- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: When taxpayer is both contributor and beneficiary of NYS 529

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When taxpayer is both contributor and beneficiary of NYS 529

Contributions to NYS 529s are income tax deductible. Why isn't turbo tax making a deduction for my 2023 NYS529 when I am both the contributor and beneficiary of funds within the same tax year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When taxpayer is both contributor and beneficiary of NYS 529

Can you clarify if you mean that there is both a contribution and a distribution in the same year? Or do you just mean the contribution is for an account on which you are also the beneficiary?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When taxpayer is both contributor and beneficiary of NYS 529

Both. The contributor was the beneficiary in the same tax year. This appears to be income tax deductible and not counted as income in NYS, but I don't see the calculation being tabulated in Turbo. Is it only income tax deductible if one is itemizing or is there a software issue or is the information I'm receiving from the state incorrect? Thank you in advance for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When taxpayer is both contributor and beneficiary of NYS 529

The program has you enter contributions and then nonqualified withdrawals. If all withdrawals were qualified, the amount should be zero for nonqualified withdrawals.

Here is the 2024 update to NY 529 plan

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When taxpayer is both contributor and beneficiary of NYS 529

Respectfully, this doesn't answer the question. I'm asking for clarification on why the software does not make the NYS income deduction once it is entered indicating that there were no unqualified withdrawls. After entering both the contribution and beneficiary allocation, the amount should be reflected as an income tax deduction on the NYS portion, however this is not happening once the figures are entered. Can you please clarify? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When taxpayer is both contributor and beneficiary of NYS 529

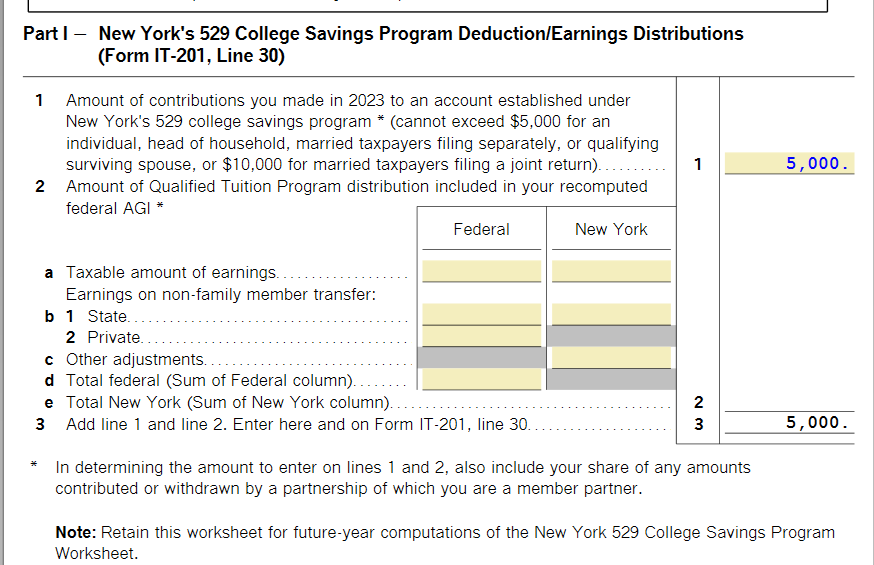

I think you are saying that your line 30 is not showing the NY subtraction for the 529 contribution. You must be the owner of the account. If you qualify and have things properly marked, you should be getting the credit.

Reference: subtractions instructions

Maybe you have a bit of data stuck. Please go through the directions below. Let us know if you still don't have your credit.

Follow these steps:

Follow these steps:

Desktop version:

- Delete the form

- Save your return while closing the program.

- Update the program

- Open

- Enter the information again.

Online version:

A full or corrupted cache can cause problems in TurboTax, so sometimes you need to clear your cache (that is, remove these temporary files).

For stuck information follow these steps:

- Delete the form/ worksheet- if possible, see How to Delete

- Log out of your return and try one or more of the following:

- Log back into your return.

- Enter the information again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

flyday2022

Level 2

tbduvall

Level 4

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

NH16

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

trust812

Level 4

pchicke

Returning Member