- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: If I received a 1099-NEC for a Ph.D. stipend/scholarship for doing research, should I File Form 8919 or use the "offset" method to avoid SE taxes??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I received a 1099-NEC for a Ph.D. stipend/scholarship for doing research, should I File Form 8919 or use the "offset" method to avoid SE taxes??

I received a 1099-NEC for a Ph.D. stipend/scholarship for doing research for my main advisor. He had left my school, went to another, and so he paid me from the other school for my stipend. The condition was that I would be doing research for him.

On the 2020 instructions for the 1099-NEC posted by the IRS here: https://www.irs.gov/pub/irs-pdf/i1099msc.pdf, they state:

"Do not use Form 1099-MISC to report scholarship or fellowship grants. Scholarship or fellowship grants that are taxable to the recipient because they are paid for teaching, research, or other services as a condition for receiving the grant are considered wages and must be reported on Form W-2. "

Because I was paid for research, should I go with the

1) The "offset" method described here: https://ttlc.intuit.com/community/tax-credits-deductions/discussion/re-1099-nec-graduate-student/01/...

or

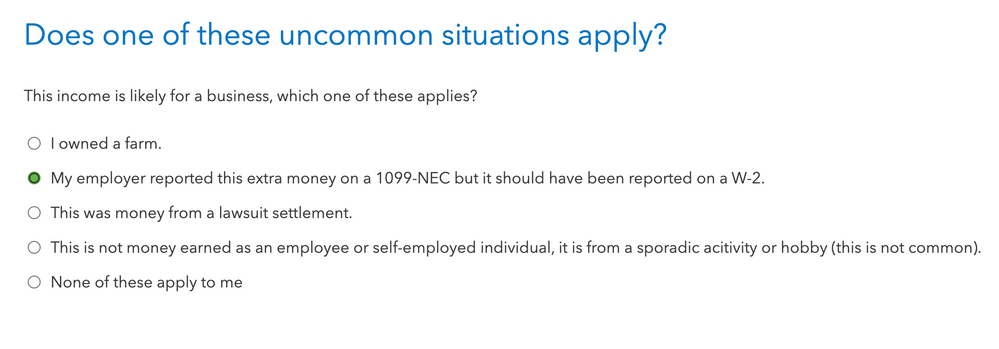

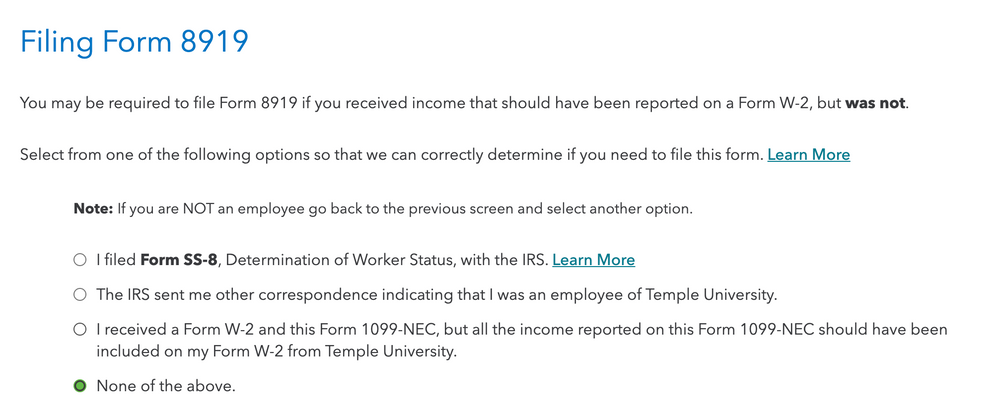

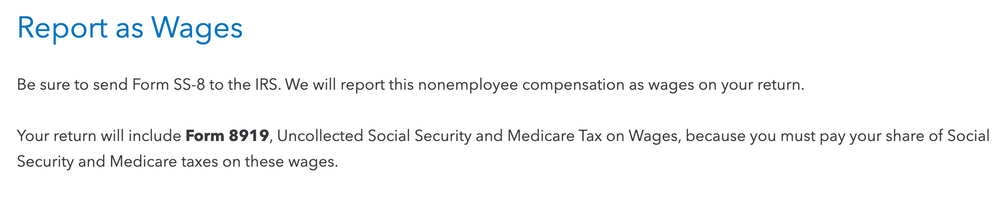

2) Selecting "My employer reported this extra money on a 1099-NEC but it should have been reported on a W-2." and then going to the "Filing Form 8919" page. If so, should I have filed a Form SS-8 prior to today? I have attached screenshots below.

Would option 2 be the same as the 1st option, but more automated? I ask this because it says "We will report this nonemployee compensation as wages on your return".

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I received a 1099-NEC for a Ph.D. stipend/scholarship for doing research, should I File Form 8919 or use the "offset" method to avoid SE taxes??

None of these is correct. (By the way, did you involve the finance people from your current university, did they know about the arrangement?)

Most of the time, a PhD candidate is treated as a student. You are a trainee, and you are technically not performing "work" for "compensation", even though you perform duties similar to other people who are employees, and you are exempt from medicare and social security tax. This is an exception to the usual rules. (And there are exceptions to the exceptions. Suppose you are paid $1000 extra to TA a course. If that is required as part of your degree requirement, you are student and exempt from social security and medicare. If you take a TA job for extra income that is not part of your degree requirement, then it is a job and subject to W-2 wage withholding, even though the bulk of your stipend is still exempt.)

You already found the correct answer. Report it in the Education (1098-T) interview.

Instead of entering as income, at the 1099-NEC screen, In TurboTax (TT), enter at:

Federal Taxes Tab (Personal for H&B version)

Deductions & Credits

-Scroll down to:

--Education

--Education Expenses

After entering your 1098-T (if you don't have a 1098-T, answer that you qualify for an exception). That will eventually get you to a screen to enter scholarships not shown on a 1098-T. When asked how much of the scholarship was used for room and board, enter the entire amount of the 1099-Misc. That will make it taxable. It will go on line 1 of form 1040 with the notation SCH.

See also longer discussion here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I received a 1099-NEC for a Ph.D. stipend/scholarship for doing research, should I File Form 8919 or use the "offset" method to avoid SE taxes??

I think the fact that you did not do this work for YOUR school ("He had left my school, went to another, and so he paid me from the other school for my stipend") means all the previous discussions do not apply in your case.

The most likely answer is: your 1099-NEC should be reported as self employment income, including paying self employment tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I received a 1099-NEC for a Ph.D. stipend/scholarship for doing research, should I File Form 8919 or use the "offset" method to avoid SE taxes??

Thanks, would it change things if my professor was still employed at my university as a research associate? He did this to be still affiliated with the university so that he could have a say with my graduation. So even though he had the professor title at another university, he still had a research associate post at my university.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I received a 1099-NEC for a Ph.D. stipend/scholarship for doing research, should I File Form 8919 or use the "offset" method to avoid SE taxes??

@digitaltaxation wrote:

Thanks, would it change things if my professor was still employed at my university as a research associate? He did this to be still affiliated with the university so that he could have a say with my graduation. So even though he had the professor title at another university, he still had a research associate post at my university.

I disagree with @Hal_Al . I am very familiar with your type of situation. You were still a degree candidate at school A. Your primary mentor relocated to school B, but you stayed at school A to finish your degree. School A appointed a new primary mentor to be compliant with the graduate program regulations, but your professor still had oversight of your project. And, since you continued on the same research project (most likely funded by a grant to your mentor that they took with them to school B), school A and B worked out a way for your mentor's grant to pay your stipend (since otherwise, your new mentor would have to cover your stipend even though you weren't working on their grant-funded project.).

You are still a student within the meaning of the IRS regulations and you do not have to report wages. This is a taxable student stipend as previously discussed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I received a 1099-NEC for a Ph.D. stipend/scholarship for doing research, should I File Form 8919 or use the "offset" method to avoid SE taxes??

When Turbotax wants the school name for the 1098-T portion, would I put the new university my professor is at (the school that issued me the 1099-NEC), or would I put my own university? Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I received a 1099-NEC for a Ph.D. stipend/scholarship for doing research, should I File Form 8919 or use the "offset" method to avoid SE taxes??

Either one, it doesn’t matter because you aren’t claiming tax credits and the name of the school doesn’t get transmitted to the IRS. It’s required by TurboTax to get to the place where you enter the fellowship. Probably the school you are actually enrolled at will be the slightly better choice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I received a 1099-NEC for a Ph.D. stipend/scholarship for doing research, should I File Form 8919 or use the "offset" method to avoid SE taxes??

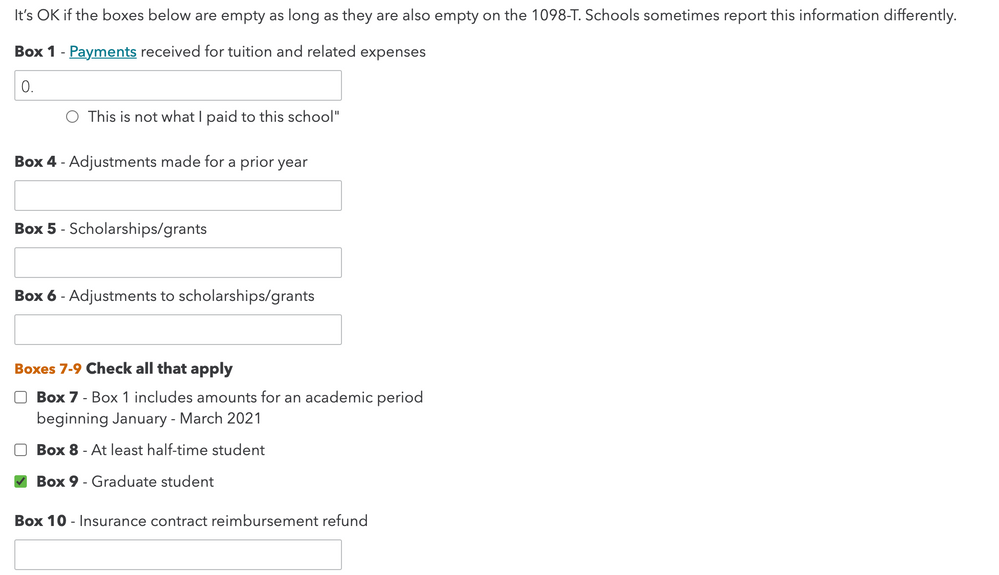

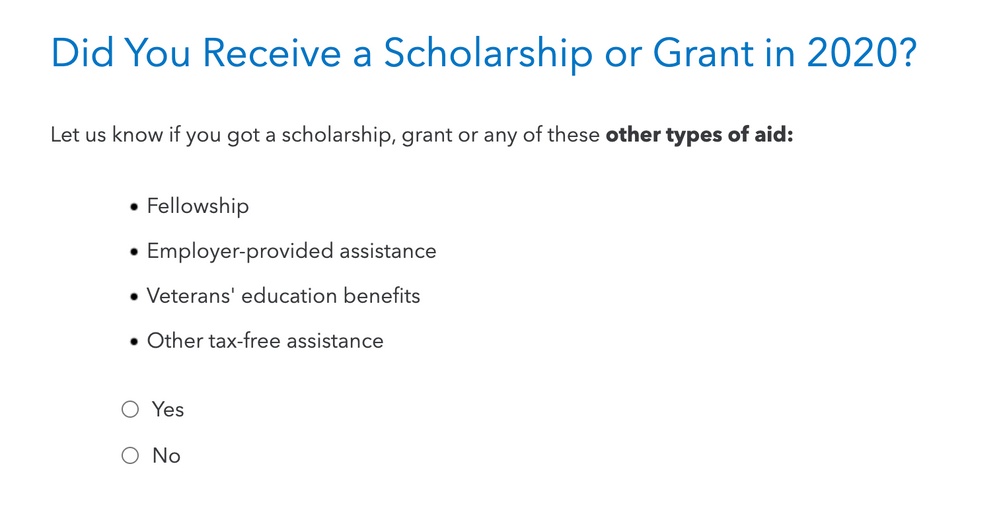

Thanks, I did not receive a 1098-T, so I indicated I qualify for an exception. It lead me to the following portion below. Would I enter the 1099-NEC amount in Box 5? Or would it be in the "Did you receive a Scholarship or Grant in 2020?" interview portion (also below)? Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I received a 1099-NEC for a Ph.D. stipend/scholarship for doing research, should I File Form 8919 or use the "offset" method to avoid SE taxes??

Leave the 1098-T blank since you did not actually get one. Check the box for fellowship.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I received a 1099-NEC for a Ph.D. stipend/scholarship for doing research, should I File Form 8919 or use the "offset" method to avoid SE taxes??

Thanks, to double check, do I put my school's name on the 1098-T, but leave the rest blank? Or do I also add in the "Enter the Tuition You Paid" portion of the 1098-T where I report the amount paid to my university in 2020? Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I received a 1099-NEC for a Ph.D. stipend/scholarship for doing research, should I File Form 8919 or use the "offset" method to avoid SE taxes??

@digitaltaxation wrote:

Thanks, to double check, do I put my school's name on the 1098-T, but leave the rest blank? Or do I also add in the "Enter the Tuition You Paid" portion of the 1098-T where I report the amount paid to my university in 2020? Thank you

Did you pay tuition out of pocket?

You really need to forget about the 1098-T. The only reason you have to enter one is to get Turbotax to treat your fellowship correctly as line 1 income with "SCH" next to it. You could also do this manually using Turbotax installed on your own computer by making direct entries on the forms.

The school must issue a 1098-T if you paid tuition out of pocket. More likely, your tuition was covered by your department or your PI's grant funds. It's a bit of a financial shuffle: the school "charges" tuition but they "pay" your tuition from another account. But if you did not pay tuition out of pocket, the school does not issue a 1098. You just have to use it as a back door to enter the fellowship correctly in Turbotax.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

yenmde8

New Member

griverax

New Member

helenehallowell

New Member

Jbrooksnw

New Member

Mikiayane

Level 1