- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- If I said I was a full-time student in 2019 on my TurboTax report, does this make me ineligible for a stimulus check?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I said I was a full-time student in 2019 on my TurboTax report, does this make me ineligible for a stimulus check?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I said I was a full-time student in 2019 on my TurboTax report, does this make me ineligible for a stimulus check?

If you are eligible to receive the Recovery Rebate Credit on the 2020 federal tax return the credit will be entered on the federal tax return Form 1040 Line 30.

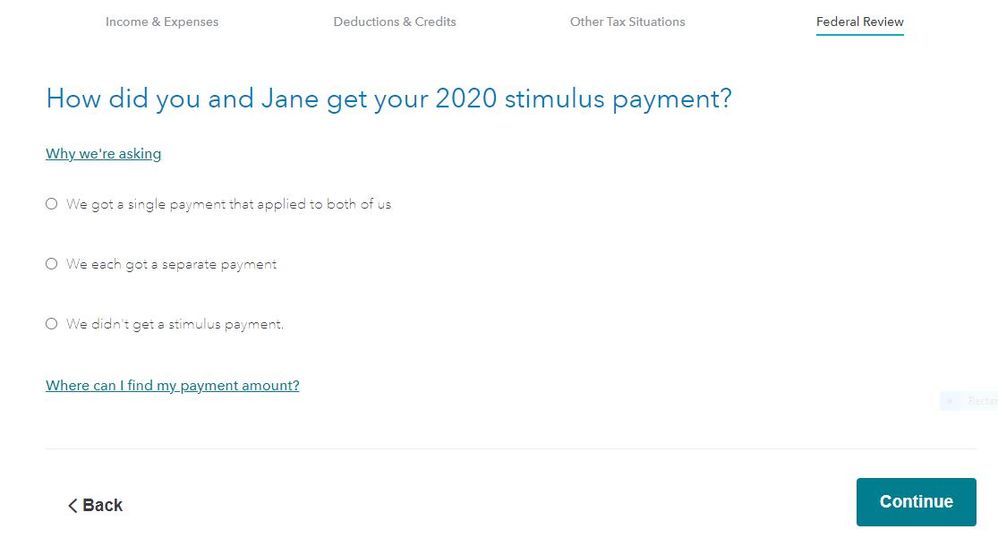

TurboTax will ask if you received the stimulus in 2020 when going through the Federal Review section of the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I said I was a full-time student in 2019 on my TurboTax report, does this make me ineligible for a stimulus check?

Being a student does not disqualify you but if you *could* have been a dependent, even if you were not claimed as a dependent, could. It depends on your age, where you lived (or would have lived if not in school) and if you paid for more then half of your own support with your earned income.

If eligible then when you file your 2020 tax return TurboTax will ask if you received a stimulus and you will get it based on your 2020 tax return.

---Tests To Be a Qualifying Child---

(Must pass ALL of these tests)

NOTE: If a child passes all of these tests he must say “yes” on his/her own tax return (if he/she files one) that another taxpayer CAN claim him/her as a dependent even if they DO NOT claim him/her)

1. The child must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother,stepsister, or a descendant of any of them.

2. The child must be (a) under age 19 at the end of 2019, (b) under age 24 at the end of 2019 and a full-time student* for any part of 5 months of 2019, or (c) any age if permanently and totally disabled and must be younger than you (or your spouse if filing jointly).

3. The child must have lived with you for more than half of the year (There are exceptions for temporary absences such as school, illness, business, vacation, military service).

4. The child must not have provided more than half of his or her own support for the year.

See Worksheet 3-1. Worksheet for Determining Support

https://www.irs.gov/publications/p17#en_US_2019_publink1000171012

5. If the child meets the rules to be a qualifying child of more than one person, you must be the person entitled to claim the child as a qualifying child.

6. The child is not filing a joint return.

7. The child must be a U.S. citizen, U.S. resident alien, U.S. national, or a resident of Canada or Mexico

*A full-time student is a student who is enrolled for the number of hours or courses the school considers to be full-time attendance during some part of each of any 5 calendar months of the year.

See IRS Publication 17 for more information.

https://www.irs.gov/publications/p17

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I said I was a full-time student in 2019 on my TurboTax report, does this make me ineligible for a stimulus check?

No, being a full time student was not the reason your didn't get a stimulus check in 2020.

As others have said, you will get it in 2021, when you file your 2020 tax return, regardless of the reason, as long as you don't check the box on the 2020 form 1040 that says you can be claimed as a dependent by someone else.

The most likely reason was that that box was checked on either your 2018 or 2019 return, or both. Second most likely reason: you parents claimed you, and you didn't know about it.

"In essence, the stimulus check acts as an advance of your 2020 income tax refund. This means when you prepare your 2020 income tax return, there will be a line to include the section 6428 credit (line 30 on the 2020 form 1040). The credit on your 2020 return is subtracted by any amount received as a stimulus check in 2020. If the amount you received as a stimulus check is less than the credit you are due, the difference will be included as part of your 2020 refund. If you have been overpaid by receiving the stimulus check, however, you will not be required to return any excess amount".

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

GordoD1

Returning Member

HSAQuestion1

Level 2

mdlof05

New Member

wlsnbrr

New Member

rwhit

Level 1