- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: Room & Board Expenses -- where to enter

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Room & Board Expenses -- where to enter

it is confusing

- 1099Q goes on the return of the social security number that is on the form. If the administrator sent the parent the money, then the parent's social will be on the form. If the administrator sent the money directly to the school (or the student), the student's social will be on the form

- the 1098T goes on the parents return, assuming the parent CAN claim the student (whether they do or not is not the question) AND Box 1 and any related expenses EXCEED Box 5. Otherwise it goes on the student's return.

please post the following and we can explain the math

1) Box 1 and Box 5 of form 1098T

2) Box 1 and Box 2 of Form 1099Q

3) any qualified expenses (Room and Board, books, computer expenses, etc.) that are NOT part of Box 1 of Form 1098T

4) whose social security number is on the 1099Q

5) are you eligible for AOTC? (AGI below $160,000)

6) confirm your student is a dependent on your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Room & Board Expenses -- where to enter

>>>any qualified expenses (Room and Board, books, computer expenses, etc.) that are NOT part of Box 1 of Form 1098T

What I found out that the amt sent from my 529 plan for room and board to school is not matching the Box1 of Form 1098T.

It is off by 14163.67. That's why when I file a return for my daughter it ask me to pay tax on the difference. The student is a dependent on my tax return.

>>>the 1098T goes on the parents return, assuming the parent CAN claim the student (whether they do or not is not the question) AND Box 1 and any related expenses EXCEED Box 5

During filing return for the student, it asks if you have received 1098T and enter it. It compares 1098T (Box1-Box5) with 1099Q (Box1) (if qualified distribution) and calculates whether you have to pay the tax or not. that's what is happening. Is there a way to delete 1098T from student's filing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Room & Board Expenses -- where to enter

Room and Board is not going to be on form 1098T - it's not "tuition or related fees"

are you using the online version or desktop?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Room & Board Expenses -- where to enter

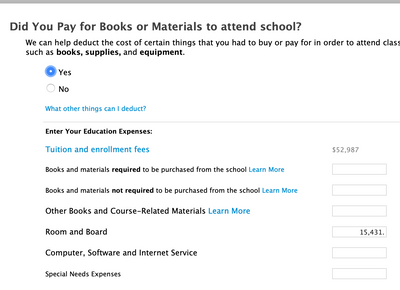

Desktop premier version. In 2018 1098T form, it was included but looks like school excluded that amount from 2019 1098T. Is it changed from this year. I compared my last year turbo tax (desktop premier) and it is included ( just because it was part of 1098T). What's the option now? Housing Payment in 2019 (Paid from 529 plan) 15430.67 (Box1 1099Q) shows in school payment website. Please suggest.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Room & Board Expenses -- where to enter

Is it the right place to enter Room and Board?If you don't enter 1098-T in student's tax filing then it is considering the 1099Q earning as taxable. How to handle that in student's tax filing? alternatively, don't report it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Room & Board Expenses -- where to enter

From 1099Q:

Instructions for Recipient

Distributions from Coverdell education savings accounts (CESAs) under section 530 and qualified tuition programs (QTPs) under section 529, including rollovers, may be taxable. Nontaxable distributions from CESAs and QTPs are not required to be reported on your income tax return.

You are right. if it is qualified distribution then there is no point to report it. Just wanted to know your thought. The confusion started when you report these two forms (1098T and 1099Q) separately and school is not including room and board in 1098T anymore.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Room & Board Expenses -- where to enter

@SK250 - which is why I asked you these questions a few days back..... depending on the math, I was going to respond that submitting the 1099Q was not necessary:

1) Box 1 and Box 5 of form 1098T

2) Box 1 and Box 2 of Form 1099Q

3) any qualified expenses (Room and Board, books, computer expenses, etc.) that are NOT part of Box 1 of Form 1098T

4) whose social security number is on the 1099Q

5) are you eligible for AOTC? (AGI below $160,000)

6) confirm your student is a dependent on your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Room & Board Expenses -- where to enter

comments inline

Box 1 and Box 5 of form 1098T

52987.00 and 51720.00

2) Box 1 and Box 2 of Form 1099Q

15,430 and 4,326

3) any qualified expenses (Room and Board, books, computer expenses, etc.) that are NOT part of Box 1 of Form 1098T

Out of 15,430 (from 1099Q) - 1267 fees (52987.00 - 51720.00) = 14163 (room and board)

4) whose social security number is on the 1099Q

Student

5) are you eligible for AOTC? (AGI below $160,000)

No

6) confirm your student is a dependent on your tax return.

Yes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Room & Board Expenses -- where to enter

to summarize

- The expenses (net of the scholarship) are $1267. Room and Board is $14163. So in total the expenses are $15430.

- Box 1 of the 1099Q is 15430

Nontaxable distributions from CESAs and QTPs are not required to be reported on your income tax return. You must determine the taxability of any distribution.

and you have determined that the distribution is not taxable since the expenses meet or exceed the distribtion.

So no need to input into TT as it's not required to be reported on your tax return. Suggest just documenting for your files and put away in a drawer in case the IRS ever comes knocking.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Room & Board Expenses -- where to enter

The only thing that ever works for me is to go over to the ESA/QTP Wks in Forms. You can get there by pressing the "Open Form" button and start typing E,S,A,...

Part III is a section titled Taxable Earning from Qualified Tuition Program (Section 529 Plan)

Line 2h is editable. It may default to 0, and you can put in your true expenses, or if you have enough expenses you can match the Part III line 1 number which will magically make the Part III line 8 number 0 which amounts to no taxes on the distributions from your QTP. Note: I do this in each of the two columns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Room & Board Expenses -- where to enter

To get the screen to enter Room & Board (R&B), first enter the 1099-Q before you enter the 1098-T and expenses (TT must be told you have a 529 distribution or it won't let you enter R&B). In the 1098-T/educational expenses section, answer yes when asked if you have book expenses (R&B will be on the same screen as books).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Room & Board Expenses -- where to enter

that doesn't work in 2023 deluxe for me

i get to Education expenses and it mentions books and materials but not room and board.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Room & Board Expenses -- where to enter

You wouldn't enter this as an education expense. Instead it will be reported at the end of the section where you reported the QTP distribution. To enter, go to:

- Federal>wages and income

- Less Common income

- Miscellaneous Income, 1099-A, 1099-C>Coverdell ESA and 529 qualified tuition programs (Form 1099-Q)

- Answer the questions about the distribution and at the end of section, you will be able to add all the expenses including room and board.

[Edited 01/2/24|6:15 pm PST

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Room & Board Expenses -- where to enter

@taxcurious2 You must enter the 1099-Q before entering the 1098-T. If you didn't do that, you have to delete the 1098-T and start over (after entering the 1099-Q).

Go through the entire education interview until you reach a screen titled "Your Education Expenses Summary". Click delete next to the student's name .

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MukeshJain

New Member

skywaympls79

New Member

seple

New Member

ekudamlev

New Member

ke-neuner

New Member