- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I received a 1099-NEC for a Ph.D. stipend/scholarship for doing research, should I File Form 8919 or use the "offset" method to avoid SE taxes??

I received a 1099-NEC for a Ph.D. stipend/scholarship for doing research for my main advisor. He had left my school, went to another, and so he paid me from the other school for my stipend. The condition was that I would be doing research for him.

On the 2020 instructions for the 1099-NEC posted by the IRS here: https://www.irs.gov/pub/irs-pdf/i1099msc.pdf, they state:

"Do not use Form 1099-MISC to report scholarship or fellowship grants. Scholarship or fellowship grants that are taxable to the recipient because they are paid for teaching, research, or other services as a condition for receiving the grant are considered wages and must be reported on Form W-2. "

Because I was paid for research, should I go with the

1) The "offset" method described here: https://ttlc.intuit.com/community/tax-credits-deductions/discussion/re-1099-nec-graduate-student/01/...

or

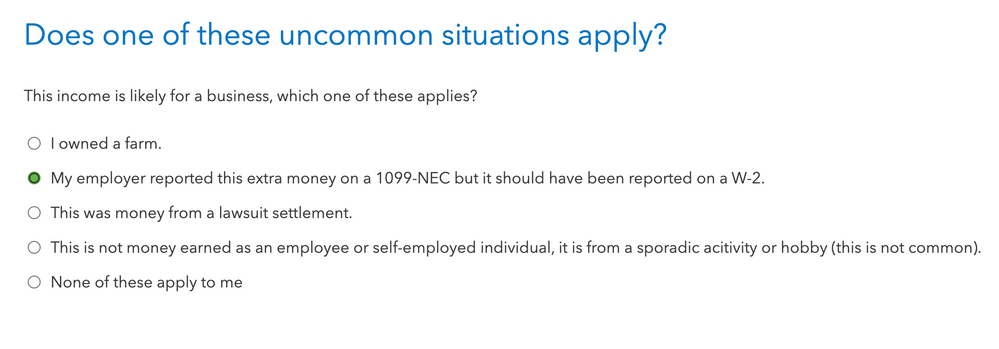

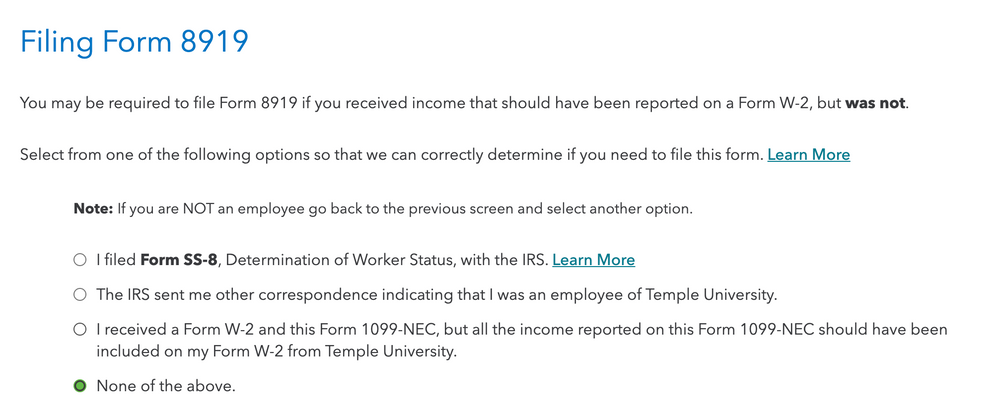

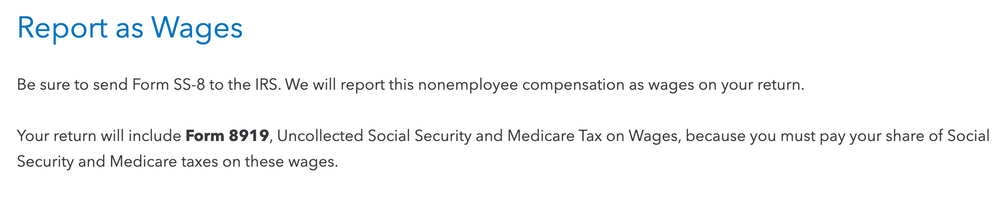

2) Selecting "My employer reported this extra money on a 1099-NEC but it should have been reported on a W-2." and then going to the "Filing Form 8919" page. If so, should I have filed a Form SS-8 prior to today? I have attached screenshots below.

Would option 2 be the same as the 1st option, but more automated? I ask this because it says "We will report this nonemployee compensation as wages on your return".