But if it was on your W-2, you had to report it.

* " employees who were pursuing education that would increase their abilities in their current role did not need to report the excess tuition payments for themselves that were over the $5250 limit. "

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Working Fringe Benefit for Excess Tuition Assistance

Hi @Hal_Al, I appreciate your response but.... I don't think you've got the latest information. :(

===

Here's a link to the current IRS publication that discusses it: https://www.irs.gov/publications/p15b

Titled: Publication 15-B (2020)

Here's the relevant excerpt I think you must not be familiar with:

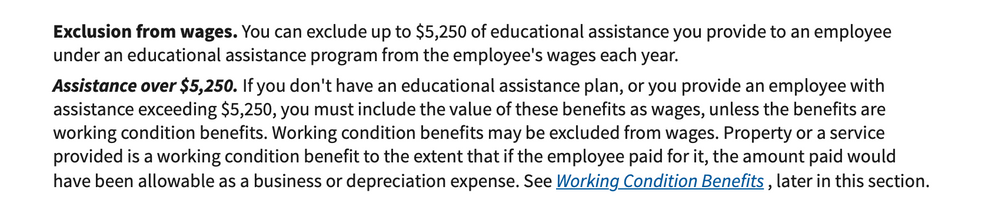

Assistance over $5,250.

If you don't have an educational assistance plan, or you provide an employee with assistance exceeding $5,250, you must include the value of these benefits as wages, unless the benefits are working condition benefits. Working condition benefits may be excluded from wages. Property or a service provided is a working condition benefit to the extent that if the employee paid for it, the amount paid would have been allowable as a business or depreciation expense. See Working Condition Benefits , later in this section.

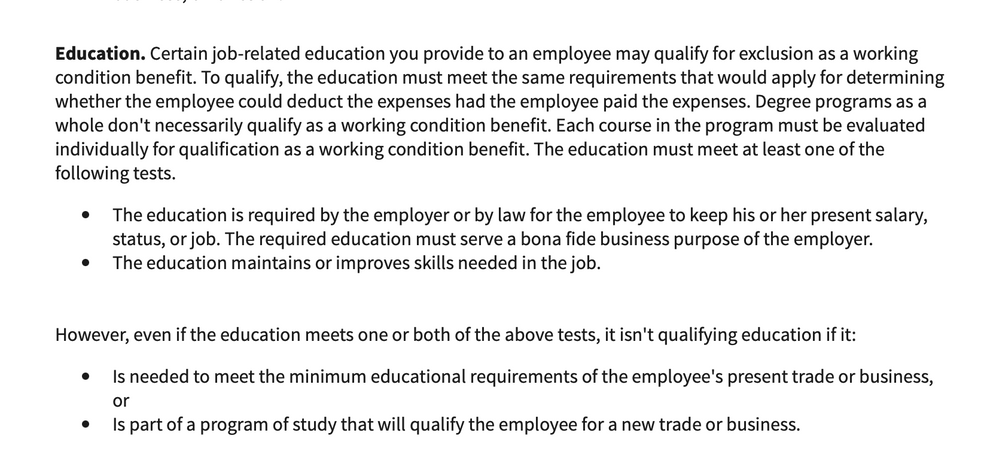

Education.

Certain job-related education you provide to an employee may qualify for exclusion as a working condition benefit. To qualify, the education must meet the same requirements that would apply for determining whether the employee could deduct the expenses had the employee paid the expenses. Degree programs as a whole don't necessarily qualify as a working condition benefit. Each course in the program must be evaluated individually for qualification as a working condition benefit. The education must meet at least one of the following tests.

The education is required by the employer or by law for the employee to keep his or her present salary, status, or job. The required education must serve a bona fide business purpose of the employer.

The education maintains or improves skills needed in the job.

However, even if the education meets one or both of the above tests, it isn't qualifying education if it:

Is needed to meet the minimum educational requirements of the employee's present trade or business, or

Is part of a program of study that will qualify the employee for a new trade or business.

===

In my case, I do meet the requirements based on my employer and degree program's individual courses.

Having read this new information, any other thoughts to share?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Working Fringe Benefit for Excess Tuition Assistance

Note that the operative word in Pub 15-B is exclude, not deduct.

That is a provision to allow employers (not employees) to exclude the excess reimbursement from the W-2, if their plan meets the rules . But if they report it on your W-2, it's taxable income to you. There is no way for you to deduct (or exclude) it on the tax forms. You should not change your W-2. The IRS computers will catch any change and send you a dunning letter.

I believe the reason the word "option" is used, in the rules, is that employer has the duty to determine if the reimbursement meets the rules before excluding it.

You need to ask your employer for a corrected W-2, showing less money in box 1 but the same withholding in box 2. That will get the excess withholding refunded to you when you file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Working Fringe Benefit for Excess Tuition Assistance

Hi, I appreciate hearing your interpretation and... I somewhat agree but... I have also been told differently about excess tax withholdings being refunded and options employees have for reporting mistakes they're subjected to and how to get them corrected when the employer fails to act in good faith.

(Also, I don't recall ever mentioning taking a deduction but if I did, apologies for that, I mean that it would be excluded from W-2 income reporting and tax withholding by the employer.)

Incompetence or negligence by the employer

From my understanding, if the employer fails to follow the tax code instructions for qualifying individuals then you can report it to the IRS and file an amended W-2 and write a justification note where you've made a change. This is what I've been told by friend who is a CPA but of course I'd like to hear different opinions.

Claiming refund for tax withholding overpayment by employer who fails to give you a refund

There is also a process for claiming overpayment of taxes like the excess withholdings from your employer reporting excess tuition when in fact you meet the qualifications in Publication 15-B (Working Fringe Benefit for Excess Tuition) (see also screenshots attached, 1st for the Fringe Benefit of Tuition Payments under or at $5250 excluded from income reporting and then 2nd the requirements to have excess of $5250 excluded for qualified employees.)

This can be done using Form 843 .

How to get refund of excess tax withholdings for qualified working fringe benefit employees for excess tuition reported as income over $5250

But so, going back to your earlier statement,

@Hal_Al wrote:

You need to ask your employer for a corrected W-2, showing less money in box 1 but the same withholding in box 2. That will get the excess withholding refunded to you when you file.

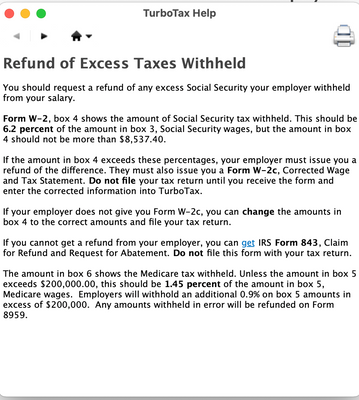

about being able to receive a refund from the tax return filing for excess taxes paid from employer withholdings. So, according to TurboTax (see screenshot attached) the employer should be contacted to receive a refund.

However, if they fail to provide it then, Form 843 can be used. From what I am reading, when I make the adjustment to my W-2 (for what my employer will be doing for me with a corrected W-2 if they follow the law), there is no additional refund that TurboTax will calculate for you based on your employer withholding too much tax because they failed to not report excess tuition payments over the $5250 for qualified working fringe benefit individuals.

Discussion / Reflection

Honestly, I wish there was a little more process in place to check some of these things. Too much is left up to the employer to decide, alone, and make mistakes when the employee could be required to review and validate these things. In my case, my employer is a big organization and the HR group which houses the payroll tax division have no idea whether or not I'm enrolled in courses or a whole degree program that meets the requirements. Additionally, because there is no process to require them to review individuals to see if they qualify, it's up to the employee, like in my case, to become aware of the Working Fringe Benefit and report it so they either fix it or I report it to the IRS for failure to comply. :(

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Working Fringe Benefit for Excess Tuition Assistance

I'm only vaguely familiar with form 843 and do not believe it applies to your situation (rebate of income tax withheld).

TurboTax does not support IRS Form 843

IRS Form 843, Claim for Refund and Request for Abatement - https://www.irs.gov/pub/irs-pdf/f843.pdf

IRS Form 843 instructions - https://www.irs.gov/pub/irs-pdf/i843.pdf

I don't think you have a do-it-yourself situation and if you want to pursue it, should consult a professional tax person.

the IRS has instructions on what to do if you receive an incorrect W-2 and the employer is uncooperative: https://www.irs.gov/faqs/irs-procedures/w-2-additional-incorrect-lost-non-receipt-omitted/w-2-additi...

I'm afraid that's the limit of my ability to help. You appear to be convinced you're right. I pretty sure it doesn't work that way. But, I'm not CPA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Working Fringe Benefit for Excess Tuition Assistance

it depends. According to irs.gov, form 843 is used to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. This is not be be used to claim excess tax withholdings.

Instead, the correct procedure is to do as Hal suggested above and first request that your employer issue a corrected W2 correcting the mistake that you think may have occurred. the Irs will then send a demand letter to your employer to furnish you a corrected W2. If this isn't done by the end of February, then the IRS will send you instructions on filling out form 4852. Complete instructions are found here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Working Fringe Benefit for Excess Tuition Assistance

So I have an update. I got in contact with my employer's tax group and showed them the working fringe benefit section of 15-B and they agreed to let me do it. Now, I'm filling out a spreadsheet of each and every course I've taken at the university my degree program is at. They are requesting a course description and a note describing how the course relates to my job role in improving it. They said they will reissues W-2c(s) and a refund will happen with them. However, they did not say they were going to do any refunding, yet. Any thoughts on who should be giving me excess withholdings refunds? TurboTax says my employer should refund these monies to me directly although not sure why this would be true or not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Working Fringe Benefit for Excess Tuition Assistance

Thanks for letting us know.

You get a great big "attaboy" for getting that done with your employer.

Wait for the corrected W-2. File the corrected W-2 and you will get your income tax refund that way (but not FICA)

I wouldn't push your employer on trying to get it earlier. They've done more than most would. Where TurboTax says my employer should refund these monies to me directly is referring only to FICA (social security & Medicare about 7.65%)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Working Fringe Benefit for Excess Tuition Assistance

Well thanks! 😀 In the case my employer decided to be snotty and not help me out, I would have filed an amended W2 and stated the justification to go along with it. It’s really odd that it’s something an employer “could” do if you qualify but on a whim they can decide to tell you to go kick rocks. I wonder how I could file a complaint with the process that is currently in place. Unlike many people I suspect, I don’t see tax law as an inerrant unchanging and always correct code. Sometimes people writing that stuff get it wrong or really mess with the power dynamics. I kinda wish there was a version history (like with document repos) to see how it got written and how it has changed and who did the writing. 🙂

Thanks everyone for your time and insights on this, I really appreciate it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Working Fringe Benefit for Excess Tuition Assistance

In a similar situation but can I deduct the amount over the $5,250 that I incurred taxes on via the Lifetime Learning Credit instead of going the route of an amended W2 through my employer?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Working Fringe Benefit for Excess Tuition Assistance

YES,

In fact there would be no reason to ask for a corrected W2 if your employer taxed you on the amount over 5,250. 5,250 is the limit to what they can pay tax-free towards your education expenses in a tax year. Any amount over that is taxable income for the employee.

If you had additional expenses (over the 5,250,) certainly claim those expenses for a credit if you meet the other requirements.

Please be sure to only report the expenses not paid by the 5,250 tax-free employer assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Working Fringe Benefit for Excess Tuition Assistance

No, @KrisD15 you’re wrong. You didn’t read any of the prior discussion it does seen like. Given certain situations the excess tuition does not have to be reported as income. I encourage everyone and @buhockey21 to READ 😂 the discussion we had above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Working Fringe Benefit for Excess Tuition Assistance

Hello @zalera

Threads often turn into different questions. You asked a question, but I am answering the question from buhockey21 who piggy-backed on the thread you started. Often these threads can go for weeks and morph in to several different topics.

The question buhockey21 has is different than what you were asking which is why I used @buhockey21 in my answer.

Your issue seems to have been resolved. My answer for buhockey21 is correct.

We try to make sure everyone is served and get the answers they need. Thank you for using TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Working Fringe Benefit for Excess Tuition Assistance

No, @KrisD15 I think you’re wrong on this one. @buhockey21 said they were in a similar situation to me which I take to mean: their employer is providing them with tuition coverage and the education they’re receiving meets the criteria to not report excess income.

No, agree, they can’t use the lifetime learning credit but, what you said about them reporting the excess as income is also wrong.

They probably qualify for their employer to not report it under the Working Fringe Benefit exception that this post is about.

@buhockey21 if you meet the criteria we were discussing earlier then your employer can issue you a corrected W2 if they go through verifying each of your courses in your education program. This is what is happening for me because my employer agreed to do it when I notified them and let them know what I would do if they didn’t make the correction following the tax law.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17574348216

New Member

AS70

Level 1

anonymouse1

Level 5

in Education

tandonusatax

Returning Member

MamaC1

Level 3