- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Nontaxable Income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

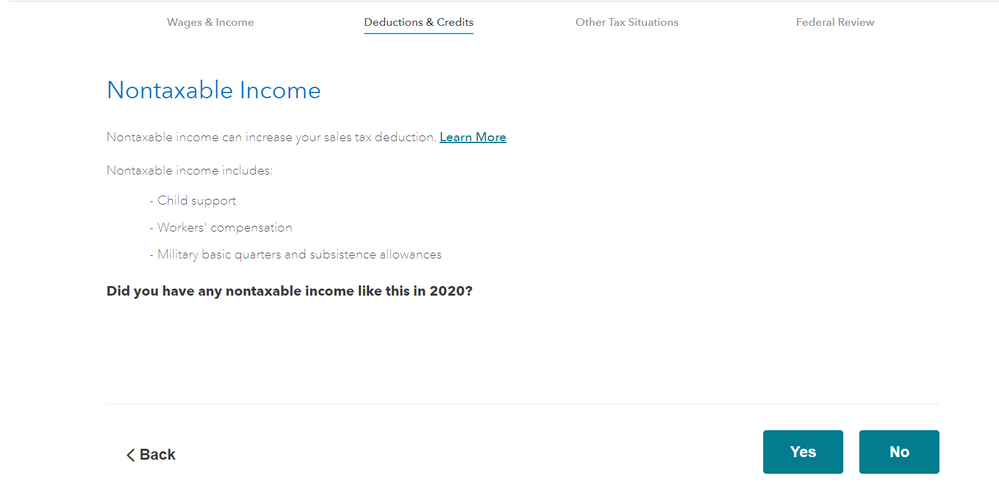

Nontaxable Income

Does Nontaxable income in this section include grants I received from FAFSA to pay for tuition and money my parent gave me to help pay for my expenses?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Nontaxable Income

BTW this is in the Federal section if that means anything

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Nontaxable Income

Yes scholarships and grants should be included but not gifts or support money from your parents.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Nontaxable Income

Wait hold up, this question is in the sales tax part. Would I still then put the parts of the scholarship/grants amount that were nontaxable(some parts were taxable as it was used to cover room/board since there was money remaining from paying tuition)? I know I asked it but it was just to verify. It's seems weird to put in the sales tax section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Nontaxable Income

Yes, I knew it was a sales tax question when I answered it. What they're doing is increasing the amount of money you can use for the optional table.

What's weird is that a student would even be doing the sale tax section. Sale tax is an itemized deduction.

You are allowed to deduct state & local income taxes OR sales tax; but not both. This provision was added primarily to allow a deduction for people in states without income tax. Sometimes, with a big purchase (like a car), you may be better off deducting sales tax even if your state has an income tax. Enter both, under deductions, and TT will calculate the best option. If you don't have all your receipts (and hardly anybody does), you are allowed to use tables (built into TT from IRS Pub 600) based on income & exemptions, You can then add major purchase sales tax to the table amounts. Neither is deductible if you use the standard deduction instead of itemizing.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

uvcatastrophe

Returning Member

JWint

New Member

user17717734672

New Member

Sandy4344

New Member

shifi-reif

New Member