- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

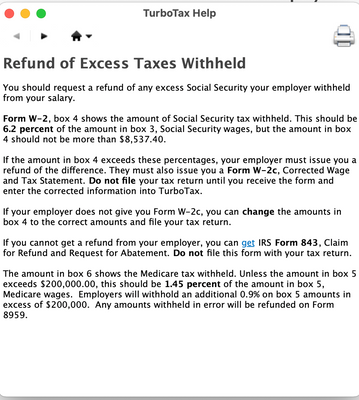

Hi, I appreciate hearing your interpretation and... I somewhat agree but... I have also been told differently about excess tax withholdings being refunded and options employees have for reporting mistakes they're subjected to and how to get them corrected when the employer fails to act in good faith.

(Also, I don't recall ever mentioning taking a deduction but if I did, apologies for that, I mean that it would be excluded from W-2 income reporting and tax withholding by the employer.)

Incompetence or negligence by the employer

From my understanding, if the employer fails to follow the tax code instructions for qualifying individuals then you can report it to the IRS and file an amended W-2 and write a justification note where you've made a change. This is what I've been told by friend who is a CPA but of course I'd like to hear different opinions.

Claiming refund for tax withholding overpayment by employer who fails to give you a refund

There is also a process for claiming overpayment of taxes like the excess withholdings from your employer reporting excess tuition when in fact you meet the qualifications in Publication 15-B (Working Fringe Benefit for Excess Tuition) (see also screenshots attached, 1st for the Fringe Benefit of Tuition Payments under or at $5250 excluded from income reporting and then 2nd the requirements to have excess of $5250 excluded for qualified employees.)

This can be done using Form 843 .

How to get refund of excess tax withholdings for qualified working fringe benefit employees for excess tuition reported as income over $5250

But so, going back to your earlier statement,

@Hal_Al wrote:

You need to ask your employer for a corrected W-2, showing less money in box 1 but the same withholding in box 2. That will get the excess withholding refunded to you when you file.

about being able to receive a refund from the tax return filing for excess taxes paid from employer withholdings. So, according to TurboTax (see screenshot attached) the employer should be contacted to receive a refund.

However, if they fail to provide it then, Form 843 can be used. From what I am reading, when I make the adjustment to my W-2 (for what my employer will be doing for me with a corrected W-2 if they follow the law), there is no additional refund that TurboTax will calculate for you based on your employer withholding too much tax because they failed to not report excess tuition payments over the $5250 for qualified working fringe benefit individuals.

Discussion / Reflection

Honestly, I wish there was a little more process in place to check some of these things. Too much is left up to the employer to decide, alone, and make mistakes when the employee could be required to review and validate these things. In my case, my employer is a big organization and the HR group which houses the payroll tax division have no idea whether or not I'm enrolled in courses or a whole degree program that meets the requirements. Additionally, because there is no process to require them to review individuals to see if they qualify, it's up to the employee, like in my case, to become aware of the Working Fringe Benefit and report it so they either fix it or I report it to the IRS for failure to comply. :(